Gold Price in Different Currencies

Commodities / Gold and Silver 2015 May 30, 2015 - 06:16 AM GMTBy: Arkadiusz_Sieron

The slowdown of worldwide trade and GDP may affect different currencies in distinct ways. It is well time that we briefly analyze the relationship between the yellow metal and other currencies than the U.S. dollar. It is very important issue, since many non-American investors measure gold in their local currencies.

The slowdown of worldwide trade and GDP may affect different currencies in distinct ways. It is well time that we briefly analyze the relationship between the yellow metal and other currencies than the U.S. dollar. It is very important issue, since many non-American investors measure gold in their local currencies.

We shall state first that gold price movements are relative to the currency to which they are measured. In other words, the gold prices, like all prices in general, reflect not only the inherent value of gold, but also the relative strength of the currency in which it is quoted. Thus, because of the activity of forex traders, the yellow metal's price may change (actually it may simultaneously rise and fall) even during a quiet and boring day in the gold market with unaltered fundamentals or expectations. This may happen if, for example, the value of U.S. dollar goes down against euro. In this case, the price of gold rises when measured in the greenback, but falls when measured in the euro. Investors should look at gold prices against all major currencies, to properly assess the fundamentals of the gold market. For example, the bull market can be identified in a more sure and valid way when gold prices advance in all currencies (like during the 2000s boom) than when gold goes up only in U.S. dollars, a possible reflection of the U.S. dollar losing value instead of gold gaining 'real' value.

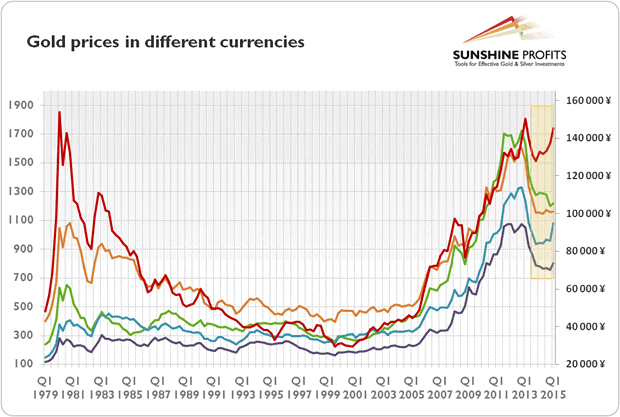

However, even if the gold prices rise in all currencies, they change differently against the various currencies, as you can be seen in Figure 1. For example, between January 2001 and August 2010 the price of gold has appreciated much more in U.S. dollars and British pounds than in the euro or Swiss franc.

Figure 1: Gold prices in different currencies between 1979 and 2015 (green line and left scale - U.S. dollar; blue line and left scale - euro/Deutsche Mark; purple line and left scale - pound sterling; orange line and left scale - Swiss franc; red line and right scale - Japanese Yen)

How did gold behave in currencies other than U.S. dollar? According to the standard approach, there is a positive relationship between gold and values of foreign currencies (like the euro). It is a logical consequence of the statement on the negative correlation between the greenback and the yellow metal. Since cheaper U.S. dollars make gold cheaper for other nations to purchase, and increases their demand for the yellow metal, stronger foreign currencies are a positive development for the gold prices.

There may be another explanation for the negative correlation between gold and the U.S. dollar index. Investors just have to realize that gold acts like just any other currency. Thus, when the U.S. dollar is losing value against the majority of currencies, it is also losing value against gold. According to O'Connor and Lucey, the same applies to other currencies: negative correlations occur between gold and the trade-weighted value of euro, pound sterling, Japanese Yen, etc. Similarly, Pukthuanthong and Roll found that the rise in the gold price expressed in a given currency can be simply associated with weakness in that currency. It works not only for U.S. dollar, but for all currencies.

In other words, gold can be considered as a currency and one of the most important alternatives to the U.S. dollar. The same applies partially to the euro (or Yen), which is seen by many as a natural first choice alternative currency to the greenback. This explains the frequent positive correlation between gold prices (in U.S. dollars) and the euro.

However, gold is not only a bet against the U.S. dollar, but it may serve as a safe-haven against global risks alongside the greenback. Thus, the recent problems of the Eurozone and the plunge of the euro trade index supported the gold prices measured in U.S. dollars. Despite the rise of the greenback against the euro, there is a growing confidence in the yellow metal as an alternative currency or an alternative safe haven to the U.S. dollar. Some analysts even believe that the relationship between Greek government bond yields as a proxy for Eurozone break-up risk is more reliable than that between gold and the greenback.

However, non-American investors have to take into account the impact of the exchange rate on their investment in gold. For them the return on investment in gold depends on gold price movements measured in greenbacks and on the changes in exchange rates between the U.S. dollar and their domestic currency.

Let's assume that Hans from Germany buys one ounce of gold at the quoted price of $1200 per ounce. Since Hans pays with euros, and the exchange rate is 1.2 dollar per euro, in fact he spends €1000. So, if gold gains 2.5 percent against the greenback (to $1230 per ounce), but the value of U.S. dollar against euro drops even more, let's say, 5 percent to 1.26 dollar per euro, our German investor actually loses almost 2.4 percent when he measures the value of investment in euro ($1230 are worth only €976.2 with the exchange rate at 1.26 dollar per euro).

As you can see, the gold prices in other currencies are affected by the exchange rates between the local currencies and the U.S. dollar. This is why the gold market when seen through the lens of other major currencies than U.S. dollar can be a totally different beast than the one seen by Americans. For example, this year gold prices have performed much better when measured in euros than in the greenback, because the euro plunged, and the U.S. dollar surged.

To sum up, the data on global trade indicate that the worldwide economy is slowing down. It may be partially due to the contraction and reduced liquidity. Currently, the risk of illiquidity shock is one of the main concerns of the global economy. The weak economic activity should be positive for the gold prices, as would an eventual recession or international financial crisis. Global developments can affect distinct currencies and gold prices measured in different currencies, in various ways. Gold is another currency, so its price movements are affected by the exchange rates between the U.S. dollar and other currencies and are relative to the currency against which they are measured.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.