Gold Price Has “Hallmarks Of Market That Is Bottoming”

Commodities / Gold and Silver 2015 Apr 17, 2015 - 04:36 PM GMTBy: GoldCore

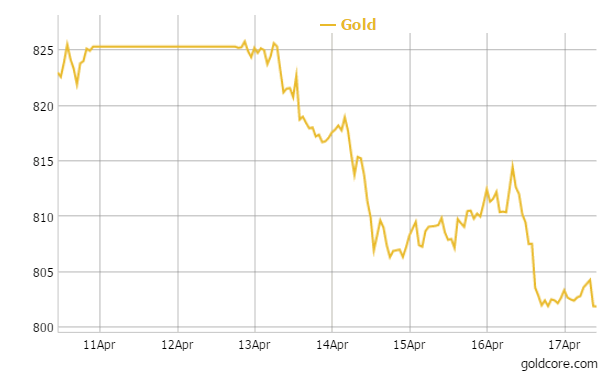

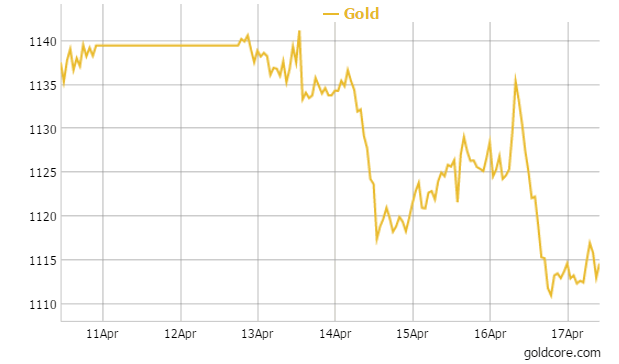

Today’s AM LBMA Gold Price was USD 1,204.55, EUR 1,113.83 and GBP 801.86 per ounce.

Today’s AM LBMA Gold Price was USD 1,204.55, EUR 1,113.83 and GBP 801.86 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,204.60, EUR 1,131.19 and GBP 811.40 per ounce.

Gold fell 0.29 percent or $3.50 and closed at $1,199.00 an ounce on yesterday, while silver rose 0.18 percent or $0.03 closing at $16.29 an ounce.

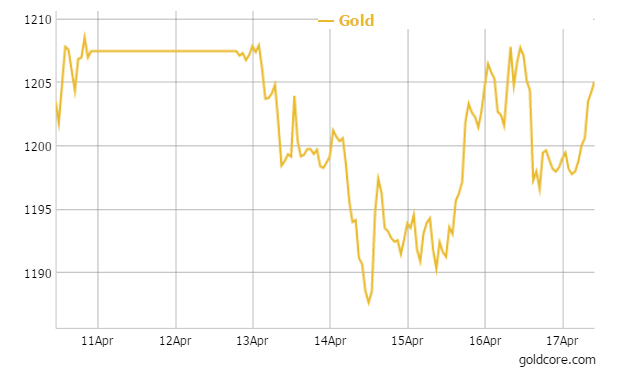

Gold in USD – 1 Week

In Singapore gold was at $1,200.80 an ounce near the end of day trading. In late European trading gold is at $1,205.31 an ounce or up 0.52%. Silver is at $16.44 an ounce or up 0.87% while platinum at at $1,165.67 an ounce or up 0.41%.

Gold remained firm above $1,200 an ounce today with the weaker dollar, negative economic data and concerns about a Greek debt default supporting this week. Greece’s government has been dead locked in talks over harsh measures to its bailout loans. Germany’s Finance Minister said an agreement next week would be unlikely increasing the likelihood of a default.

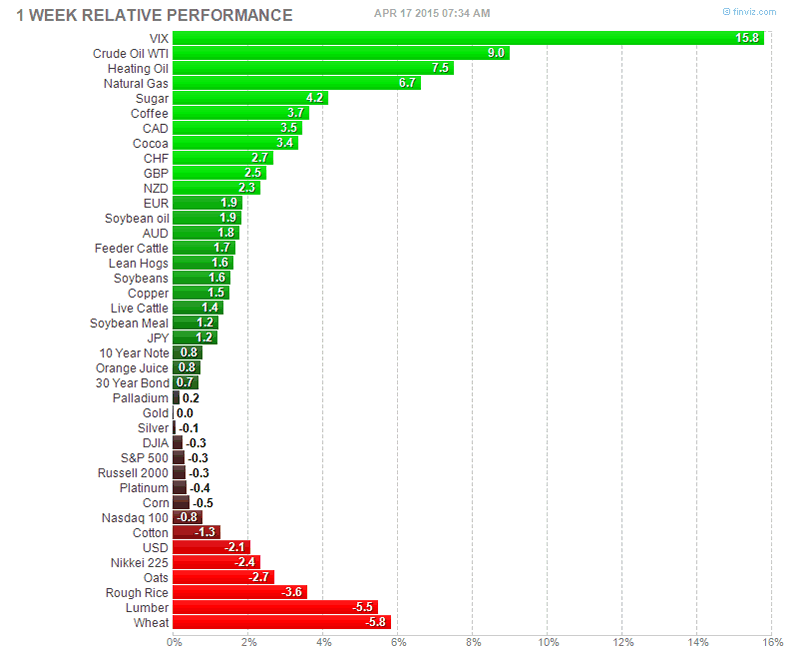

For the week, in dollar terms gold is $2 or marginally lower, while silver is down 0.3% and platinum is down nearly 1%. Palladium is outperforming and is up 1% and is having its third straight weekly gain.

The marginal losses are the first loss since the week ended March 13. After recent sharp gains in euros terms in particular and indeed in sterling terms, gold was weaker in both currencies this week.

Gold in GBP – 1 Week

European markets were sharply lower in morning trade, as investors become increasingly nervous about the funding crisis in Greece and the Chinese economy. Falls in Chinese stock markets and an outage on Bloomberg financial terminals did not help increasing market jitters.

There is also some nervousness creeping in about the risk of over valuations and developing bubbles in stock and bond markets globally – not to mention a developing global property bubble.

Some analysts posit that uncertainty over the timing of the U.S. Fed’s first interest rate hike in ten years is weighing on gold but this uncertainty appears to be exaggerated, especially given the fact that much of the economic data this week out of the U.S. and China has been negative and suggests the U.S. and global economy are weakening again.

This would be bearish for stocks and bonds and bullish for gold.

Gold in Euro – 1 Week

Yesterday’s economic data out of the U.S. was fairly poor. Weekly unemployment claims came in at 284,000 and 294,000 were forecast. The Philly Fed manufacturing index was 7.5 versus 6.5 forecasted. U.S. building permits and housing starts were both below their forecasts.

The U.S. inflation number today was a non event and was largely as expected.

U.S. economic data released this week showed signs of economic weakness, adding to speculation that the Federal Reserve may delay raising interest rates.

Fed Vice Chairman Stanley Fischer said yesterday that he expects the economy to rebound after a soft first quarter. Atlanta Fed President Dennis Lockhart and Boston Fed chief Eric Rosengren said in separate speeches the recent spate of weak data made them more wary of tightening too soon.

The surge in oil and energy prices this week could be supportive of gold next week.

Gold has all the hallmarks of a market that is engaged in a long process of bottoming.

Much of the weak hands have been washed out of the market with us and many bullion dealers internationally are seeing renewed selling of bullion this week after gold fell below $1,200 again. This is especially the case among small retail investors who are nervous about further price falls and capital losses. Some high net worth clients continue to dollar cost average into gold and silver bullion due to the quite strong fundamentals.

Sentiment in general remains poor and all the focus is on gold’s weakness in dollar terms, despite gold’s strong gains in euro terms in 2014 and so far in 2015. Poor sentiment is of course bullish from a contrarian perspective and suggests all the froth has been washed out of the gold market.

Gold’s gains in euro terms in 2014 and again in 2015 is a harbinger of higher prices in dollar terms in the coming months. The fact that gold has held up so well despite dollar strength, equities continuing to surge and the collapse of oil prices is positive for the long term outlook.

However in the short term, the technicals remain poor and the momentum, trend following traders are focussed on gains in stocks, bond and other markets. This could result in further weakness next week.

Dollar cost averaging into position remains prudent given developing risks of a new global financial crisis – possibly triggered by a Greek default in the Eurozone.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.