Gold: The Good, Bad, and Truly Ugly

Commodities / Gold and Silver 2015 Feb 24, 2015 - 02:41 PM GMTBy: DeviantInvestor

THE GOLD STANDARD: Although it may be unrealistically optimistic, I believe my paraphrase of a Churchill quote:

THE GOLD STANDARD: Although it may be unrealistically optimistic, I believe my paraphrase of a Churchill quote:

“Central Bankers will eventually do the right thing and return to a gold standard after they have exhausted all other alternatives.”

While central bankers are exhausting all other alternatives, I worry about the collateral damage to 90% of the population who are not first in line on the fiat money gravy train that benefits the financial and political elite.

Clearly, central bankers will return to a gold standard only if forced by a financial implosion, economic collapse or equivalent disaster. Hence, the powers-that-be will do whatever is necessary to conceal the sovereign debt bubble, hide the insolvency of sovereign governments, and extend and pretend regarding the value of bonds, equities, and fiat paper currencies.

THE GOOD: Gold is and has been real money for 5,000 years.

THE BAD: Gold prices will benefit from the following items. (This is a long and incomplete list.)

- Greek bankruptcy and their inevitable exit from the Euro zone: Such an exit will confirm bad debts, weaken or destroy the banks that made the loans, and damage confidence in fiat currencies, ever-increasing debt, and sovereign debt collateral.

- Euro, Yen, Dollar collapse: Can a major world currency collapse in value without damaging confidence in all other fiat currencies? People will have more confidence in gold and will lose confidence in fiat currencies.

- Baltic Dry Index has hit new all-time lows. Global economic activity is weakening. Will central banks do nothing as the world economy weakens or will they continue the global QE to infinity to stimulate the global economy? Of course central banks will print currencies.

- Price of oil has collapsed. The same arguments apply as with the Baltic Dry Index.

- Central bank creation of currencies: QE to infinity! Maybe it will prolong the current system or perhaps a deflationary collapse will occur regardless. Would you rather own gold, or sovereign bonds backed by insolvent governments that can repay their debts only because central banks create new currency and monetize their debt?

- Cooked statistics: Who still believes the GDP, unemployment, retail sales or real estate sales numbers in the US?

- Ukraine conflict: Expect this growing conflict to damage European stability, increase military budgets, and substantially increase debt and financial risk.

- Syria and the Middle East: Expect more military spending, debt, bond monetization, and currency in circulation.

- “No boots on the ground,” except in the Middle East, Asia, Africa, Europe, and South America. However, I know of no plan to invade Antarctica. Swell! And you can trust that the economies of Europe and the US are humming along nicely, employment is robust, the people are happy, banks are solvent, politicians are truthful, and this is the best of all possible worlds.

THE TRULY UGLY:

- COMEX default or shutdown: What if the COMEX can’t deliver gold or silver and is forced to cash settle futures contracts. It could happen, perhaps soon since a huge quantity of gold has been shipped from western vaults to Asia. Paper gold is not real gold and that realization will be devastating to global confidence if the COMEX defaults on gold or silver delivery.

- LBMA shutdown: Same as a COMEX shutdown. See above.

- Global reset and financial collapse: We don’t want to think about the ramifications, the inevitable blame-game, false flag diversions, escalating wars and human suffering that will result from an economic collapse.

- Global credit collapse: Most economic transactions are based on credit. A global credit collapse probably would collapse global financial and economic systems, including the delivery of food and fuel. See above. Again, the consequences will be truly ugly.

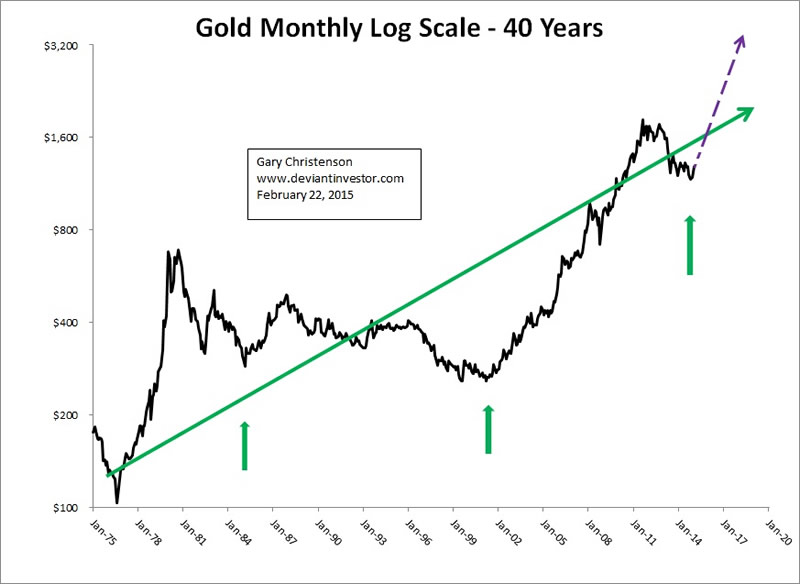

President Nixon separated gold from the dollar (temporarily) on August 15, 1971. Currency in circulation and debt have subsequently increased exponentially. The purchasing power of fiat currencies has similarly decreased. The exponential price increase is gold mirrors the devaluation of the dollar. See the graph below. I discuss this in my book, “Gold Value and Gold Prices From 1971 – 2021.”

CONCLUSIONS:

- The global financial system is vulnerable and dangerously fragile. If it were safe and healthy, why would Europe continue to “throw good money after bad” with more bailouts to Greece and other countries? Ask yourself if Italy, Spain, Japan and the US are materially different.

- A vulnerable and dangerous financial system that is increasingly leveraged is a bubble in search of a pin. Accidents happen! Protect yourself and insure your assets with gold and silver.

- The Baltic Dry Index and the price of crude oil are telling us that global demand and economic strength are faltering. Expect more central bank intervention, bond monetization, and “money printing.” If sovereign debt is a dangerous bubble now, what will it be after another year or two of massive printing and stimulus?

- Various wars and boots on the ground: Wars are inflationary. More war creates more debt, more “money printing” and higher prices for commodities and the cost of living. The S&P, sovereign debt prices, and politician approval ratings probably will not benefit from more wars, a higher cost of living, and declining living standards. Protect yourself. Gold prices will rise.

- Gold has been real money for 5,000 years. Dollars, Euros, Yen, and other unbacked fiat currencies have been printed to excess for decades. Bet on gold prices rising.

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.