Gold and Silver Move Closer to Breakdown

Commodities / Gold and Silver 2015 Jun 06, 2015 - 12:10 PM GMTBy: Jordan_Roy_Byrne

Gold and Silver are going to close down for the third consecutive day and the third consecutive week. As we pen this on Friday, Gold bounced from $1162/oz and could close near $1170/oz while Silver traded below $16/oz and may close at $16/oz right on the dot. Both metals are now dangerously close to their final weekly supports and therefore one step closer to an important technical breakdown.

Gold and Silver are going to close down for the third consecutive day and the third consecutive week. As we pen this on Friday, Gold bounced from $1162/oz and could close near $1170/oz while Silver traded below $16/oz and may close at $16/oz right on the dot. Both metals are now dangerously close to their final weekly supports and therefore one step closer to an important technical breakdown.

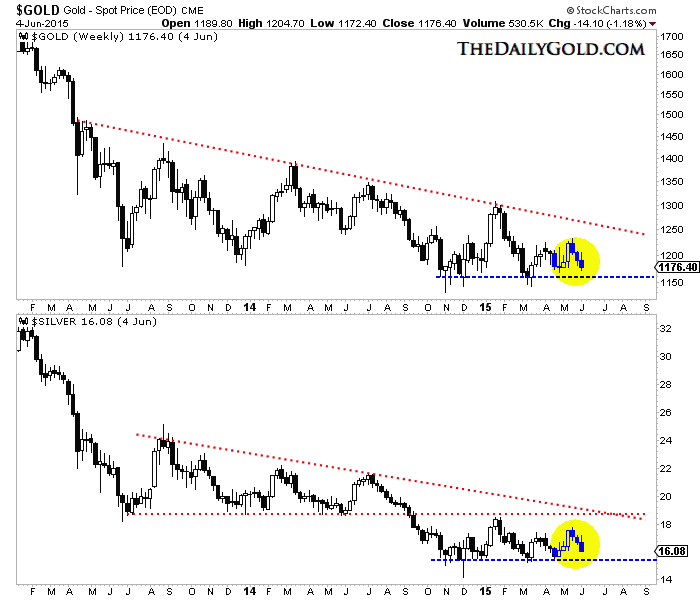

The weekly candle chart for both metals is shown below. Today's action has yet to be updated. Nevertheless, we can see the clear important weekly support for both metals. For Gold it's roughly $1150 and for Silver it's $15.50 to $15.70. The failure of the metals to rally out of their 7-month long bases bodes bearish for the weeks ahead. Furthermore, let's not forget the relatively high net speculative positions seen in both markets. The COTs will be updated by the time you read this but odds are there are plenty of speculators left to drive the metals to a final breakdown.

$GOLD Gold Spot Price (EOD) CME

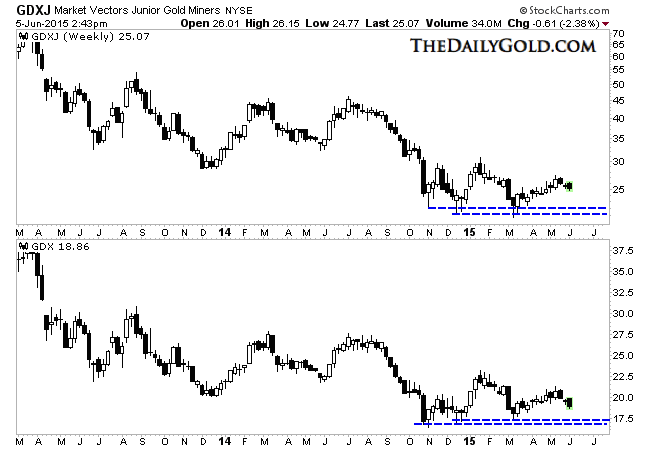

The miners, which peaked before Gold in 2011 and have shown more strength (or less weakness) in recent months figure to lead the sector out of the coming bottom. At the least, the miners are likely to remain above their lows as the metals break their own lows. In daily terms, Gold is about 2.5% from its low of $1140 while GDX and GDXJ are roughly 13% and 15% from their daily lows. The weekly chart below plots GDXJ and GDX and their weekly support (in blue).

GDXJ Market Vectors Junior Gold Miners NYSE

Put yourself in position so you can take advantage of the coming breakdown, rather than be a victim of it. We booked profits in our hedges today and will look to reload if the metals rebound next week. We also advise tuning out the super bulls and super bears who are calling for price targets which have no fundamental or technical basis. Extreme targets are an emotional distraction and not actionable.

Mind you, we are huge gold bulls and expect a very sharp rebound to come after this final breakdown runs its course. If and when Gold reaches major support around $1000/oz, it will likely find itself extremely oversold with very negative sentiment. That combination along with strong technical support can produce a big rebound. The coming breakdown in the metals could create one last chance to buy quality junior miners at bargain prices.

Consider learning more about our premium service including our current favorite junior miners which we expect to outperform in the second half of 2015.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.