Reflections in a Golden Eye - Gold Market Rejection, Repatriation and Redemption

Commodities / Gold and Silver 2015 Mar 28, 2015 - 08:56 PM GMTGillian Tett (Financial Times): "Do you think that gold is currently a good investment?"

Alan Greenspan (private citizen): "Yes. Remember what we're looking at. Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it."

– Council on Foreign Relations meeting, November, 2014

OPINION

Reflection #1

Caveat venditor

Let the seller beware! The German citizen/investor who put away a few rolls of 20 mark gold coins (.2304 tr ozs. shown below) in 1918 would have done so at 119 marks per ounce. By early 1920 the previous rapid inflation had suddenly given way to deflation. Had that gold owner decided to cash in on gold's significant gains thinking runaway inflation was over, a 100,000 mark investment would have made him or her a millionaire. The glow, however, would have quickly worn off. By late 1921 the runaway inflation had resurfaced but now with a vengeance. Gold shot to 4,000 marks per ounce. By mid-1922 gold reached 10,000 marks per ounce and the wholesale price index went from 13 to 70. By late 1922, the roof caved in. Gold traded at 134,000 marks per ounce. In January, 1923, it cracked 1,000,000 marks per ounce. By midyear, it broke the 100 million marks per ounce barrier and at the peak of the hyperinflationary breakdown, it sold for over 100 billion marks per ounce. The individual who thought he or she had the cat by the tail and cashed-in his or her golden chips during the 1920's deflation became a millionaire. In short order though, that millionaire became a pauper as wave after wave of hyperinflation washed over the German economy. One moral from this somewhat frightening tale is that becoming a millionaire or even a billionaire on one's gold holdings was inconsequential. Another is not to give up one's hedge until there is ample evidence that it is no longer needed. Momentary nominal profits can be illusory.

Caveat venditor!

TrailerNote – From The Nightmare German Inflation by Scientific Market Analysis: "Those who held funds in dollars, pounds or other stable currencies, or in gold, saved their capital. The government set up rigid exchange controls as the inflation proceeded. As usual under such conditions, a black market flourished. The ones who fared best were the small minority who had the foresight to exchange marks into foreign money or gold very early, before new laws made this difficult and before the mark lost too much value." The currency image (left) illustrates the rapid depreciation in Germany's paper money with single notes going from a 20 mark value in 1918 (the paper equivalent of one 20 mark gold coin) to a 20 million mark value in 1924. Fast forward to 2015, nearly one hundred years later, and we find that all currencies are being deliberately devalued against one another in an on-going global currency war. That hedge is no longer available. Only gold stands outside the fray. Perhaps that is why former Fed chairman Alan Greenspan recently said, "Remember what we're looking at. Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it."

Reflection #2

New Fix same as the old Fix

Though Financial Times, quoting reliable sources, reported that the new London Gold Fix would be comprised of eleven members, three of which would be Chinese banks, in the end only six banks made the cut, all of them familiar names, all of them western banks – Barclays, HSBC, SocGen and Bank of Nova Scotia, UBS and Goldman Sachs. Governing the Fix, we will now have two British banks (Barclays and HSBC), a French bank (Society Generale), a Canadian bank (Bank of Nova Scotia) and an American bank (Goldman Sachs) but no Chinese banks. Notably absent is another American bank, JP Morgan. I should add that in one announcement on the new participants, room was left for the entry of Chinese banks at some later date. No date-certain was offered. Little seems to have changed with this player roster. All six are currently under investigation by the U.S. Department of Justice for gold market rigging, so we are left to wonder whether or not anything meaningful in terms of reform has been accomplished. The new Fix, in short, looks pretty much like the old fix only on an electronic platform. At the very least, the London Bullion Marketing Association should be more forthcoming about why Chinese banks were rejected for membership at the outset. It would also be helpful to know if Chinese banks might play a role in the future and, if so, when.

TrailerNote – China is now pressuring the physical gold market the way Europe led by France did in the late 1960s, early 1970s. The blunt tool employed last century was physical delivery. China employs the same tool today and, at this juncture, one can only speculate whether or not its interest in physical delivery might have played a role in its being left out of the new price setting club. I will stick with my original contention that once the London–Zurich–Hong Kong–Shanghai runs dry, China's best interest lies in higher gold prices against all currencies including the U.S. dollar. I hasten to add that it is likely to act in its best interest whether or not it takes a seat at London's price setting table. It seems to me that London would be better off with China in the club than outside. The British establishment seems to have applied that kind of logic in joining the Asian Infrastructure Investment Bank despite American criticism. Thus far though, it has failed to apply the same logic to the new London Fix. China is not likely to sit back and wait forever for a membership invitation when it is fully capable of starting a new club on its own. That is where the Shanghai Fix might still play a role in setting the price of gold. Subsequent chapters to this tale, it seems to me, remain to be written.

By the way, here is a food for thought on the AIIB situation from the Telegraph's Ambrose Evans-Pritchard: US risks epic blunder by treating China as an economic enemy(More below)

Reflection #3

Federal budget myths and reality

The gap between the "political" deficits and the "real" deficits remains a constant source of irritation among economic conservatives. For fiscal year 2014, the political deficit, played up by the press, was $483 billion – the politicians' feel good number. Here's the reality: On October 1, 2013, the beginning of the federal government’s fiscal year, the national debt stood at $16.747 trillion. By the end of the federal government's fiscal year, September 31, 2014, it was $17.824 trillion. In reality, the federal government added $1.077 trillion, not $483 billion, to the national debt. The inability of the Beltway to confront the budget deficit reality is at the basis of its inability to deal with it.

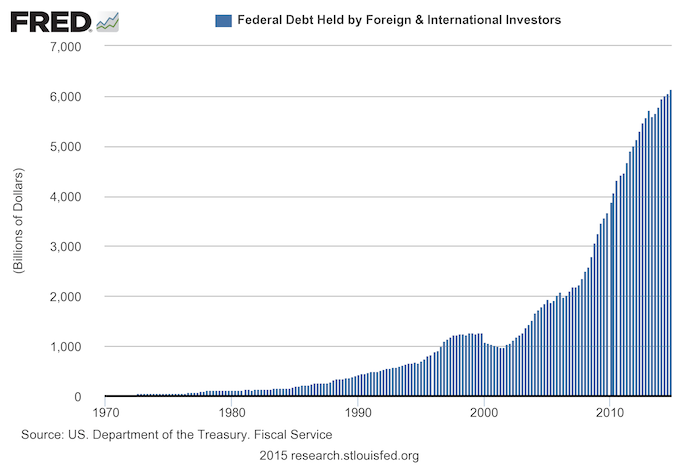

TrailerNote – The politicians complain about the deficit but they never really do anything about it – Democrat or Republican. Dick Cheney, George W. Bush's vice-president, went so far as to say that "Reagan proved that deficits don't matter." One wonders what Ronald Reagan, a life-long critic of over-blown government spending and the irredeemable national debt, might have thought of that comment. Another myth promoted by many within the political class (mostly the Keynesian variety) is that the national debt doesn't matter because we owe it to ourselves. First, deficits do matter because as a practical matter the taxpayers ultimately must pay the interest on the national debt. In fact roughly one-third of the real deficit quoted above is interest on the national debt, money that would be better spent elsewhere. Secondly, we no longer owe the money only to ourselves. We owe a big chunk to China ($1.24 trillion) and another big chunk to Japan ($1.24 trillion). In total, the United States owes the rest of the world $6.22 trillion – or about one-third of the total national debt. To redeem this debt with the bullion in U.S. Treasury coffers, gold would need to be priced at $23,800 per troy ounce.

Reflection #4

How gold benefits from the yuan's challenge to the dollar

The United States government reacted strongly to China’s introduction of financial institutions to rival the International Monetary Fund and the World Bank. The United Kingdom, Germany and France – Europe’s core nation states – have become (or are in the process of becoming) members of China’s news Asian Infrastructure Investment Bank (AIIB) much to the chagrin of the U.S. government. China set up the AIIB to rival the International Monetary Fund and the World Bank – two institutions at the heart of the dollar's global hegemony and top reserve currency status. Last week, the United States, in a rare public criticism of the United Kingdom, complained of a “constant accommodation of China, which is not the best way to engage a rising power.” Japan, Australia and New Zealand have also joined the AIIB, so none of those countries is engaging China in "the best way" either. China has designs of making the yuan an international rival to the dollar and with its nearly $4 trillion in currency reserves, it has the financial muscle to make it stick.

So what does all this have do with the demand for gold? The World Gold Council's Juan Carlos Antigas offers this interesting take on the situation:

“The importance of China on the global stage is not yet reflected in its currency. It is likely that we will see a greater renminbi footprint before long. . . The dollar’s share of global reserves has fallen slowly but steadily – from 61% in 2000 to 55% in 2014 – as the euro’s share grew from 15% to 22%. Other currencies are growing too, particularly the Canadian and Australian dollars. However, as non-dollar currencies increase in their share of global reserves, their effectiveness in diversifying foreign reserves may diminish as the monetary policies of their respective central banks become more synchronised. This could make gold’s value as a diversifier in foreign reserves more apparent to central banks. "

The potential effects of gold repatriations on the rest of the market

Bundesbank reported recently that it repatriated 120 tonnes of gold last year. Gold analysts thought the repatriation had stalled but that does not seem to be the case. The 120 tonnes represents about 18% of the intended repatriation to be completed by 2020. The pace of repatriation is not as important as the intent. With the ECB having launched its quantitative easing program and the seemingly intractable sovereign debt problems in the southern tier creeping back into play, Germany – like Netherlands, Belgium, Austria and possibly others – would like to repatriate its foreign gold within national borders.Though none of these countries talk about the real rationale for repatriation officially, there has to be an element of on-going concern about whether or not the euro system rests on solid ground. Too, with the U.S. national debt being what it is, monetary fundamentalists the world over worry about the long-term stability of the dollar as well, and some of those, believe it or not, still hold advisor status in the policy councils of nation states.

TrailerNote – These repatriations are not well understood. Many believe that the depositories (e.g., the New York Federal Reserve, the Bank of England, the Bank of France, Bank of Canada) are on the hook for returning this gold to its rightful owners – other central banks like Bundesbank. That, however, is not the case. The real debtors are the bullion banks who took the gold on deposit from central bank creditors then loaned it back out to various customers who, in turn, used it in their ordinary business operations. Now that gold is widely dispersed among the global population, and reassembling it in 'good delivery' form is like putting Humpty Dumpty back together again. As a result, the bullion banks are forced into the open market to make good on their promises – a process likely to take several years depending upon who lines up in the queue and when they decide to do so.

I have mentioned in previous writings that gold repatriation is a hidden source of demand. In fact, it is a hidden source of semi-permanent, built-in, and elevated demand. As such it serves as an important adjunct to China's acquisitions. Neither of these demand sources is likely to go away any time soon. This shift in sentiment only adds to gold's long term prospects for the investor who understands the suppy-demand dynamics and has the patience to let the market find its way on these matters. The best way to do that is by owning physical gold coins and bullion, tucking it safely away and taking a 50 yard line seat to watch the action here at USAGOLD. No country seeking repatriation would be going to all this trouble if it and an important chunk of its citizenry lacked faith in gold's centuries old status as a reliable and constant store of value. That perhaps is the most important message of all in the unfolding repatriation movement.

If you are looking for a gold-based analysis of the financial markets and economy, we invite you to subscribe to our FREE newsletter – USAGOLD’s Review & Outlook, edited by Michael J. Kosares, the author of the preceding post, the founder of USAGOLD and the author of “The ABCs of Gold Investing: How To Protect And Build Your Wealth With Gold.” You can opt out any time and we won’t deluge you with junk e-mails.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.