Greece Will Lead the West Into a Debt Implosion

Interest-Rates / Global Debt Crisis 2015 Jul 07, 2015 - 04:57 PM GMTBy: Graham_Summers

For over 30 years, sovereign nations, particularly in the West have been buying votes by offering social payments in the form of welfare, Medicare, social security, and the like.

For over 30 years, sovereign nations, particularly in the West have been buying votes by offering social payments in the form of welfare, Medicare, social security, and the like.

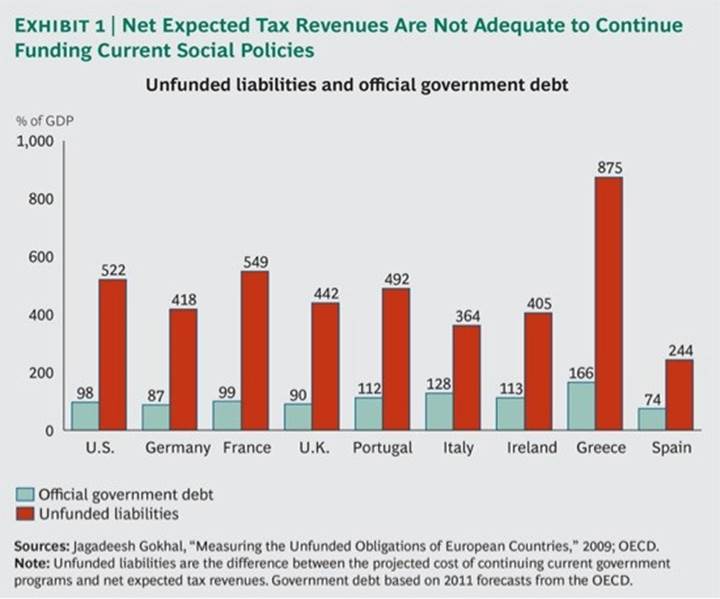

When actual bills came due to fund this stuff, Governments quickly discovered that current tax revenues couldn’t cover it (see the image below)… so they issued sovereign debt to make up the difference.

And so the global bond bubble was created.

As far back as 2009, most Western nations were completely bankrupt when you consider unfunded liabilities from their social policies. But Central Banks did everything they could to paper of this fact by soaking up as much bond issuance as possible while simultaneously maintaining zero interest rates.

Throughout history, Central Banks have tried to inflate away debts for as long as possible. They do this right up until:

1) The debt loads are impossible to manage, or…

2) It becomes politically unsavory to print more money… or

3) The System implodes.

Greece has passed #2 and is on its way #3.

As the above chart shows, Greece has always been the worst offender as far as excessive social programs spending relative to tax revenue. And so it was not surprising that Greece was the first nation to enter a sovereign debt crisis back in 2009/2010.

Since that time Greece has experienced multiple bailouts/ interventions from the ECB and IMF. The only reason it did this rather than default or engaging in a formal debt restructuring was because Greece’s political elites were able to cobble together enough political capital/votes to force it through.

Not anymore.

Greece has just defaulted on its debts to the IMF. It’s now asking for a debt haircut. The IMF is open to this, but the EU is terrified because, as the above chart shows, there are other much larger EU countries with massive debt problems waiting in the wings.

Greece is not the real issue for Europe. The entire Greek debt market is about €345 billion in size. So we’re not talking about a massive amount of collateral… though the turmoil this country has caused in the last three years gives a sense of the importance of the issue.

Spain has over $1.0 trillion in debt outstanding… and Italy has €2.6 trillion. These bonds are backstopping tens of trillions of Euros’ worth of derivatives trades. A haircut on them would trigger systemic failure in Europe.

And this is just the beginning.

Globally the bond bubble is over $100 trillion in size. The derivatives based on this bubble exceed $555 trillion. So when sovereign debt restructurings begins the real crisis (the one to which 2008 was just the warm up) will begin.

Greece will be first, followed by the rest of the PIIGS in Europe. Japan is also on the block as will be the UK and ultimately the US.

If you’ve yet to take action to prepare for the second round of the financial crisis, we offer a FREE investment report Financial Crisis "Round Two" Survival Guide that outlines easy, simple to follow strategies you can use to not only protect your portfolio from a market downturn, but actually produce profits.

You can pick up a FREE copy at:

http://www.phoenixcapitalmarketing.com/roundtwo.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2015 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.