Silver Bullion Buying Outstripping Supply – Solar Demand Ramps Up

Commodities / Gold and Silver 2015 May 13, 2015 - 05:30 PM GMTBy: GoldCore

- Silver one of most undervalued assets in world today

- Silver one of most undervalued assets in world today

- Fundamentals for silver market very strong

- Total demand for silver outweighed supply by almost 22% last year

- Industrial demand set to surge as solar energy projects are expanded

- Artificially low prices have forced some mines out of business which may lead to a supply crunch

- Smart money including JP Morgan acquiring silver

- Silver to outperform assets including gold

Silver bullion remains one of the most undervalued commodities and store of value assets in the world today and therefore one of the greatest opportunities.

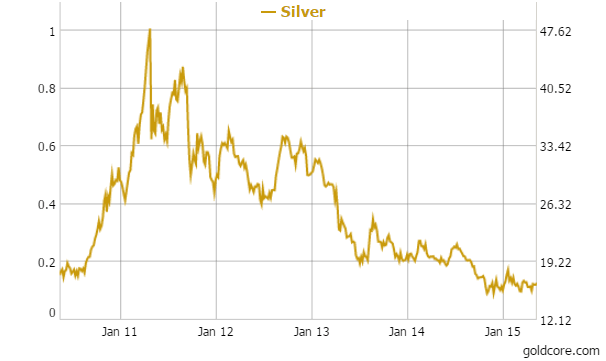

Indeed, we view the opportunity in silver bullion today as very much like that seen in the period from 2003 to 2006. Then, silver traded below $10 per ounce prior to sharp gains during and after the financial crisis which saw silver surge to $20 prior to a sharp correction and then surge to nearly $50 per ounce in April 2011.

Silver in USD – 12 Years – Thomson Reuters

Gold remains under covered in the mainstream media rather than specialist financial media such as Bloomberg, CNBC and the FT. It is very rarely covered in mainstream media and when it is covered it is frequently covered in a very unbalanced way – see ‘The Economist’ Anti-Gold Article – Case Study in Disinformation.

Poor man’s gold, silver is covered even more rarely and is therefore not on the radar of the majority of investors internationally and remains a hugely under owned asset. Therefore, it is encouraging to see the UK’s Telegraph publish an interesting piece this week making a strong case for owning silver.

The main thrust of the article by the commodities editor Andrew Critchlow, is that demand for solar power is increasing globally and this will impact positively on the price of silver as it is a crucial component of photovoltaic cells.

Indeed, the fundamentals in the silver market remain strong due to its role as an industrial commodity as well as a precious metal used in jewellery and for investment or rather store of value purposes.

New industrial applications for silver are constantly being discovered. It is an excellent electrical conductor, withstands corrosion and has anti-microbial properties making it very useful to a wide array of technologies.

These factors, coupled with its function as a store of value, would suggest that the strong demand currently seen for the precious metal will continue.

Demand has indeed, been strong – outstripping supply by almost 22% last year. Total global demand amounted to 1.07 billion ounces while total mine production worldwide came to 877.5 million ounces, according to the Telegraph.

The shortfall was made up from existing stocks of silver. How long this trend can continue is unknown.

Moreover, demand for silver is set to grow substantially in the coming years, according to the Telegraph, due to increasing demand for solar energy, and indeed other electronic, industrial and medical applications.

Renaissance alchemists like Isaac Newton associated silver with the moon. Its light – the energy which it transmitted to the earth – was harnessed from the sun.

Interestingly, in our modern endeavours to harness the sun’s energy, the moon’s metal plays a crucial role. As the Telegraph reports “Silver is a key component in crystalline silicon photovoltaic (PV) cells.”

The Telegraph continues:

“According to IHS, demand for solar power is set to increase by 30pc to 57 gigawatts of electricity in 2015. China alone is expected to install something in the region of 17 gigawatts of solar capacity by the end of the year, creating huge potential demand for silver.”

The case will look even more favourable “should a binding agreement be reached among major nations in Paris this year on climate change.”

The article says that 70 million ounces will be used just in the manufacturing of photovoltaic cells this year. That amounts to almost 8% of last years mine production.

Artificially low prices for the metal have forced mines to close in recent years. The Telegraph notes that supply may not be able to match increasing demand in the coming years, writing:

“Analysts fear that a lack of investment by silver miners could see production plateau over the next few years at a time when demand from the fast-growing solar power industry is expected to pick up rapidly.”

Critchlow concludes that silver “is a commodity that will grow dramatically in importance as the world searches for new sources of renewable energy.”

It would appear that the fundamentals in the case for owning silver are as strong as ever. It has been subject to the same ongoing price suppression that has beleaguered gold in recent years which has scared many safe-haven and store of value investors out of the market.

However, the tide may now be turning as large industrial users – for whom falling prices are a bonus – come into the market.

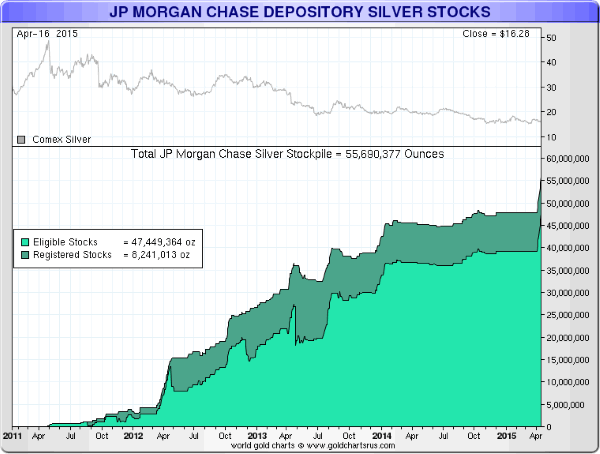

We recently covered JP Morgan’s rapidly increasing stockpile of over 55 million ounces (either in behalf of the bank itself or clients) and rumoured JP Morgan silver acquisition of an enormous hoard of 350 million ounces of physical silver. Indeed, the blog was picked up very widely and we received much feedback – mostly positive but some critical.

We intend looking at this more closely next week but in the meantime here is Ted Butler’s latest blog on this important development.

Conclusion

Unlike gold – almost every ounce of which was ever mined is still usable – silver is like oil and has been steadily consumed over the course of the last hundred years in non-recyclable industrial applications such as photography and more recently in electronic appliances including iPhones.

Nobody is really sure how much above ground silver is still in existence, however estimates are that there are around 1 billion ounces of above ground refined silver. This would mean that the entire silver market is worth approximately a tiny $17 billion today.

To put this in perspective, there are thousands of companies today with $1 billion plus market capitalisations – including companies that most of us have never heard of. Central banks globally print $17 billion in a few hours.

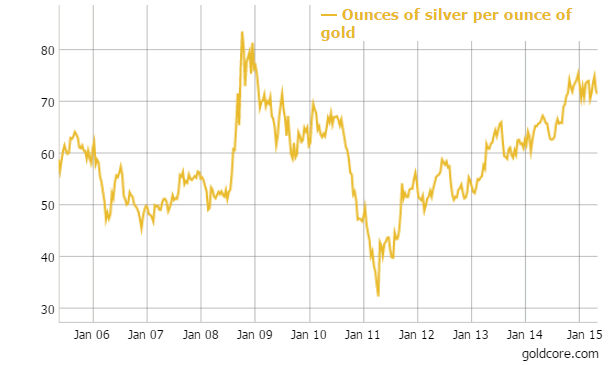

Throughout history, one ounce of gold could be exchanged for roughly fifteen ounces of silver. By that metric, silver, at over 70 ounces to 1 ounce of gold ($1,195/$16.77), is greatly undervalued today. In order to come back into balance, silver will likely outperform gold in the coming months and years.

We advise clients to diversify and hold a healthy allocation to physical silver stored in the safest vaults in the world. It is subject to fluctuations in price and volatility but then what markets are not today?

However due to its inverse correlation with financial assets, it is beneficial from a diversification and hedging point of view as it can reduce volatility and enhance returns in the overall investment portfolio.

How To Store Gold and Silver Bullion – 7 Key Must Haves

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,193.00, EUR 1,062.43 and GBP 761.55 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,184.45, EUR 1,051.07 and GBP 755.49 per ounce.

Silver in USD 5 Years

Gold climbed $9.80 or 0.83 percent yesterday to $1,193.20 an ounce, and silver outperformed and rose $0.26 or 1.6 percent to $16.54 an ounce.

Gold continued gains moving to its highest in a week with support from volatile markets, rising bond yields and a weak dollar. Gold in Singapore climbed 0.2 percent to $1,195.20 an ounce near the end of day trading and this was consolidated on in European trading.

Recent volatility in the bond markets and pressure in the equity markets have investors focused on economic data being released today. There are increasing concerns about the financial and economic outlook.

Precious metals often benefit from short term market turbulence especially when the U.S. dollar comes under pressure.

In late European trading gold is up 0.36 percent at $1,193.11 an ounce. Silver is up 0.87 percent at $16.67 an ounce, and platinum is also up 0.06 percent at 1,133.57 an ounce.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.