Gold and Silver Capped - The Iron Heel

Commodities / Gold and Silver 2015 Jun 11, 2015 - 05:21 PM GMTBy: Jesse

"We discover that the fortunes realized by our manufacturers are no longer solely the reward of sturdy industry and enlightened foresight, but that they result from the discriminating favor of the Government and are largely built upon undue exactions from the masses of our people.

"We discover that the fortunes realized by our manufacturers are no longer solely the reward of sturdy industry and enlightened foresight, but that they result from the discriminating favor of the Government and are largely built upon undue exactions from the masses of our people.

The gulf between employers and the employed is constantly widening, and classes are rapidly forming, one comprising the very rich and powerful, while in another are found the toiling poor.

As we view the achievements of aggregated capital, we discover the existence of trusts, combinations, and monopolies, while the citizen is struggling far in the rear or is trampled to death beneath an iron heel.

Corporations, which should be the carefully restrained creatures of the law and the servants of the people, are fast becoming the people's masters."

President Grover Cleveland, State of the Union, December 3, 1888

Gold and silver popped this morning in New York, and then gave a bit of it back in the afternoon.

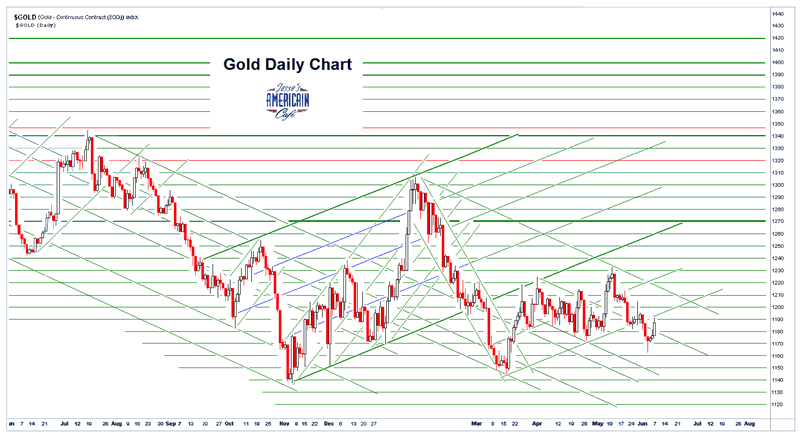

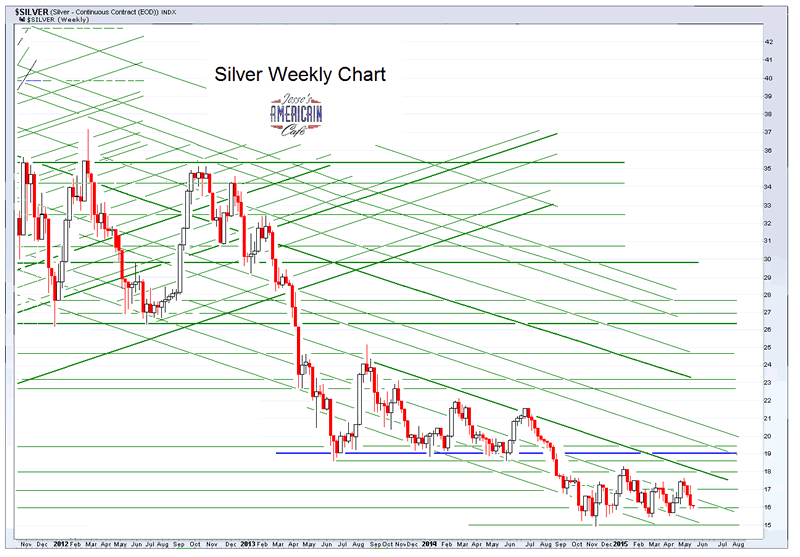

Silver is still hanging on to the 16 handle, and gold is hovering near the bottom end of a trading range between 1170 and 1230 US dollars.

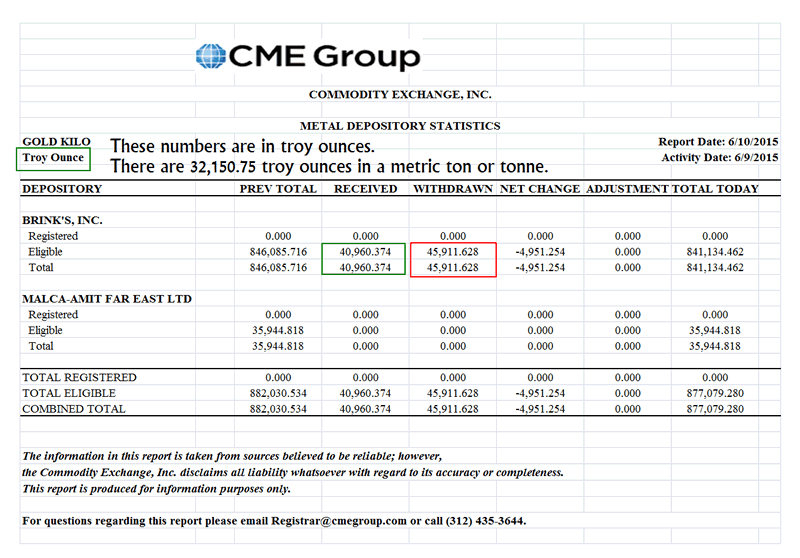

There was intraday commentary on the CME futures exchange in Hong Kong here.

I have not yet made up my mind on how real this market is.

More specifically, even though it seems to require 'physical delivery' it is a thin market, and it is not completely clear to me how much of the gold might be round-tripping, how easy it might be for that to happen. Koos Jansen in particular has done extraordinary good work sorting that out on the Shanghai Gold Exchange. I do not wish to make any assumptions about the CME in Hong Kong and what the mechanics of things might be there. I don't suppose any reader are trading on the CME gold exchange in Hong Kong and can let us know.

However I wanted to pass along a very interesting comment from my friend Nick:

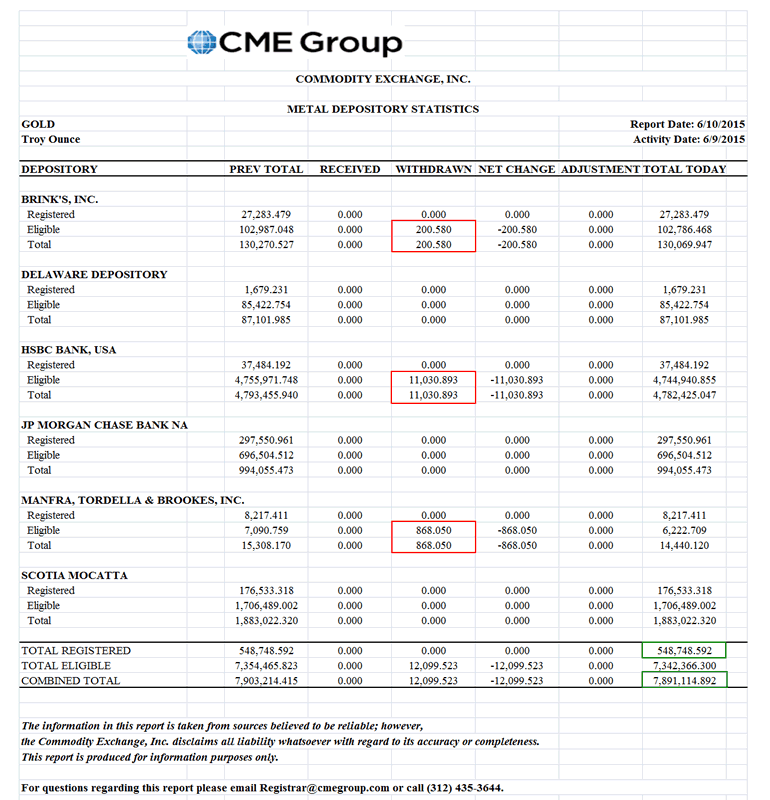

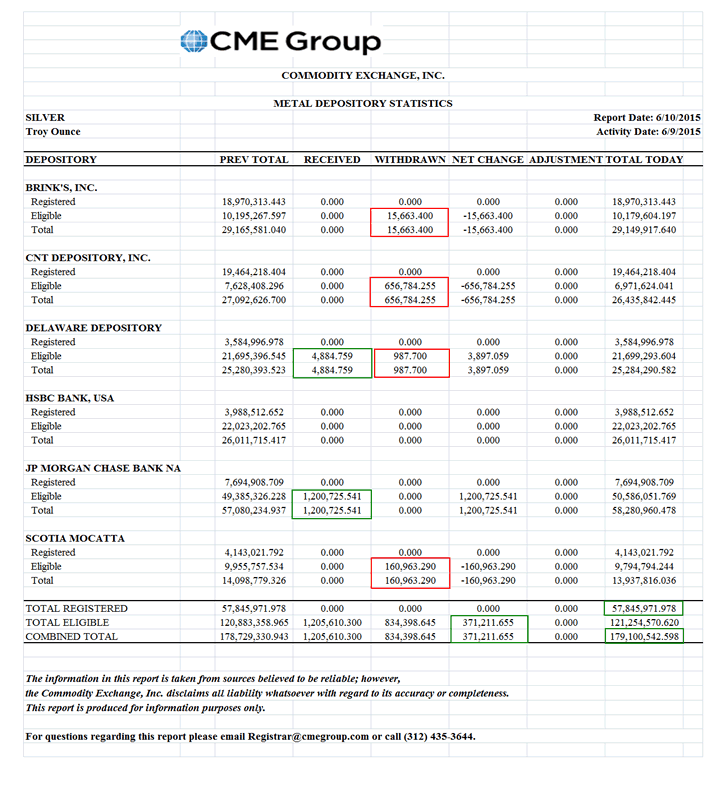

For Tuesday the NY Gold Futures Contract had Volumes of 96,032 and Open Interest of 407,893 contracts.

For Tuesday the HK Gold Futures Contracts had Volumes of 168 & Open Interest of 45 contracts. (this is normal - very thinly traded).

Yet for the last two months the NY Contract delivered 16.2 tonnes of gold whilst the HK Contract delivered 257 tonnes of gold.

Yes that is something to think about, BucketShop-wise.

There was also some interesting commentary on the surprising fragility in the US debt markets here.

They'll never learn.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2015 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.