Cyberwarfare Threat To Websites and Financial System

Stock-Markets / Financial Markets 2015 Jun 12, 2015 - 03:45 PM GMTBy: GoldCore

- Legacy of stuxnet is risk posed to technology dependent world

- Legacy of stuxnet is risk posed to technology dependent world

- 20 countries have launched cyberwarfare programmes since exposure of stuxnet in 2010

- Stuxnet virus targeted safety mechanisms in Iran’s nuclear reactors in 2010

- Virus launched to sabotage Iran’s nuclear program was also used for mass spying

- All types of digital systems at risk, including financial, banking and gold providers

- Direct ownership of physical gold, unlike digital currency, not vulnerable to cyber warfare

A new book detailing the development, operation and ramifications of the deployment of the notorious Stuxnet virus shows that it has created a far more risky world.

The book, Countdown to Zero Day, by Wired magazine writer Kim Zetter, shows that – apart from being an extremely irresponsible and dangerous act of sabotage – the deployment of Stuxnet against Iran has led to an acceleration in development of cyberwarfare.

In a must read article in the Irish Times, respected technology journalist, Karlin Lillington reviews the book which presents some fascinating insights into the whole Stuxnet affair which she describes as “the world’s first digital weapon”.

Most unnerving is the fact that twenty different countries have announced digital warfare programmes since the exposure of Stuxnet in 2010.

The U.S. had been demanding that other countries refrain from engaging in cyber warfare techniques until it emerged that the U.S. itself, along with Israel, had deployed the extremely destructive virus against Iran. The NSA had been authorised to launch Computer Network Attacks (CNA’s) for over a decade.

Zetter’s book gives a fascinating insight into how the virus operates. It was launched via a USB key rather than via the internet. The developers had identified glitches in Microsoft’s operating systems which were not publicly known and used these flaws against their target.

The virus secretly collected data on the operation of centrifuges in nuclear reactors for thirty days. Then it began interfering with the operation of the centrifuges in such a way that it would damage the reactors while reporting back the data of the previous thirty days so that engineers could not identify any problem.

Normally, Iranian engineers would need to decommission around 800 centrifuges in a year. Stuxnet caused such havoc that they were forced to change 2000 in a two month period.

The virus then spread rapidly into the systems of contractors working in the power stations who unwittingly infected systems all around the world. In all, over 100,000 computers were infected which Zetter says laid the groundwork for a mass espionage program.

Lillington writes

“Zetter says the attackers also failed to eventually kill the code and stop log files in Stuxnet from communicating back to the command and control server, even after it was apparent the worm had spread beyond Iran. She argues this was to keep the backdoors into millions of computers globally that were obtained in this way, which would form the basis for subsequent mass surveillance programmes.”

Zetter believes that the launch of Stuxnet by the U.S. and Israel was particularly foolish because its

“development also meant the US lost moral ground for demanding other countries not use cyberwarfare techniques … And, inevitably, it launched many more digital warfare programmes across the world.”

She warns that it

“ignores the fact that our systems are just as vulnerable, because U.S. systems are the most connected systems in the world.”

Indeed, our modern western financial and banking system with its massive dependency on single interface websites, servers and the internet faces serious risks that few analysts have yet to appreciate and evaluate.

We previously referred to Russian Prime Minister Medvedev’s allusion to cyber warfare when he stated the Russia’s response to U.S. attempts to have it locked out of the SWIFT system that the Russian response “economically and otherwise – will know no limits.”

Dormant malware, apparently of Russian origin had previously been discovered buried in the software that runs the Nasdaq stock exchange according to Bloomberg.

Given that a military confrontation is not desired by Russia it is likely that cyber-warfare will be part of Russian arsenal in any confrontation with the U.S. and NATO countries.

Hacking is becoming more common and recent months have seen the hacking of Sony Pictures, allegedly by North Korea, and the hacking of Instagram, Tinder and Facebook.

Banks have been hacked, stock exchanges have been hacked and critical infrastructure, including nuclear have been hacked in recent years. It is likely that many of these small scale attacks have been merely testing of defenses.

Even one of the largest and most powerful banks in the world, JP Morgan has been hacked.

Exactly a year ago, in June 2014, JP Morgan Chase were hacked by unknown parties who stole the personal details of 83 million customers.

A concerted attack on the western financial system would likely include attempts at disabling various exchanges including stock markets and foreign exchange markets. Banks could be attacked in such a way that bank balances, which are merely digital figures, could be erased.

Should banks be hacked and customers deposit accounts compromised then the vista of potential bail ins becomes a real one.

The vulnerability of investment providers, banks and the global banking system – reliant as they have become on single interface websites, servers, computer systems, information technology and the internet – is very slowly being realised.

Academic and independent research and indeed the modern and historical record shows how physical gold is a safe haven asset – provided you have direct ownership of coins and bars and are not dependent on single websites and technology.

An allocation of some of one’s portfolio to physical gold is insurance against technological and systemic risks posed to all virtual wealth today – whether that be digital bitcoin and gold or electronic currencies in deposit accounts.

These risks have never been seen before and are largely unappreciated and ignored by brokers, financial advisors, bankers and the majority of people.

Having all your eggs in a deposit account or with one single investment, or indeed gold broker or storage provider, is no longer prudent.

Must Read Guide: 7 Key Gold Must Haves

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,179.25, EUR 1,055.68 and GBP 761.27 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,180.50, EUR 1,049.19 and GBP 763.51 per ounce.

Gold fell $4.70 or 0.4 percent yesterday to $1,181.50 an ounce. Silver climbed $0.01 or 0.06 percent to $16.04 an ounce. Gold is on track for a 1% gain in dollar terms, is flat in euro terms and is lower in sterling terms.

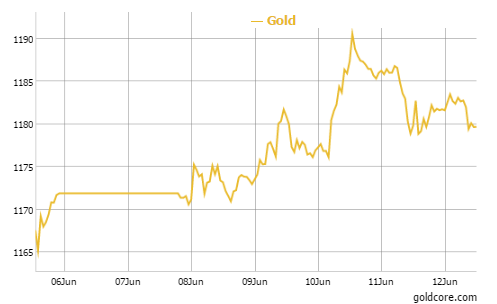

Gold in USD – 1 Week

Gold in Singapore for immediate delivery was steady at at $1,183.03 an ounce near the end of the day, while gold bullion in Switzerland was again marginally lower.

Even though gold declined yesterday on the back of positive U.S. retail figures, it is still on track for a 1 percent weekly gain due to a weaker U.S. dollar.

Gold is not seeing a boost from safe haven buyers due to the Greek financial crisis, which may or may not include an exit from the euro. European Commission President Jean Claude Juncker said today that stalled debt talks between Athens and its creditors would restart but put the ball firmly in the Greek government’s court to come up with an acceptable deal.

The question is whether this is due to quite poor sentiment in the gold market or are banks that have been found rigging most markets, manipulating the gold market?

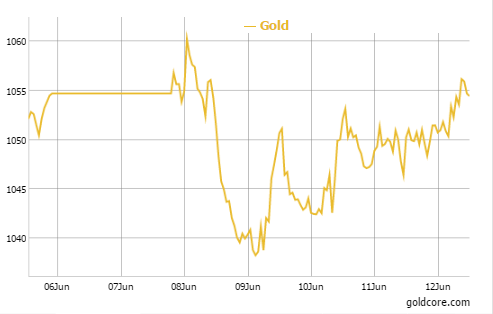

Gold in Euros – 1 Week

Poor sentiment towards gold is seen in liquidations of the gold ETF’s such as the SPDR Gold Trust, the world’s largest. It has seen its holdings fall again this week to the lowest levels since 2008.

With sentiment poor and prices depressed or suppressed, depending on your point of view, gold looks gold value at these levels and is over due a bounce. The possibility of a Greek financial debacle should support gold and potentially push it higher before the important June end deadline.

The psychological price level of round number $1,200 per ounce will offer resistance but should gold rise above it, we would expect a move to $1,250 in short order.

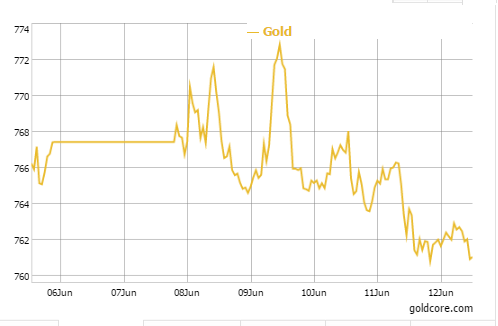

Gold in British Pounds – 1 Week

The sharp bond market selloff is bullish for gold as it is starting to pinch American consumers and companies, causing a mild economic tightening that will raise alarms at the Fed and will likely delay the expected hike of interest rates in coming months.

U.S. mortgage rates have reached their highest level in 18 months, auto loans are getting more expensive, and corporations across the board have seen their borrowing costs jump as U.S. and European debt retrenched in recent weeks.

Asia’s demand has faltered a bit with monsoon season in India and China’s surging stock market has softened buying of the yellow metal but demand remains quite high as seen in the premiums on the Shanghai Gold Exchange (SGE).

In late morning European trading gold is down 0.13 percent at $1,180.14 an ounce. Silver is off 0.44 percent at $15.95 an ounce, and platinum is also down 0.81 percent at $1,098.90 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.