Gold Has Two Major Hurdles to Overcome

Commodities / Gold and Silver 2015 May 27, 2015 - 05:10 AM GMTBy: Bob_Kirtley

Background

Background

Gold has 2 major hurdles to overcome and they are as follows:

1. Interest rate rises in the US

2. Money printing by other nations, Japan, UK, Europe, etc.

Both support the US$ and put downward pressure on gold.

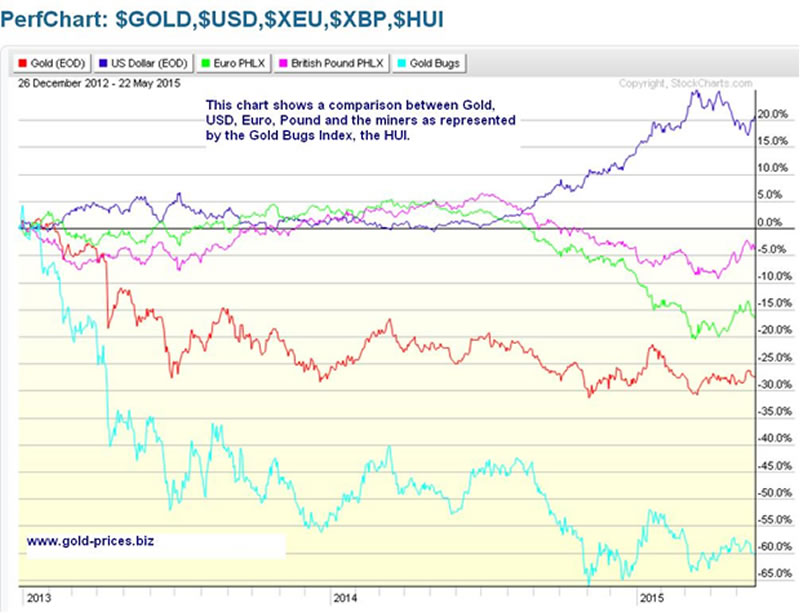

The Chart above compares Gold, USD, Euro, Pound and the HUI.

The specter of interest rate increases in the US hangs over the precious metals sector like the Sword of Damocles. The Federal Reserve has stated that they want to ‘normalize’ rates now that the period of Quantitative Easing is over. Employment figures published by the Department of Labour have shown a steady increase in the number of jobs created over the last twelve months or so. On the inflation front; core prices, which exclude food and energy rose at a yearly pace of 1.8% for the month of April, which is the fastest monthly rise for almost a year. These data points will be viewed in a positive light by the Fed in that the economy is on track and recovering at a sufficient rate to allow for tighter monetary policy.

The European Union has announced a programme of Quantitative Easing for their members in an attempt to boost the European economy. The effect of this action will be to dilute the purchasing power of the Euro and so its value will fall. The same goes for the British pound and the Japanese Yen. These three currencies make up the lion’s share of the US Dollar Index, so as they drop it follows that the dollar will rise. The rising dollar will exert downward pressure on gold rendering gold cheaper in dollar terms.

Conclusion

It should be mentioned that gold has been outperforming most currencies other than the US dollar to the benefit of those living or trading in such currencies. However, they have all underperformed when compared to the dollar, so for those who wish to hold some of their funds in cash then the dollar rules.

At this stage of the cycle we remain of the opinion that the above mentioned factors weigh heavily on gold and as such gold’s progress will be severely hampered in the coming months. We also believe that some investors will throw the towel in and walk away from this sector thus precipitating a final capitulation in the precious metals sector.

The lion’s share of our investment funds are in the dollar as it continues to outperform the precious metals sector and we think it will continue to do so for now.

Patience is the order of the day and though it isn’t an exciting stance to take it certainly beats losing money.

We will continue to watch the Fed for what they say and do bearing in mind that they are ‘data driven’ which tells us the situation is fluid and subject to change. However, for those who are waiting for the advent of more Quantitative Easing, this is not going to happen and is certainly not on the cards for this year.

The producers may be cheaper than they have been for some time but that does not make them cheap or a viable investment opportunity. The mining sector has oscillated wildly this year but has gained nothing as the Gold Bugs Index, the HUI, is at the same level as it was in early January 2015.

Rallies will come and go but without the formation of new higher highs and some decent traction, this sector is held prisoner by the rising dollar and the continuing dilution of the other major currencies.

Patience is the order of the day and funds kept in US dollars are the current outperformers. Use this time to analyze and research the stocks that you would like to own and formulate a short list that you can manage and keep up with once you have made the purchase. Our watch list is huge but if we had to move tomorrow we have identified around 20 stocks that we would be happy to own and we will continue with the due diligence as a week can be a long time in the life of a mining company.

We currently retain 70% of our funds in dollars and are glad we did so as they have strengthened considerably which should enable us to purchase more stocks and or gold and silver when the bargains present themselves.

Stay flexible and don’t be afraid to place the occasional short trade as and when the market is overbought. These trades may take time to eventuate, but when the outlook in the short term is bleak the risk/reward environment is favorable.

Finally, go gently and only deploy small amounts of capital until a new direction is confirmed, we all need to be able to take a hit and live to fight another day.

Got a comment, then please fire it in whether you agree with us or not, as the more diverse comments we get the more balance we will have in this debate and hopefully our trading decisions will be better informed and more profitable.

Go gently.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.