Stocks and Bonds Seven Year of Negative Returns; Fraudulent Promises

Stock-Markets / Financial Markets 2015 Apr 23, 2015 - 05:24 PM GMTBy: Mike_Shedlock

It is extremely refreshing to see a large, prominent, and historically accurate fund manager lay it on the line.

It is extremely refreshing to see a large, prominent, and historically accurate fund manager lay it on the line.

GMO does that quarter after quarter, with no-nonsense projections.

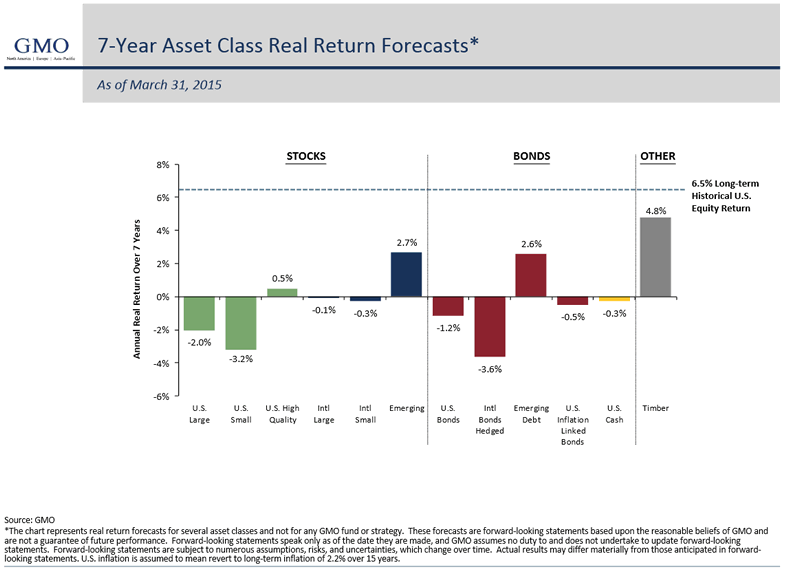

As of March 31, their 7-Year Asset Class Real Return Forecast is as follows.

Serious Question for Pension Plans

Given pension plan assumptions of 7-8% annualized returns how many of them can survive negative returns for seven years? It's important to not that GMO is talking about "real" inflation-adjusted returns with an assumption of mean-reversion inflation to 2.2% over 15 years.

Still, that leaves US equities at zero to -1% returns and bonds US bonds at negative 2.4% returns.

Even if GMO is wrong by say 3%, many pension plans will be in deep serious trouble at those returns.

Illinois Pension Plans

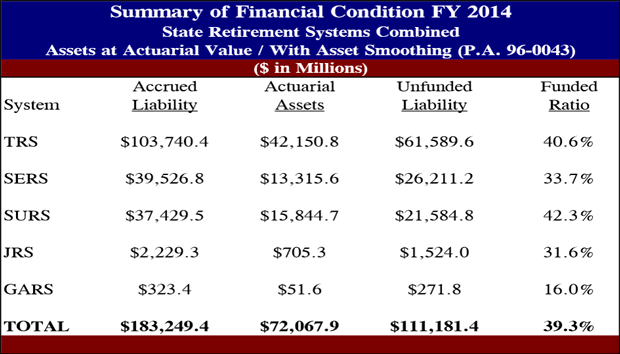

I keep harping about this issue, but it's an important one. In the state of Illinois, and in spite of an enormous rally in the stock market since 2009, Illinois pension plans are only 39% funded.

A "Special Pension Briefing" last November, shows the Illinois State Retirement Systems are in dismal shape.

Unfunded Liabilities

- Teachers' Retirement System (TRS): $61.6 Billion

- State Retirement Systems (SERS): $61.6 Billion

- State Universities Retirement System (SURS): $21.6 Billion

- Judicial Retirement System (JRS): $1.5 Billion

- General Assembly Retirement System (GARS): $0.3 Billion

The above numbers show actuarial (smoothed) asset valuations.

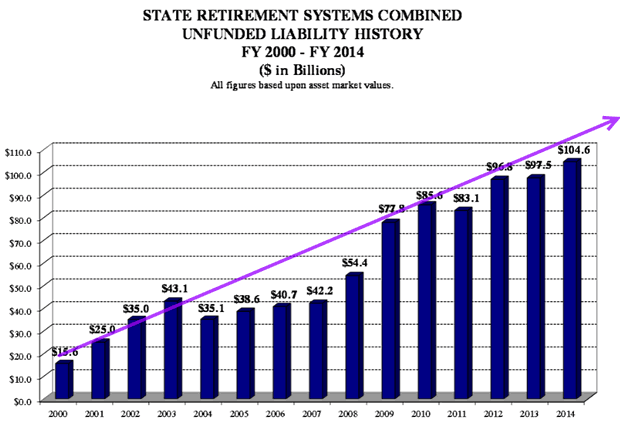

Liability Trends - Not Smoothed

In spite of the massive stock market rally, Illinois liabilities increased every year since 2011.

For still more details, please see Illinois Pension Plans 39% Funded; Taxpayers On the Hook for $105 Billion in Liabilities; It Will Get Worse!.

Any notion that pension shortfalls can be balanced on the backs of Illinois taxpayers needs to vanish now.

How did Illinois plans became so underfunded?

In general, by promising far more than can possibly be delivered.

Summary of Liabilities and Unfunded Ratios

Congratulations go to the Illinois General Assembly Retirement System (GARS) for having one of the worst, (if not the worst) pension plan in the entire nation. It is 16% funded.

No doubt, that increases the pressure of the General Assembly to put the burden of bailing out the system on the backs of Illinois taxpayers.

Fraudulent Promises

Pension promises were not made in good faith.

Rather, pension promises were the direct result of coercion by public unions on legislators, mayors, and other officials willing to accept bribes because they shared in the ill-gotten gains of backroom deals at taxpayer expense.

Illinois taxpayers cannot be held accountable for coercion of public officials by public unions. Fraudulent promises will be held "null and void" in any "non-stacked" court of law in the nation.

Given the 31% funding of the Illinois Judicial Pension Plan (JRS), the sorry state of Illinois pensions is likely headed to federal courts.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.