Gold Price Rises 2.1% – Fed Signals Loose Monetary Policies to Continue

Commodities / Gold and Silver 2015 Mar 19, 2015 - 01:42 PM GMTBy: GoldCore

- Gold rose over 2% – Fed signals ultra loose monetary policies to continue

- Gold rose over 2% – Fed signals ultra loose monetary policies to continue

- Fed dampens expectation of a rate hike in June

- Yellen no longer “patient” – notes weakness in recent US economic data

- Fed knows that fragile, debt laden U.S. economy cannot handle higher rates

- Despite recent dollar strength, dollar vulnerable in long term

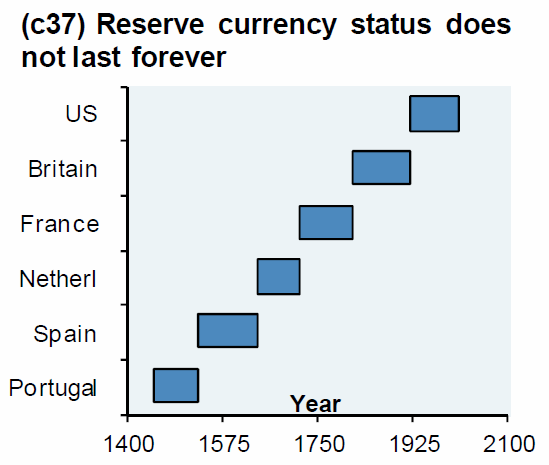

- Sole reserve currency status threatened in currency wars

Gold rose sharply following yesterday’s Fed announcement in which it was indicated that the Fed are unlikely to raise rates in June – although the possibility was not ruled out – due to the poorer economic data that has been emerging this year.

Gold rose after Fed Chair Yellen said that economic growth had “moderated somewhat” which means that ultra loose monetary policies look set to continue. The Federal Reserve dropped the word “patience” from its policy statement, stoking expectations for a mid-year rise in U.S. interest rates.

Many analysts regard this as further evidence that the Fed is caught in a bind. It needs to tighten monetary policy in order to rein in the developing bubbles in stock, bond and certain property markets. Stocks are seeing “irrational exuberance” once again and valuations surging despite declining earnings and dividends. Earnings and dividends are not likely to be improved given the weak economic data emerging from the U.S..

On the other hand, raising rates could cause the dollar to surge even higher in the short term, further undermining U.S. exports and the jobs market with a knock on effect on consumer confidence.

What is yet to be appreciated by most analysts is that it is unlikely that the massively over-leveraged and debt saturated financial system can weather increases in interest rates.

Global debt has ballooned since the 2008 crisis – itself a product of gargantuan debt. If consumers, investors, banks and other financial institutions are forced to service their debts at higher interest rates it will likely cause a new debt crisis and contagion.

Most likely the Fed will continue suggesting an imminent rate hike while plodding along as long as it can. But at some point rates will rise or the Fed will be overwhelmed when it finally becomes clear that they are reacting to events and are no longer in control of monetary policy.

Meanwhile, the dollar’s status as the world’s reserve currency continues to be undermined. Now, even its UK and European allies are beginning to adapt a more international approach to monetary affairs and not slavishly following Washington’s diktats.

Britain recently joined China in establishing a new infrastructure bank – the Asian Infrastructure Investment Bank (AIIB) – and is now being joined by France, Germany and Italy.

This new bank – which along with the BRICS bank will rival the U.S. dominated IMF and World Bank system – will not lend exclusively in dollars and will likely undermine the status of the dollar as sole reserve currency.

There has been much negative comment of gold in the financial sphere despite the fact that gold has been protecting investors in the Euro zone and in terms of other currencies gold has seen slight losses or has been thriving.

In dollar terms gold is marginally lower in the past year. Most currencies are lower than the dollar this year. But the undue status of the dollar as safe haven reserve currency is growing more questionable as we move from a uni-polar U.S. dominated world to a multi-polar world with an increasingly powerful China, India and Asia.

A new international currency order is emerging and we believe that certain countries, such as Russia and China, will bring back some form of quasi gold standard, using gold as backing, in order to bolster confidence in fiat currencies.

Gold will almost certainly be a foundation stone in a new international monetary system. Therefore, we expect it to be revalued to much higher levels in the coming years in dollar and all currency terms.

Must Read Guide: Currency Wars: Bye Bye Petrodollar – Buy, Buy Gold

MARKET UPDATE

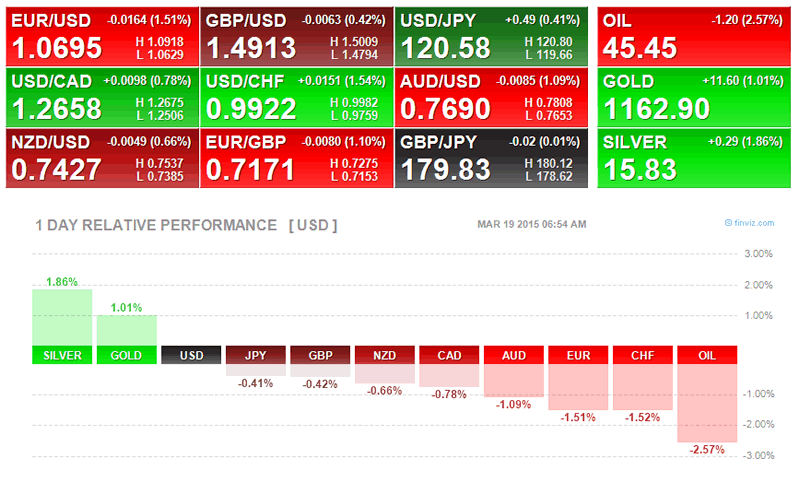

Today’s AM fix was USD 1,164.00, EUR 1,091.52 and GBP 781.10 per ounce.

Yesterday’s AM fix was USD 1,149.00, EUR 1,080.50 and GBP 782.91 per ounce.

Finviz.com

Gold climbed 1.96% percent or $22.50 and closed at $1,171.00 an ounce yesterday, while silver surged 3.21% or $0.50 at $16.06 an ounce.

In Singapore, bullion for immediate delivery ticked lower after the sharp gains seen on Wall Street.

Yesterday’s dovish tone of the U.S. Fed policy statement that left out the word “patient” sent precious metals upward and pressurized the U.S. dollar.

The Fed downgraded its economic growth and inflation projections for the first time since 2006, hinting that it is in no rush to push borrowing costs to more normal levels. It also cut its median estimate for the federal funds rate.

It is important to note that the Fed has been suggesting it will raise rates for many years now.

Gold in US Dollars – 1 Week (GoldCore)

Chairwoman Janet Yellen also noted that the dollar would be a “notable drag” on exports and may be a downward force on inflation.

The U.S. central bank removed a reference to being “patient” on rates from its policy statement, opening the door for a hike in the next couple of months while sounding a cautious note on the health of the economic recovery.

Of interest is the fact that Fed officials also slashed their median estimate for the federal funds rate – the key overnight lending rate – to 0.625 percent for the end of 2015 from the 1.125 percent estimate in December.

In London’s late morning trading gold is at $1,165.75 or down 0.2 percent. Silver is at $15.88 or off 0.55 percent and platinum is at $1,118.97 or down 0.65 percent.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.