Negative Interest Rates Financial Black Hole

Interest-Rates / International Bond Market Apr 25, 2015 - 12:22 PM GMTBy: GoldSilverWorlds

It feels like not a single soul is worried about the increasing amount of negative interest rates. Ignorance or indifference? This could become a very expensive ordeal.

It feels like not a single soul is worried about the increasing amount of negative interest rates. Ignorance or indifference? This could become a very expensive ordeal.

A black swan event is a metaphor for an enormous problem that develops underneath the surface and then suddenly puts the whole financial system at risk. The financial crisis of 2008 was a black swan event, for example, that slowly developed in the US real estate market where excess had ruled in the years before.

Today, market conditions are ideal for a new black swan event to develop. An event like this takes people by surprise, because it matures under the radar in places where no one is looking. Today, for example, everyone is afraid of deflation. That means that everyone is trying to prepare for deflation.

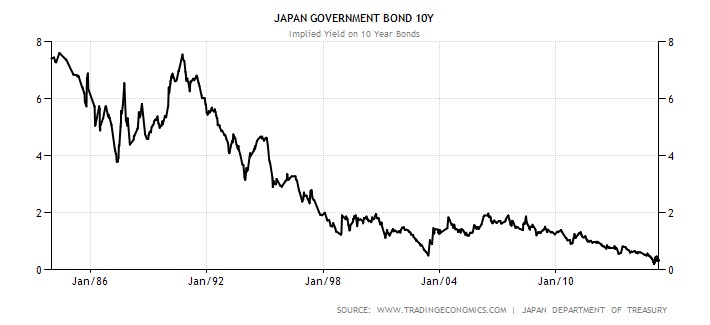

If everyone takes measures against deflation you get a mass migration to cash and government bonds, however, which are the assets that perform the best in a deflationary environment. Take a look at Japan: the yen had been on the rise for years up until the Japanese central bank took exceptionally aggressive monetary measures to fight the trend (at which they succeeded). Japanese investors historically also like its country’s government bonds, however, ever since deflation tormented the country in the ‘90s. At one point you got a 5% yield on a 10-year Japanese government bond, today you get 0.3% per year for the next 10 years.

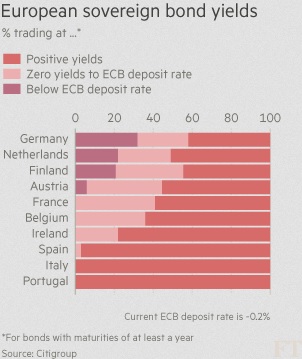

A comparable drama can be found in Europe today. Even worse, the fear of deflation has grown so much over there that negative interest rates can be spotted in an increasing amount of countries and for increasingly longer maturities. In France, a 10-year bond will still get you 0.35%, while in Germany a government bond with the same maturity will barely yield 0.07%. It only seems like a matter of time before people will have to start paying to keep government bonds in their portfolio. Isn’t that crazy?

Negative interest rates are not exclusive to Europe as well. Last week the first government bond ever with a negative yield was issued in Australia. Not many market watchers saw this coming, which underlines the seriousness of the problem. Negative interest rates change the rules of the game in the financial system, namely. Those who want to save money, have to pay money. Those who create debt, receive additional reward. It is the world upside down, but that is in fact what is happening.

In a few countries in northern Europe a few large investors are already seeing negative interest rates on their mortgage financing. They are not getting a monthly paycheck for creating debt just yet, because at the moment this is still offset by the costs, but it only seems like a matter of time before this mechanism gets going and the larger public gets its hands on it. Because when local countries issue bonds, they often come with a yield that is lower than or equal to the ECB deposit rate, which also dropped below zero (-0.2%) in the meantime (see table below).

Who is going to save money then? Not a single soul, of course. People will start to create debt en masse, because it is the better and cheaper option. The resulting investments will rise in value, moreover, when an increasing amount of people take on debt in search for returns. Things cannot get a lot crazier than this.

If this is how the system ends up working, we fear that the effects will be irreversible. It is like a black hole that sucks in more and more matter – read: capital – and never lets go. This financial black hole story will also end with a sudden implosion, a flash of light and a big bang, just like in space, and those who do not own hard assets at that point in time could lose every bit of wealth they’ve ever accumulated. As Alan Greenspan, former chairman of the Fed and original promoter of monetary expansion, said once: “Or how you can lose your savings in a blink of an eye”.

The big issue is that we do not see any measure that can reverse this process. Governments are not moving a finger to turn things around; and why would they? They are on the side of the debt creators; the ones that are profiting enormously from this black hole. Central bankers are frustrated, however, because they do not have a lot of tools other than to make monetary demands more flexible, which has the wrong effect: it accelerates the wildfire of negative interest rates.

All of this can only end in financial drama, in our opinion, if no measures are being taken to stop it. Negative interest rates are only attracting more capital, not less, like a black hole in space continuously increasing in size and strength. The ending will be bloody, but that is something no one wants to acknowledge today because returns on government bonds are still the primary focus. We will not participate in this game, for which we cannot envision a happy ending. You are warned.

Secular Investor offers a fresh look at investing. We analyze long lasting cycles, coupled with a collection of strategic investments and concrete tips for different types of assets. The methods and strategies are transformed into the Gold & Silver Report and the Commodity Report.

Follow us on Facebook ;@SecularInvestor [NEW] and Twitter ;@SecularInvest

Source - http://goldsilverworlds.com/

© 2015 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.