Gold Price Flat In Quarter In Dollars But 5% Higher In Pounds

Commodities / Gold and Silver 2015 Apr 01, 2015 - 02:52 PM GMTBy: GoldCore

Gold flat in quarter in dollars but 11% and 5% higher in euro and sterling

Gold flat in quarter in dollars but 11% and 5% higher in euro and sterling- Gold essentially flat with fall of just $2 or 0.0017% in dollar terms

- Euro was the worst performing major currency in Q1

- Gold one of strongest currencies after silver, dollar and Swiss franc

- Silver surges 6.5% in dollars and 19% and 12% in euros and pounds

- Oil and most commodities declined on economic concerns

- U.S. stocks eked out minor gains to new record highs and look toppy

- Gold performance impressive given strength of dollar and equities, oil collapse and negative sentiment

Gold was essentially flat with a fall of just $2 or 0.0017% in dollar terms in the quarter. While gold was essentially flat in the quarter in dollar terms, it is important to note that gold was 11% and 5% higher in euro and sterling terms – building on the respective 13% and 6% gold price gain seen in 2014.

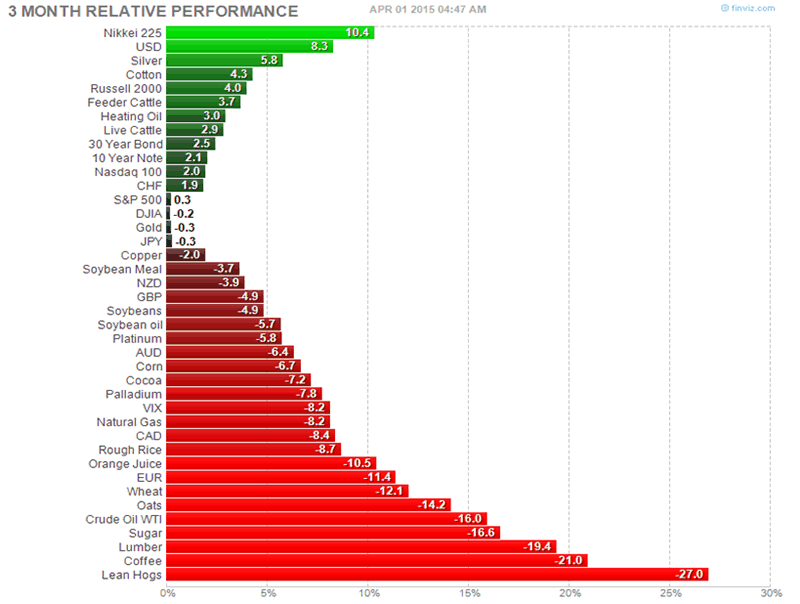

Silver surged and was third strongest market relative to other major markets globally – including currencies, financial assets, stocks and commodities – rising 6.4% in dollar terms and 19% and 12% in euro and pounds.

Gold in US Dollars – Q1, 2015 (Thomson Reuters)

The euro fell 11.2% relative to the basket of assets following the ECB’s foray into the uncharted territory of the ‘QE Bazooka’ and uncertainty over the future of Greece in the Euro zone and over the future of the euro itself.

While the euro experienced sharp decline, gold priced in euros rose substantially from around €978 to over €1100 per ounce.

Other poorly performing currencies include the Canadian dollar (-8.3%), Australian dollar (-6.0%), British pound (-4.6%), New Zealand dollar (-3.5%). The Japanese yen was flat with a 0.1% fall.

Gold performed its traditional role as hedge against currency depreciation over the period with all currencies which performed poorly seeing gold price gains. It is important to note that gold buyers buy gold in local currencies and have exposure in and to local currencies. Therefore it is important for non-U.S. investors to focus on gold in local currency terms.

Gold in Euro – Q1, 2015 (Thomson Reuters)

Gold priced in Canadian dollars was also up considerably – from around $1375 to $1500 per ounce.

In Australian dollars gold rose from around $1450 to just over $1550. In British pounds gold was up from around £760 to slightly below £800 per ounce.

The New Zealand dollar saw a slight increase over the same period from roughly $1540 to around $1590 per ounce.

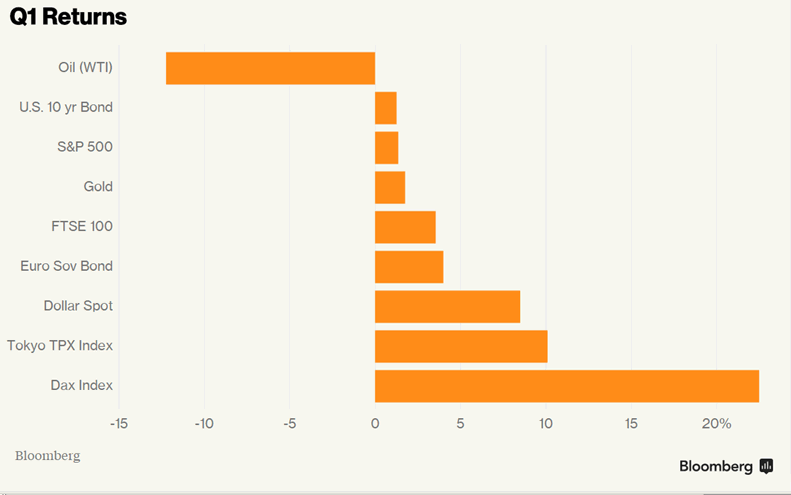

The strongest performing assets were generally those which have been the beneficiaries of ultra loose monetary policies by the Fed, BOE, ECB and the BOJ. The Nikkei 225 was up 10% and the DAX by 23% (see chart below).

The Nikkei 225, the DAX and the U.S. dollar were the strongest performing markets followed by silver and a mix of U.S. stocks and bonds and the Swiss franc.

Gold in British Pounds – Q1, 2015 (Thomson Reuters)

Platinum fell 5.5% and palladium 7.9% in the first quarter.

Commodities, and energy and agricultural commodities in particular, fared poorly. Rice, orange juice, wheat, oats, sugar, coffee and lean hogs all had sharp declines ranging from -8.7% to -27%.

Crude oil and natural gas fell 15.9% and 8.6% while copper and lumber fell -1.8% and -19.4% respectively, further demonstrating developing weakness in the global economy.

Certain commodities performed well – generally ones which have seen losses in recent months. Cotton, feeder cattle and heating oil saw gains.

Stocks and bonds were higher with the S&P, Dow, Russell 2000, Nasdaq 100, 30 year bonds and 10 year notes were up between 4% and 0.2%.

It is testament to gold and silver’s inherent strength that they have outperformed many paper assets, even assets which have been positively targeted by the Fed and other central banks and boosted by loose monetary policy – such as major stock indices and bond markets.

The very marginal decline of gold priced in dollars has led to some more negative comment about gold’s “quarterly fall.” This is contributing to poor and indeed negative sentiment towards gold in western markets. This is bullish from a contrarian perspective and suggests we have bottomed or are close to bottoming.

Much analysis focuses on gold solely in dollar terms and discusses gold with the continuing assumption of a recovery and global economic growth. Recent data calls this into question and suggests that the recovery in the real economy is meagre at best.

The resilience of gold in the first quarter against the backdrop of a strong dollar, record highs in stock markets, the collapse of oil and gas prices and negative sentiment towards the precious metal is encouraging.

The assets that performed well in Q1 were, by and large, those that are bloated with monetary stimulus – primarily stocks and bonds. These bubbles are increasingly vulnerable and will likely burst – the question is when rather than if. Then, gold’s financial insurance attributes will again protect those who have diversified into it.

MARKET UPDATE

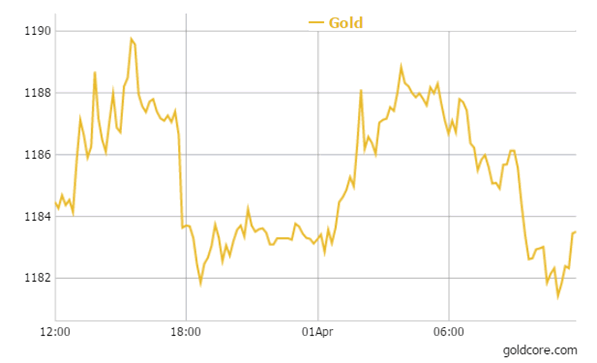

Today’s AM fix was USD 1,181.25, EUR 1,099.50 and GBP 800.36 per ounce.

Yesterday’s AM fix was USD 1,179.25, EUR 1,098.84 and GBP 797.95 per ounce.

Gold in USD – 1 Day

Gold dropped 0.11 percent or $1.30 and closed at $1,184.20 an ounce yesterday, while silver lost 0.36 percent or $0.06, closing at $16.65 an ounce. Overnight in Singapore, gold prices again fell marginally to touch a low of $1,181 per ounce prior to small gains in London this morning.

Gold closed very marginally lower in dollar terms yesterday and for the quarter. This is somewhat negative from a technical and sentiment perspective, however strong fundamentals and robust global demand are likely to support.

Did Wall Street players “paint the tape” and ensure a lower quarterly close to keep animal spirits in the gold market muted and encourage momentum traders to go short? We cannot tell but it would be somewhat naive to completely discount that possibility given the shenanigans banks have been found guilty of in recent months and years.

It is important to remember that no matter what manipulation may take place in futures markets, Asian and global physical demand including central bank demand will dictate the price of gold in the long term. Patience will reward those who retain an allocation to physical gold in the coming years.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.