China the Wild Card On Gold, Greek Referendum Vote July 5

Commodities / Gold and Silver 2015 Jun 28, 2015 - 03:09 PM GMTBy: Dr_Jeff_Lewis

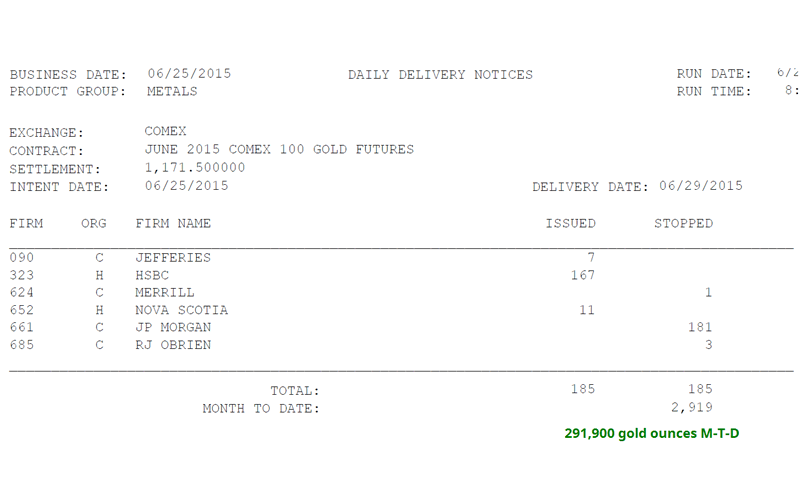

The Bucket Shop on the Hudson was quiet in this day after precious metal options expiration.

The Bucket Shop on the Hudson was quiet in this day after precious metal options expiration.

There was intraday commentary here about China's desire to make the yuan a global reserve currency, and some possible implications for gold from the head of Bloomberg precious metals analysis. You may read about that here.

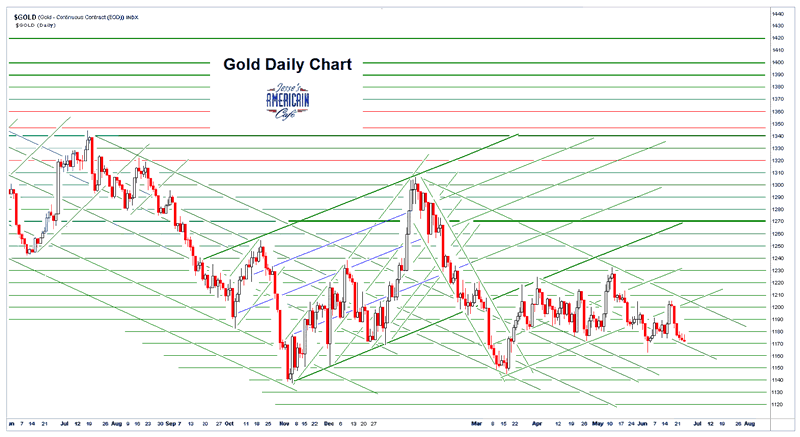

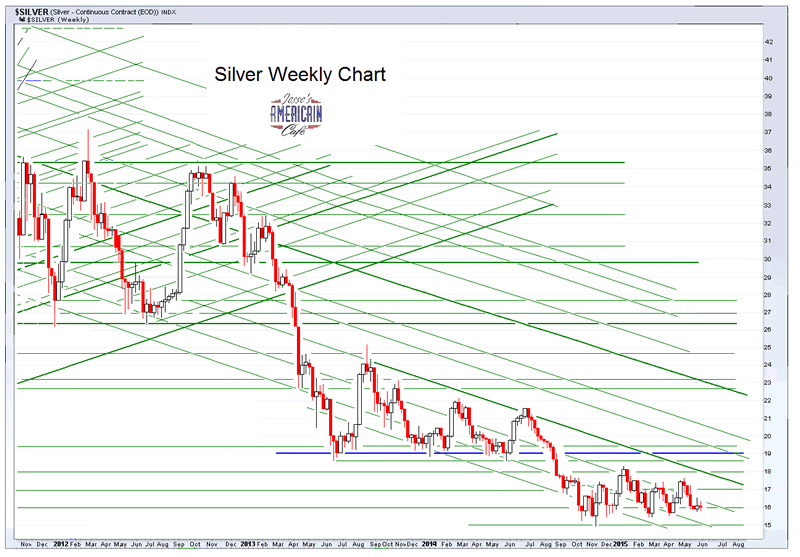

The capping in gold and silver was continuing.

The open interest in silver is now over a billion ounces. This is greater than all annual mine production in the world. As it comes with falling prices, it is most likely initiated by the bears, and is 'undeliverable' at these prices from a purely practical standpoint.

How it resolves will be another matter. But the fact that it exists, apparently unexamined and largely unremarked, is one of the reasons why I refer to the US Precious Metals Futures market as The Bucket Shop. If this does end badly, and the analysts, regulators, and exchanges dare to say 'we could not see it coming,' then we might want to nominate them for the next Oscar awards.

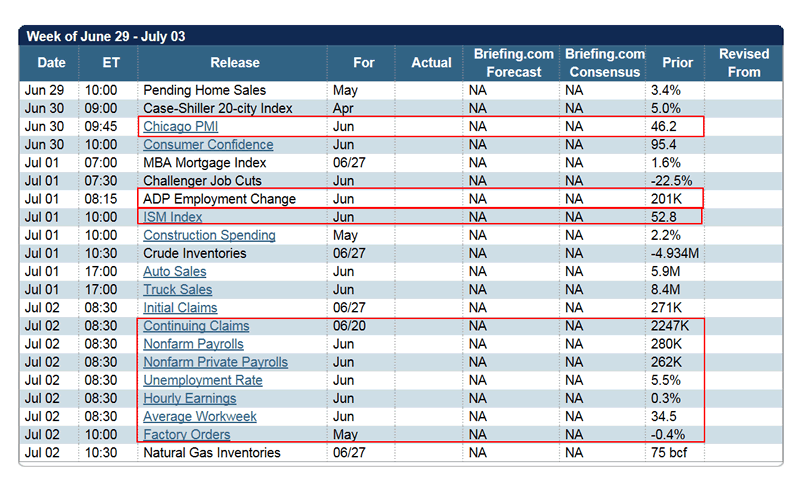

We will see the end of the quarter next week, a holiday weekend in the US for the Fourth of July, and another Non-Farm Payrolls Report on Thursday, July 2.

Many eyes will be on the Greek debt situation as the June 30 deadline for payment to the IMF approaches.

Addendum: After the bell, Tsipras has called for a special referendum vote on July 5 to decide on the ultimatum given to Greece by the Troika.

“After five months of hard negotiations our partners, unfortunately, ended up making a proposal that was an ultimatum towards Greeks democracy and the Greek people. An ultimatum at odds with the founding principles and values of Europe. The values of our common European construction. We have been presented with an ultimatum, and it is the historic responsibility of our country and people to answer this ultimatum.”

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2015 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.