Gold And Silver - China's AIIB Spells U.s. Dollar Demise, Not Clear For Precious Metals

Commodities / Gold and Silver 2015 Mar 22, 2015 - 11:54 AM GMTBy: Michael_Noonan

The Asian Infrastructure Investment Bank [AIIB]. What is it? Yet another political disaster for the Obama administration as it leaves a wide swath of blunder after blunder in massively failed efforts to keep US allies from aligning with China's newest anti-US, anti- fiat Federal Reserve "dollar, AIIB. It will not just compete with the World Bank, a US- dominated financial entity, the AIIB will logically replace the World Bank in its own Asian sphere of influence.

The Asian Infrastructure Investment Bank [AIIB]. What is it? Yet another political disaster for the Obama administration as it leaves a wide swath of blunder after blunder in massively failed efforts to keep US allies from aligning with China's newest anti-US, anti- fiat Federal Reserve "dollar, AIIB. It will not just compete with the World Bank, a US- dominated financial entity, the AIIB will logically replace the World Bank in its own Asian sphere of influence.

Obama is pissed, a crass way to express his sentiment but an apt word choice for a crass politician with virtually no international diplomatic skills, and the AIIB amply exemplifies how true this is. The US continues to become more and more isolated through its ongoing war drums beating incessantly as the only viable solution the US has to offer.

Remember, just a few weeks ago, when German Chancellor Merkel schooled Obama over Ukraine, urging a "political solution, because that is what we do as politicians." Obama did not like that, and he glibly responded he had not yet made up his mind, as the US continues to send money, arms, unofficial troop support, and an expressed intention to send "lethal weapons" to the totally inept Ukrainian army. The best way to tell if Obama is lying is to see if his lips move.

As a means of hiding its failed "policies," for lack of a better word, to hide its failed economic banking system, and to avoid taking the blame for a failed American economy about to be flushed down into a debt abyss, Obama is itching to start a war with Russia. He has so far been failing in that arena, as well. No country wants another war, none, other than the US, led by the Obama administration. If WWIII breaks out, as an increasing number of voices are expressing, it will be due to the singular effort of the US and no other reason.

Back to the AIIB. It is a clear announcement by the rest of the world that the fiat "dollar," as a world reserve currency is fading faster and faster away as the leading international currency for settling trade between nations. The AIIB is China's announcement to the rest of the world that it has had it with the bully tactics of the US, and China wants, is actually closer to demanding that she be given her due respect as a world leading power overtaking the US in increasing measures for what constitutes a new world economic leader.

The AIIB will become a leading lender for new development, particularly in Asia where a lot of new growth and development is underway. This is in sharp contrast to the US that uses warfare as its badge of "economic development," more like destruction. Just look at Libya, Afghanistan, Iraq, now Ukraine, ongoing attempts to destabilize Syria. Anywhere the US is involved, it is destroying nations. By contrast, China and Russia are making deal after deal for true economic development in and with other countries without immersing those countries in unrepayble debt situations.

China's AIIB will put an end to that, and the US is very unhappy. The UK agreed to join with the AIIB, much to the consternation of Obama, accusing the UK of "constantly accommodating" China. Obama chooses to ignore the fact that it was the US that gave Most Favored Nation status to China in the late 1990s, strengthening China and weakening the US, ultimately, but the US is "exceptional" and can do what ever it wants, or so the US thinks. A growing number of countries have turned their back on the US, and now the growing list includes what were once considered close allies.

Right after the UK came France, Italy, and Germany, all willing to join with China and the AIIB. If that were not a sufficient slap in the face to no-face Obama, Australia chimed in, a huge US accommodating agent-nation, but another one that has acknowledged extreme disappointment with ham-handed Obama diplomacy. Expect South Korea, even Japan to also join in the AIIB's constructive goals for world economic development. The number of countries that have already signed on is around 25, and growing.

The fiat Federal Reserve "dollar" is done, not quite officially, but the angle of the slope keeps getting steeper in its dissent. For all of the indignant huffing and puffing by Obama and his administration officials, this is still orchestrated Kabuki theater by the elite's banking system. As we stated previously, the elites are merely switching horses, and the show for the masses must go on.

Ultimately, this is bullish for gold and silver, but the prospects for a ramping up in price for both metals will be as slow a process as the demise of the "dollar." All the world's a stage remains as true today as it was in Shakespeare's As You Like It, [Act II, SceneVII]. All the world central banks are tied to each other, perhaps least of all for Russia, but the change in currency structure, leading to Special Drawing Right [SDRs] as the next replacement world currency will not be denied.

There is no direct correlation in the AIIB development and the pricing of gold and silver, but it serves as another nail in the coffin for the US "dollar" and its ultimate defeat into utter rejection. As we stated previously, the purposeful transition of the "dollar" demise and the ascension of SDRs as a replacement, endorsed by both Russia and China, will take place in an orderly fashion, at least for the rest of the world. It may become quite disorderly in the US as the "dollar" descends to its true intrinsic "value," which is zero.

When the sleep-walking American public realizes what has happened, it will be far too late, and a goodly number of them will have had their pensions raided and replaced with [worthless] government bonds, the same ones the rest of the world is rejecting in toto.

It remains an unknown as to how gold and silver will respond to these ongoing and ever- changing events, but as the charts reveal, there is no defined, or at least not a confirmed bottom, just as there is not a confirmed top in the climatic rallying in the value-less paper fiat "dollar." Even once a top can be identified for the fiat "dollar," it can take many more months of a distribution topping phase, just as the bottoming process for gold and silver has taken over 4 years. Anything can happen, including a straight, precipitous drop.

Nothing has changed in the reasoning for buying and holding physical gold and silver, except of course the lower prices. PMs have been both purposefully and blatantly suppressed by US and UK central banks. The death grip has not yet loosened during the death dance of the fiat "dollar." Things change, and the rate of change is ramping up, but none of it has been translated into higher gold/silver prices.

The entire Western banking system is corrupt and bankrupt, held together by issuing more and more fiat, but only into the totally insolvent banking system. For as long as people are willing to buy into the lies spewed by the criminal enterprises, more commonly known as governments, the "emperor-is-wearing-no-clothes" mentality will keep the elite's sinking fiat ship alive. There is obviously no known solution for world-wide stupidity.

We can find no single nor unifying event that relates directly to the overall movement of developing market activity in PMs, and they still have the feel of being actively suppressed. It is for this reason the charts remain the best source for reading what may happen to each metal. Our read starts with silver.

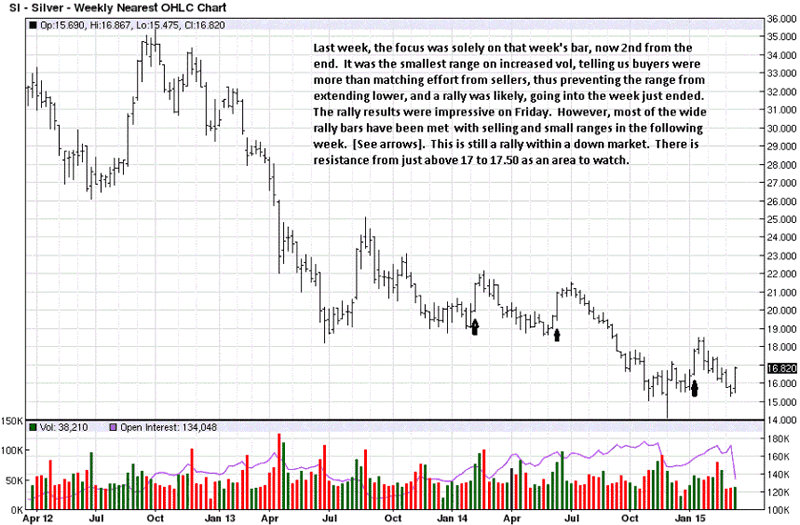

Last week and this week's charts are great examples of how reading market activity has logic to the process. [As an aside, we added a brief commentary on Trading Developing Market Activity, showing a trade in the making based on reading chart development, for anyone who thinks chart reading is akin to tea leaves.]

Patterns repeat, over and over, which is why the arrows show how prior wide range rally bars in a down market led to immediate resistance and sellers resuming control. It remains to be seen of the November '14 spike low becomes a bottom. For now, there is not sufficient confirmation.

Silver Weekly Chart

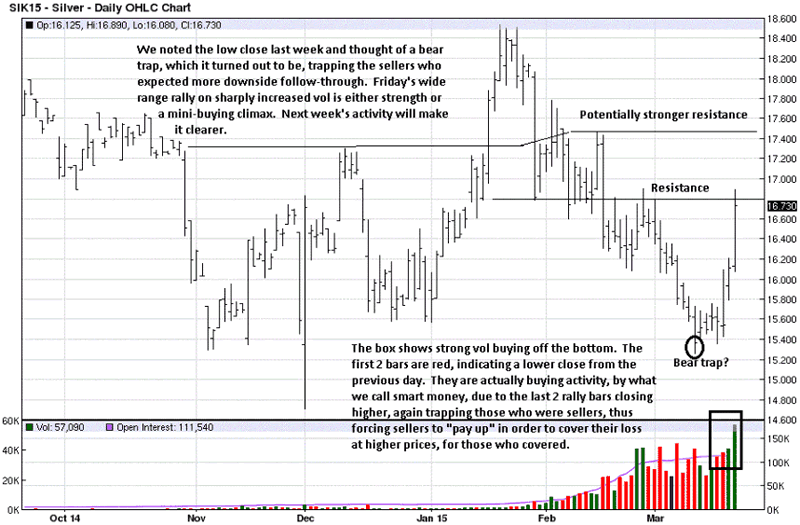

Last week, there was no outstanding feature on the daily chart, except a throw-in comment of a possible bear trap close. Turned out to be accurate. Often, what the market is saying cannot be identified with certainty until after the fact. Refer to Friday's strong rally and close, along with the sharply higher volume. Is it strength, or a mini-climatic rally? Intra day activity can help answer the question sooner than waiting for the daily to complete.

Silver Daily Chart

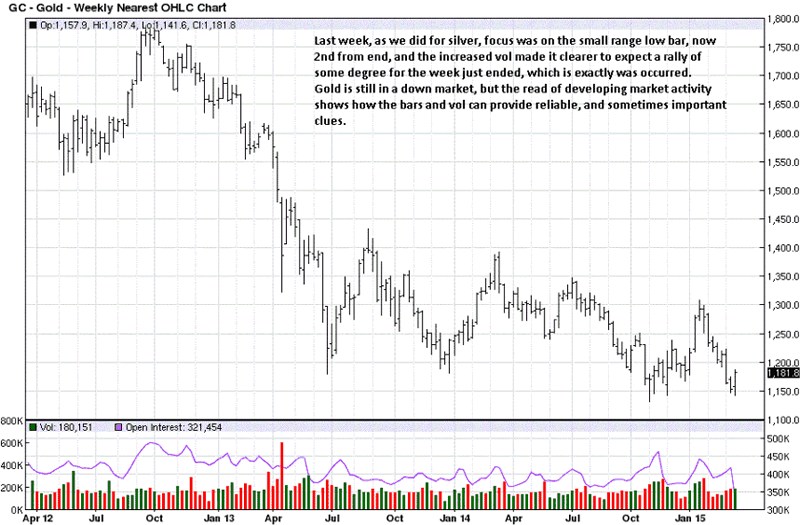

While gold is rallying off support from last November, this is the 4th retest at sub-1200 lows. The more often a level is retested, the more likely it will fail. With that possibility in mind, there is still no confirmation of a bottom, at this point.

Gold Weekly Chart

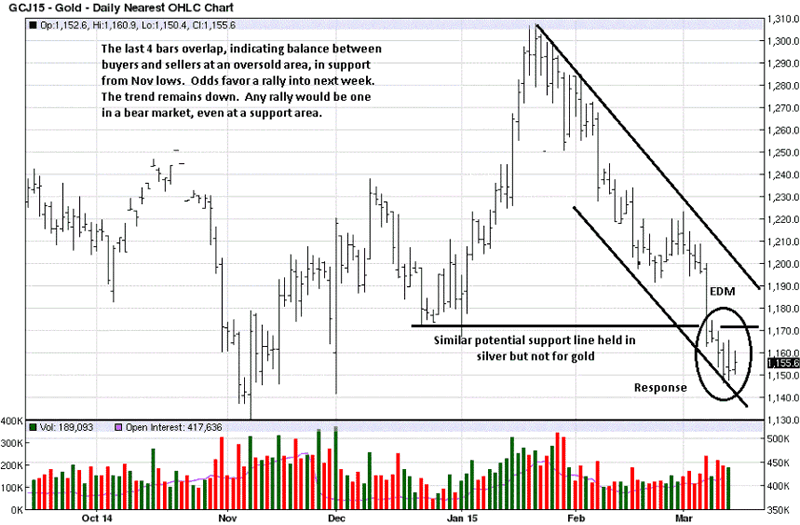

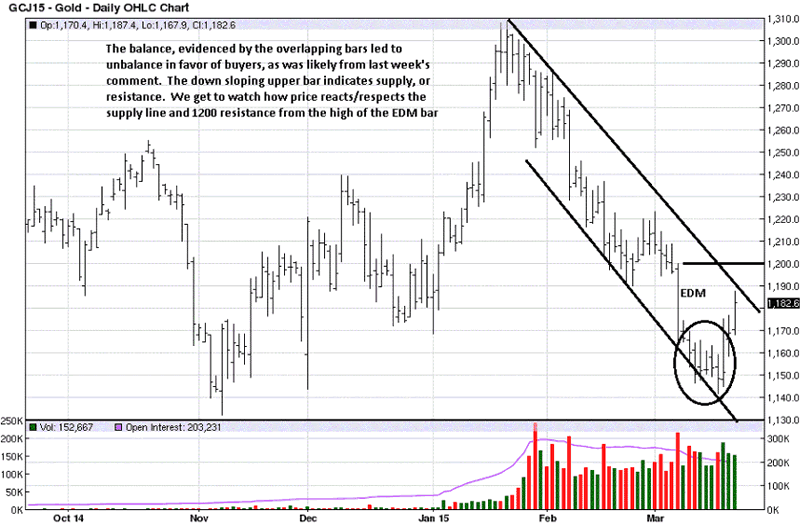

This is last week's daily chart shown again to make a visual comparison with the observations made that led to this past week just ended. [EDM = Ease of Downward Movement.]

Gold Daily Chart

The point is to show how drawing what appear to be pertinent support/resistance lines are not just a past tense exercise, but show where price may meet up with resistance or find support, as the case may be. The overlapping of bars mentioned 2 weeks ago, occurring at a level of support from last November, and added lower channel line support, gave a higher degree probability for a rally than one could otherwise expect. These pieces of market information are not random.

With the discussion of China's AIIB, and the Western banking system falling apart in front of everyone's eyes, or at least for those willing to look, the reasons for buying and holding PMs have not, and will not change. Timing has been an issue, but owning them is not.

Gold Daily Chart 2

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2015 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.