Time to Move Capital into Next Bull Market – Part I

Stock-Markets / Financial Markets 2015 Jun 09, 2015 - 06:22 PM GMTBy: Chris_Vermeulen

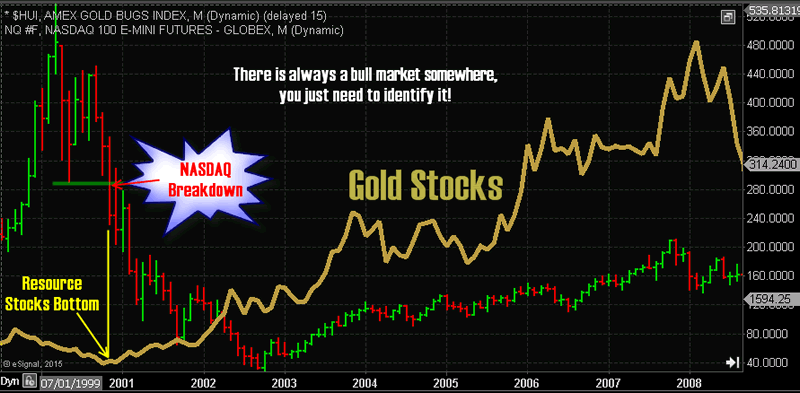

If you remember the dot com bubble as clearly as I do and are a technical analyst then you will recall the month which the NASDAQ broke down and confirmed a new bear market has started. The date was November of 2000.

If you remember the dot com bubble as clearly as I do and are a technical analyst then you will recall the month which the NASDAQ broke down and confirmed a new bear market has started. The date was November of 2000.

You may be wondering why I bring this up. What do tech stocks have to do with commodities?

Good question because they have nothing in common. But the key here is that when a bull market ends in one asset class that money is shifted into another. That money moved into commodities and resource stocks and in a big way.

Precious metals and miners exploded, surging an average of 1000% return (10 times ROI) over the next six years, topping out in 2008. In fact, these resource stocks bottom the exact month which the NASDAQ confirmed it was in a bear market on Nov 2000.

Compare Dot-Com Bubble & Burst to Precious Metals Stocks

Over the next couple of weeks, I will be sharing some of my top stock picks in the metals sector (gold, silver, nickel, and copper). If you missed the 2001 and 2008 metals bull market then you best pay attention and be sure you don’t miss what is about to happen.

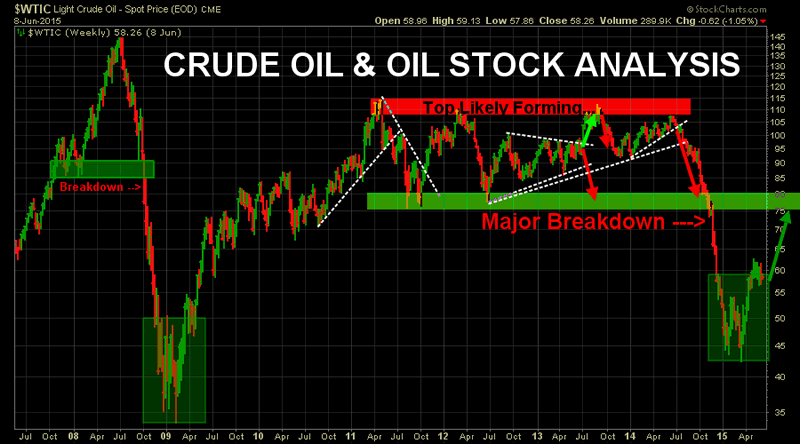

Compare Bull Market in Stocks with the Energy Sector

The financial markets and asset classes move in cycles, and there are times when specific sectors outperform others. Resources stocks specifically the energy sector is about to enter its strongest phase within the US equities bull market which started in early 2009.

Oil stocks have a lot of positive things in their favor in my opinion, though many will disagree. But it’s all in how you look at the data and your investment horizon.

During the previous market tops which are the same for NASDAQ, DOW, S&P 500, energy stocks have outperformed most sectors. Why? In short, we will always need energy, many of the companies pay dividends and when money starts to roll out of equities the underlying commodities typically hold their value for an extended period of time.

These past stock market tops generated 36%-40% returns during a time when most traders and investors were losing their shirts, or should I say lost 50% of their life savings… Which train would you rather be on?

Now take a quick look at the price of crude oil

Oil has formed what is called a (double bottom, or “W” formation and also appears to be completing a cup & handle pattern). Whatever you want to call it, they are all very bullish patterns, meaning a much higher price for oil is expected.

In short, higher oil prices, means more profits for energy companies, it’s that simple.

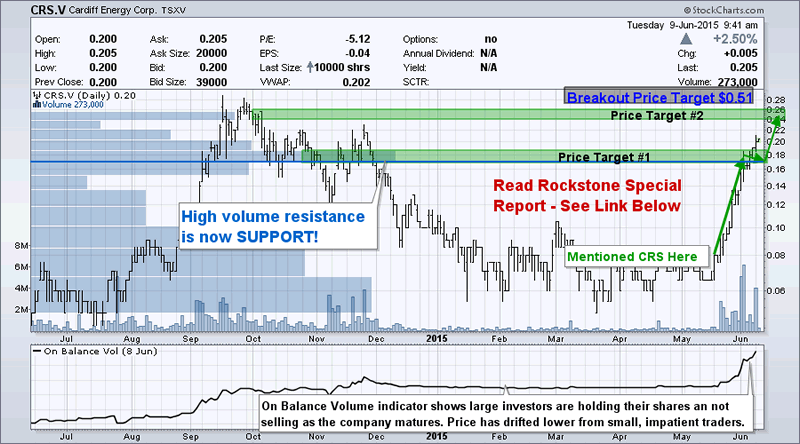

An Oil Junior Resource Stock

There are times during market cycles when I like to own shares of some junior companies. When a major shift looks imminent within a market or sector just like we saw in 2000 and again in 2008 I like to hold shares in companies which have the potential to rally several hundred percent.

A couple of weeks ago I talked about a speculative oil stock Cardiff Energy Corp. which I own shares. The story behind this stock is real and the horizontal well which they will start drilling mid-June 2015 has the potential to generate 5-7 times of a vertical well. Below is the chart with my short term targets.

The low priced crude oil is wreaking havoc with oil companies and share prices. The best plays are those who have the lowest cost of production per barrel and I heard this well could produce profits even if oil was trading at $25 per barrel and sold at WTI pricing with no discount.

The energy behind this share price is very impressive and shows that investors are confident in the horizontal well. If they strike oil who knows where the share price could rally to.

Rockstone Report: http://rockstone-research.com/images/PDF/Cardiff1en.pdf

Side note: I met with Jack Bal the President, CFO, and Direction of Cardiff Energy Corp. in Toronto recently to learn more about the company and projects. Cardiff is currently doing a private placement to raise capital and if I’m correct investors can get shares at 25% discount from the current market value. And from what I understand they have room for a few more small investors. If this is of interested to you give Jack Bal a call directly at Cardiff Energy 1-604-306-5285, and you can mention this report if you want.

Next Bull Market Conclusion:

In short, every good investment will eventually become a bad one and vice versa. Knowing when to shift our capital from one sector to another is vital for steady long-term growth of our portfolio.

Over the next couple weeks through this multi-part series I will be sharing some very lucrative stock picks which I am investing in and the second one will likely be a nickel resource company that looks poised to rocket higher.

Join My Free Email Alerts Newsletter: www.GoldAndOilGuy.com

Chris Vermeulen

Detail Third Party Report: http://rockstone-research.com/images/PDF/Cardiff1en.pdf

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.