Debt Crisis - When All News Is Bad News

Politics / Global Debt Crisis 2015 Apr 22, 2015 - 10:42 AM GMTBy: John_Rubino

One of the defining traits of financial bubbles is the willingness of traders and investors to interpret pretty much everything as a buy signal. Rising corporate earnings mean growth, while falling profits mean easier money on the way. War means more revenues for defense contractors and easy money for everyone else. Blizzards means consumer spending will rebound in the Spring. Inflation means higher asset prices for speculators while deflation means, once again, easier money for everyone. When people are this optimistic they find the silver lining in every black cloud and happily to buy the dips with borrowed money.

A timely example is Greece’s threat to leave the Eurozone, default on its debt and go back to using drachmas. This could be seen as either the beginning of a chain reaction that destroys the eurozone and the rest of the world as we know it, or as an excuse for vastly easier money. So far — in a sign that the bubble is still expanding — each new twist (like last weekend’s announcement of de facto capital controls) has been accompanied by European Central Bank reassurances and market acceptance of those promises.

Another case in point is China’s twin weekend announcements that two major companies defaulted on their debt while the government eased bank reserve requirements. The pessimistic take on such things happening simultaneously would be that China’s financial sector is in crisis and the government is desperately and probably impotently trying to stop the bleeding. But the European and US markets saw only the liquidity side of the story and bid up risk assets pretty much across the board.

When we change our minds

But in the life cycle of every bubble there comes an emotional phase change. Dark clouds start to obscure their silver linings and new highs get harder and harder to achieve. Think home prices rising beyond middle-class affordability in 2007 or tech stocks hitting 50-times sales in 1999. Only unambiguously good news can keep the bubble going, and because few events are that pure, the crowd gets nervous and the spin gets negative. Faster growth means tighter money; a weak dollar means inflation while a strong one means falling corporate profits. War means instability, extreme weather means lower near-term growth. So sell the rallies and hide out in cash.

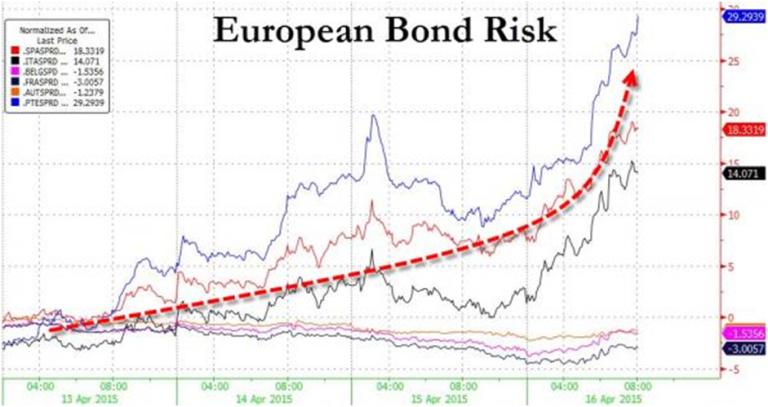

The world isn’t quite at this point — or maybe it is. The following chart (from Bloomberg) shows the impact of Greece’s impending loan deadline on a measure of risk in peripheral eurozone bond markets. Greece is the blue line; the black and red are Italy and Spain.

There’s no way to know until after the fact if the dark night of the market’s soul has begun. But when it comes, that’s how its first stage will look.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.