Ireland’s Minister of Finance Dumps Stocks to Buy Gold

Commodities / Gold and Silver 2015 Mar 16, 2015 - 07:40 PM GMTBy: GoldCore

- Ireland’s Minister of Finance shifted personal wealth out of stocks and into gold

- Ireland’s Minister of Finance shifted personal wealth out of stocks and into gold

- Minister invested in SPDR Gold Shares ETF, Portuguese government bonds and other ETFs

- Maintained holdings in bank and agricultural commodities ETFs

- Gold ETF not a safe haven asset – much unappreciated counterparty risk

The Minister for Finance in Ireland, Michael Noonan, sold his shares in funds that track European and US stocks and diversified his portfolio including allocating some of his personal wealth into a gold exchange traded fund (ETF) in 2014.

Noonan sold out of his positions in the Lyxor Eurostoxx 50 ETF and SPDR DJIA ETF in 2014 and opted to invest in the SPDR gold shares ETF and Portuguese government bonds. He maintained his holdings in SPDR KBW Banks ETF, Ishares FTSE 100 ETF, Market Vectors Agri Business ETF, ETFS Agricultural Commodities ETF.

The information was published last week in the Register of Members Interests, in which members of Oireachtas – the Irish Parliament – must declare financial interests valued at over €13,000.

The changes to the Minister’s portfolio were highlighted by Ireland’s Sunday Independent yesterday, who described Noonan as “bearish” and interpreted the move as a “hedge against euro deflation”.

The piece acknowledged that gold is a safe haven – the “traditional hedge against tough times” and that “gold is an asset that has outperformed in times of both inflation and deflation.”

Noonan is believed to be quite a shrewed investor. The Sunday Independent reported that

“Noonan’s personal investments give an insight into his thinking and his views on the risk and opportunities facing the global and European economies and markets. He has a track record stretching back decades of canny private investments.”

The news is of interest given Noonan’s status within the Eurogroup of Finance Ministers, the Council of the European Union and the Ecofin. The Economic and Financial Affairs Council (Ecofin), is composed of the Economics and Finance Ministers of the Member States, generally meets once a month under the chair of the rotating EU Presidency.

Noonan is an EU economic insider and would have access to good information with regards to financial and economic developments in Europe.

Noonan represents Ireland at these meetings and chaired the Council during the first half of 2013. He is committed to the European political project. The political opposition and an angry public have accused him of putting the interests of EU banks and political elites over those of Irish society.

Given Noonan is close to EU elites, it is interesting that he chose to sell his European stocks and his allocation to Eurostoxx. Was the decision made prior to the ECB mooting the possibility of QE? If so it would suggest that Noonan may have been concerned about deflation. And yet the ECB never considered factoring the potential for deflation into its stress tests for banks.

Or was the decision made with knowledge of the ECB’s intention? If this were so it would indicate a lack of faith by a European finance minister in the ability of the ECB to achieve its stated objectives, given that QE should raise European stock markets.

Unfortunately, the Register of Members Interests does not detail the timeline of investments or their relative value so it is difficult to speculate whether the minister dumped his stock market investments prior to buying the gold ETF.

Noonan also bought Portugal 4.35% October 2017 government bonds. This either suggests that he has more confidence in the economic outlook for Portugal than for Ireland or more likely it is a form of diversification.

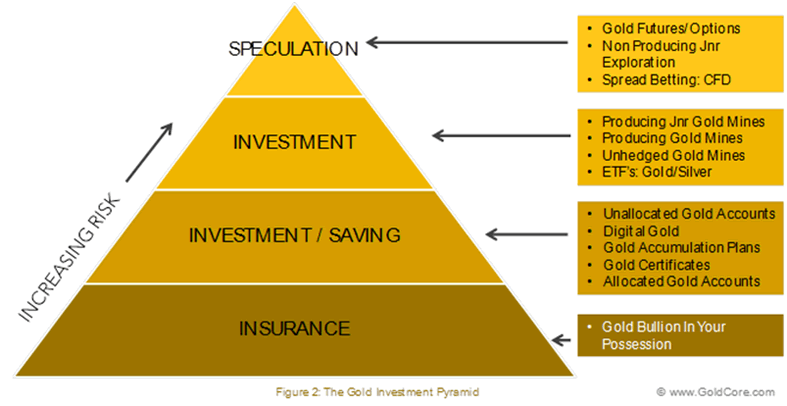

Gold Investment Pyramid – GoldCore

He continues to hold SPDR KBW US Banks ETF – which tracks US banks, iShares FTSE 100 ETF, Market Vectors Agribusiness ETF and ETFS Agricultural Commodities ETF.

Whatever the motivation of a European finance minister to buy into a gold ETF – which, incidentally, is not the same as owning physical gold as it carries significant counterparty risk – it represents a significant shift in attitude toward gold.

It also demonstrates that the recovery narrative is not one that the Minister appears to have much faith in. Noonan is prudently hedging his bets in this regard.

We advise readers and clients to do as the Minister has done and prudently hedge the many risks of today by diversifying into gold – not paper gold but physical gold. The gold ETF is not a safe haven asset rather it is a derivative that tracks the price of gold and in which one does not have legal title to or own the underlying asset.

Download: Comprehensive Guide To Investing In Gold

MARKET UPDATE

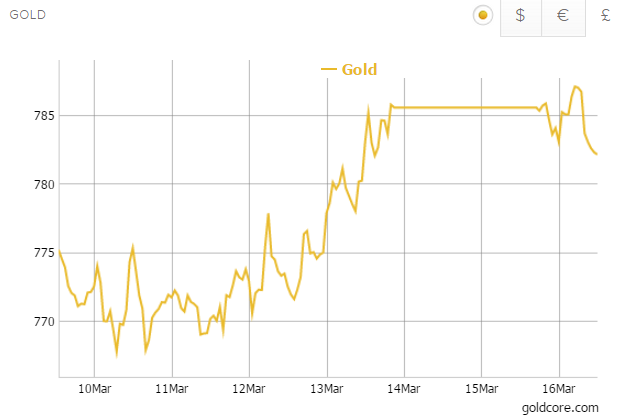

Today’s AM fix was USD 1,157.00, EUR 1,097.67 and GBP 782.13 per ounce.

Friday’s AM fix was USD 1,156.50, EUR 1,091.24 and GBP 779.58 per ounce.

Gold climbed 0.17% percent or $1.90 and closed at $1,155.20 an ounce Friday, while silver remained unchanged at $15.57 an ounce. Gold and silver both traded down for the week at 0.90 percent and 1.89 percent.

In Singapore, bullion for immediate delivery ticked lower and then higher and was up 0.3 percent to $1,162.50 an ounce near the end of day trading.

Gold hovered at its lowest in nearly three months today pressured by the still strong U.S. dollar. The two day U.S. Federal Reserve policy meeting starting Tuesday, may hint at the timing of any hike in U.S. interest rates.

Bearish sentiment continued as holdings in SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, fell to 750.67 tonnes down 0.28 tonnes on Friday – the lowest since late January.

Asians continue to buy physical bullion on dips in price and premiums on the Shanghai Gold Exchange were about $5-$6 an ounce above the global benchmark, even stronger than Friday’s premiums.

In Ireland, in late morning trading gold is trading at $1,157.03 or off 0.09 percent. Silver is at $15.64 or up 0.15 percent and platinum is $1,115.32 or up 0.03 percent.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.