Goldman Sachs Warns “Too Much Debt” Threatens World Economy

Commodities / Gold and Silver 2015 May 29, 2015 - 01:30 PM GMTBy: GoldCore

- Debt load of many countries is an economic risk

- Debt load of many countries is an economic risk

- Ageing populations in developed world to put pressure on economies

- Goldman proposes “creative” social policy to deal with looming crisis

- Entire debt-based monetary system needs reform

The debt burden – particularly in “developed” countries – along with ageing populations pose a risk to the economies of those countries, Goldman Sachs has warned. Andrew Wilson, Goldman Sachs Asset Management’s chief executive in Europe said, “There is too much debt and this represents a risk to economies. Consequently, there is a clear need to generate growth to work that debt off but, as demographics change, new ways of thinking at a policy level are required to do this.”

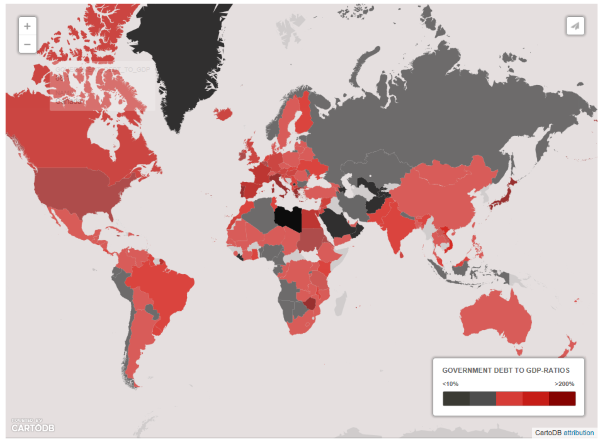

Japan, as an example of a major economy, now has a government debt-to-GDP ratio of over 200%, which Wilson says is “not sustainable over the long term.” Other countries with very high debt loads include the U.S., most of Europe and Brazil.

Among those countries on the other end of the scale are Russia, other central Asian countries and most of the Gulf states demonstrating the latent and as yet widely unacknowledged strength of the emerging Eurasian Economic Union and its ties to the Chinese New Silk Road project.

Wilson is particularly focussed on the issue of an ageing population:

“The demographics in most major economies – including the US, in Europe and Japan – are a major issue – and present us with the question of how we are going to pay down the huge debt burden. With life expectancy increasing rapidly, we no longer have the young, working populations required to sustain a debt-driven economic model in the same way as we’ve managed to do in the past.”

Goldman proposes that society should bend to the needs of the financial and monetary system rather than reform of that system. “The demographic shift means that we need to look to more creative policy, including immigration and workforce expansion in order to find ways to pay down debt.” He lauds prime Minister Shinzo’s drive to increase female labour participation and efforts to boost inflation in Japan.

Peter Sutherland, who retired as head of Goldman Sachs International earlier this month after 20 years, has shown great interest in migrant affairs in recent years.

According to the Financial Times, “His main activity in retirement will be his role as a special representative of the Secretary-general of the UN for Migration and Development. Mr Sutherland recently spoke on Irish national radio about his support of EU proposals that would share the burden of migrants more broadly across the continent.”

Sutherland was quoted as saying, “The fundamental issue here is saving people who are drowning in the Mediterranean…this is not about getting into battles about quotas when we are facing a humanitarian crisis.”

While we are in favour of any measures that may relieve the hardship suffered by people in parts of the world where life can be more harsh, we are not convinced that using migration as a tool to deal with a broken system is a wise policy. Migration should be a natural process, not one that is orchestrated by the most powerful people in our society.

Unless and until the debt-based money system is reformed there will always be debt-related crises. Almost all currency today comes into existence as interest on existing debt. Debt cannot be repaid unless new debt is created. This process leads to ever greater amounts of debt.

This global money system – from which Goldman Sachs derives such immense benefit – actually creates, to a considerable extent, the environment where emigration becomes imperative.

At any rate, the proposals put forward by Goldman are unlikely to achieve any kind of long-term solution to the problem of massive unsustainable debt faced by the western world and Japan. If central banks begin to raise interest rates to more normal levels a debt crisis will likely ensue.

The longer central banks wait before raising rates, the greater the bubbles in financial assets will grow and the greater the eventual crisis will be. Either way a financial, currency and economic crisis seems unavoidable at this point.

Such a crisis would likely involve bail-ins of deposits in bank accounts as banks and governments struggle to deal with wave after wave of defaults. Physical gold, held outside of the banking system is an essential form of insurance against such crises. We offer storage in the most trusted facilities in the world in very safe jurisdictions such as Switzerland and Singapore.

Must-read guides:

Protecting Your Savings In The Coming Bail-In Era

From Bail-Outs To Bail-Ins: Risks and Ramifications

MARKET UPDATE

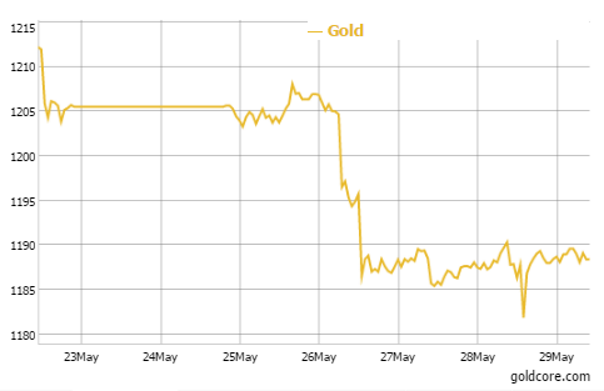

Today’s AM LBMA Gold Price was USD 1,190.40, EUR 1,083.86 and GBP 778.24 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,189.45, EUR 1,087.08 and GBP 775.94 per ounce.

Gold climbed $1.00 or 0.08 percent yesterday to $1,188.50 an ounce. Silver rose $0.01 or 0.06 percent to $16.70 an ounce.

Gold in USD – 1 Week

Gold in Singapore for immediate delivery was steady at $1,187.90 an ounce while gold in Zurich was also little changed as it continues to be capped below $1,200 per ounce.

Gold inched up on Friday in London as the U.S. dollar pulled back, but the yellow metal still remained on track for its second weekly decline of about 1.5 percent.

U.S. GDP figures are out at 12:30 pm today.

Although Greek officials seem optimistic that they can negotiate a deal before the weekend, IMF director Christine Lagarde has cautioned that Athens is unlikely to agree any deal in the next few days and that “a Greek exit is a possibility”.

In late morning European trading gold is up 0.11% at $1,190.00 an ounce. Silver is up 0.16 percent at $16.74 an ounce and platinum is down 0.02 percent at $1,117.68 an ounce.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.