U.S. Employment Numbers Raise USD and TNX, Sink SPX

Stock-Markets / Financial Markets 2015 Mar 06, 2015 - 05:14 PM GMT Good Morning!

Good Morning!

SPX Premarket appears to have fallen beneath the hourly mid-Cycle support at 2094.26, but we really need to see the neckline at 2087.62 broken to confirm the reversal.

The big news is that February Payrolls surged to 295,000 and the (official) unemployment rate dropped to 5.5%.

However, Americans not in the Labor Force rose to a record 98.9 million. The Labor Participation rate dropped to 62.8%.

In addition, the US Trade Deficit worsened to -$41.8 billion.

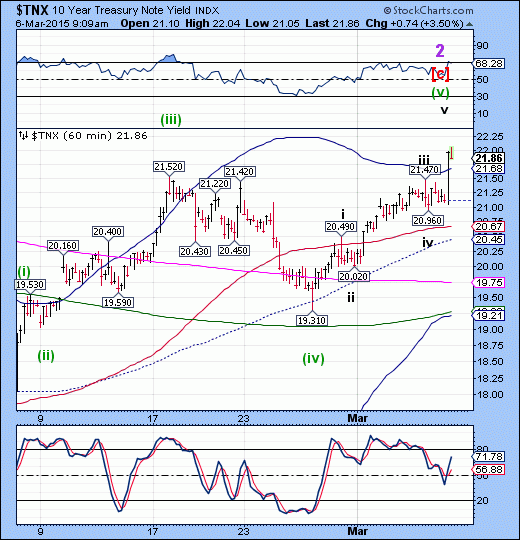

TNX made a new Wave 2 high this morning. USB has tumbled beneath its Wave A low as well. This raises the sppecter of a rate hike earlier than later, which will be fought by the Fed tooth and nail. Remember, this is a retracement and not a trending move. However, investors’ attention span is short and there may be a tempest in a teapot about this matter.

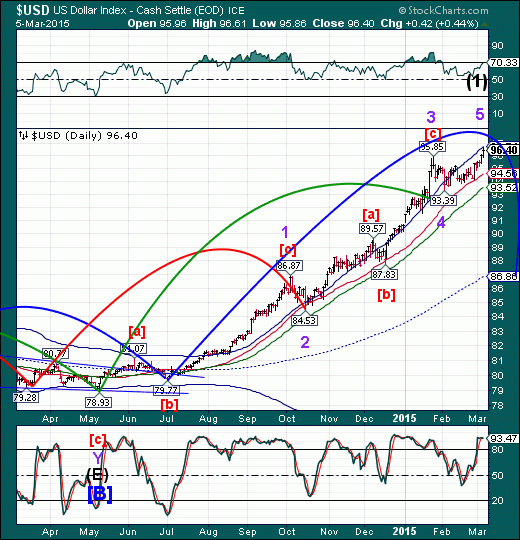

The USD rose to 97.45 changing the structure of the Waves to show an Intermediate Wave (1) nearing completion. It may attempt to reach 100.00. However, what awaits afterwards is an Intermediate Wave (2), which can be very deep. This is the reversal that may pull the rug out from under stocks.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.