What’s Wrong With Silver?

Commodities / Gold and Silver 2015 Mar 25, 2015 - 02:13 PM GMTBy: DeviantInvestor

Which silver? Paper silver or real silver?

Which silver? Paper silver or real silver?

Silver prices are largely set on the COMEX futures – paper silver. A company can post the margin and sell short thousands of contracts with no actual metal available thereby creating artificial supply. The reverse occurs when some company buys thousands of contracts. It is a paper game, but unfortunately it has tremendous influence on the price of real silver.

What’s wrong with paper silver? Paper silver has been aggressively sold and that pushes prices down – just the opposite of what occurred between 2009 and April 2011. What is wrong with paper silver is … probably nothing. Buyers and sellers do their thing, sometimes in fractions of a second, and they define a price for paper.

What’s wrong with physical silver? The usual – the paper markets set the price for the physical markets and drive prices to unsustainable highs and lows. We are currently at the low end of the cycle.

How do we know the price is low and due to turn up? Of course we have no guarantee (my crystal ball is being repaired) but we can look at the demand and charts. Steve St. Angelo publishes excellent analysis on physical supply and demand for silver. Read his many articles, but a summary is: silver supply is weak and global investment demand is strong, especially at these prices.

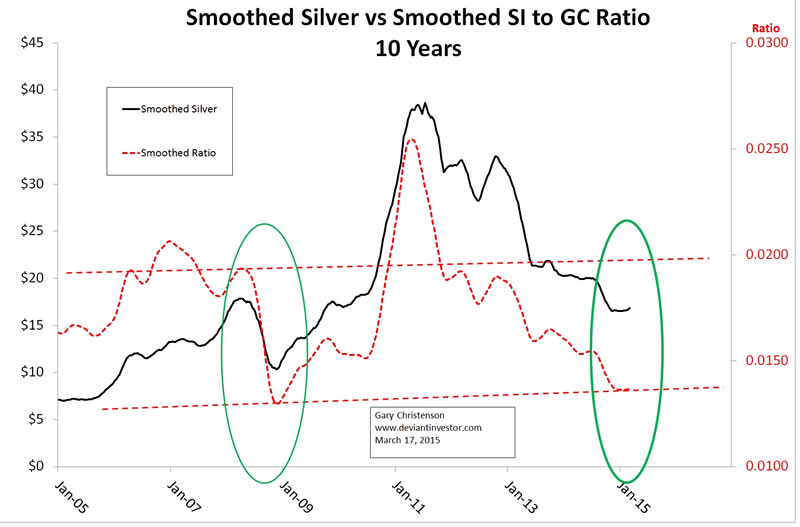

The silver to gold ratio shows a clear pattern for the past 44 years. When silver prices are low so is the ratio, and when the ratio is high, look out below. Silver moves higher faster than gold and crashes more quickly, hence the volatility in the ratio. Examine the (smoothed) chart for the past 10 years as an example. The ratio is now quite low and so is the price of silver. History shows that exponentially increasing debt creates exponential increases in consumer prices, currency in circulation, and gold prices. Debt will increase – this is as certain as tomorrow’s sunrise – and gold prices will also increase, albeit erratically.

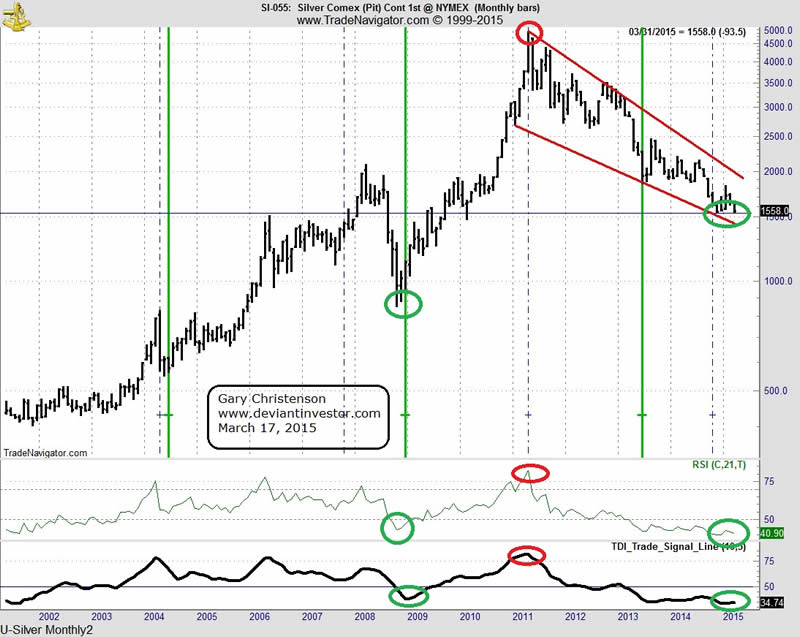

Other analysts suggest gold and silver have not reached their final lows. They may be correct in the short-term (not my take), but in the long-term, prices for both metals will go substantially higher. Examine the monthly log scale chart of silver.

Note the massive correction in prices, and the deeply oversold (monthly) condition of the RSI (Relative Strength Indicator) and the TDI. Prices have been ready to turn up for several months. Prices may not rally this week but they will soon. Stacking silver is good insurance.

What could go wrong with our political and financial systems that might assist silver prices?

The US recently sent 3,000 troops and 750 tanks and other military vehicles to Latvia on the Russian border.

“Russia Starts Nationwide Show of Force:” 45,000 Russian troops plus war planes and submarines are performing military drills.

Over 20 central banks have reduced interest rates in the past few months. They are not reducing interest rates because their economies are strong. Hint: more QE.

Great Britain joined the Chinese backed Asian Infrastructure Investment Bank, clearly in opposition to US interests. Germany, France and Italy did the same. US influence is declining and Chinese and Russian military and economic influence is rising. How long will the dollar be the ONLY reserve currency in the world? When those excess dollars flood back to the US, after they are no longer needed elsewhere, how much inflation will that create for the U.S.?

Economic wars and hot military wars increase debt and commodity prices. Gold and silver will see another rally, probably one that surprises almost everyone.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.