Are We in Another Credit Bubble? And Is It Different than Before?

Interest-Rates / US Debt May 23, 2015 - 11:51 AM GMTBy: EWI

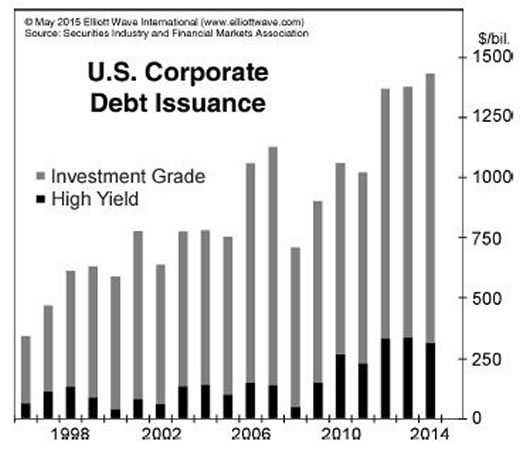

Part 1 of our FREE report on the recent build-up in credit includes a chart of U.S. corporate debt issuance since 1998 you don't want to miss

Part 1 of our FREE report on the recent build-up in credit includes a chart of U.S. corporate debt issuance since 1998 you don't want to miss

Whatever your politics, creed or nationality -- we can all agree that a huge catalyst for the 2008-9 global financial meltdown was the universal binge of bad credit.

A huge part of that bad-debt pile were the "don't-ask-don't-tell" high-yield bonds -- a.k.a. junk bonds -- which were used to fund a lot of things, including corporate takeovers.

You might still remember how, at the time, few saw any reason to question the upside potential of these lower-grade yet higher-yielding loan instruments. Here, the following articles from 2007 recapture the scene:

"We're in the thick of a period when debt is a good thing rather than a bad thing, at least in the corporate world. And the riskier the debt, the more investors want it. There is a self-sustaining cycle at work here. The global economy has been so strong in recent years that few companies, even those loaded with debt, have had trouble paying their obligations." (LA TIMES)

"We say it isn't politically correct to call them junk bonds anymore. There's not a lot of downside risk because money managers burned in the dotcom era learned their less and portfolios aren't as risky as 10 years ago." (Associated Press)

The ensuing credit implosion systematically restored the political correctness of the word "junk," as high-yielding bonds plummeted in the worst debt crisis since the Great Depression.

Which brings us to the trillion-dollar question: What about now? Or, expanded in a handy bullet-point format, the same question may be phrased like this:

- Has the world's leading economy learned its lesson?

- Is the thirst for yield less than the need for caution?

- Is the credit health of the United States different than before?

- Is it different this time?

Well, the following chart from Elliott Wave International's May 2015 Elliott Wave Financial Forecast shows you that -- yes! The credit bubble underway in the United States today is different than the one that triggered the 2008-9 crisis.

It's bigger.

"While the total value of investment-grade bond issuance surpassed $1 trillion in each of the last three years, the junk bond total more than doubled from the prior high in 2006 to more than $300 billion.

"'Back in 2006/2007, 28% of debt being issued was B-rated,' says hedge-fund manager Stanley Druckenmiller. Today 71% of the debt that's been issued in the last two years is B-rated. So, not only have we issued a lot more debt, we're doing so with much [lower standards].

"The quantity and quality of bond issuance over the last three years signals the potential for a credit washout that is even more severe than that of 2008/2009."

Our new, May Financial Forecast goes on to explain why it is so with an equally shocking chart of U.S. consumer credit since 1980.

You can see that second chart in part 1 of our brand-new, 3-part report titled

"Credit Insanity: The Biggest Debt Bomb in History and the Fuse is Lit."

Credit Insanity: The Biggest Debt Bomb in History and the Fuse is LitCreated for paying subscribers and now accessible to the public for the first time, this eye-opening new report reveals the precarious consumer, corporate and government debt situation around the world. Read this three-part report now and hear directly from the top analyst at the world's largest financial forecasting firm about key research, statistics and concerns about U.S. and global debt, as well as its imminent threats to investors. |

This article was syndicated by Elliott Wave International and was originally published under the headline Are We in Another Credit Bubble? And Is It Different than Before?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.