Eurozone Gold Holdings Increase to 10,792 Tonnes As “Reserve of Safety” Amidst Crisis

Commodities / Gold and Silver 2015 Feb 24, 2015 - 02:22 PM GMTBy: GoldCore

The Euro zone raised its gold holdings by 7.437 tonnes to 10,791.885 tonnes in January, International Monetary Fund data released overnight showed.

The Euro zone raised its gold holdings by 7.437 tonnes to 10,791.885 tonnes in January, International Monetary Fund data released overnight showed.

The rise in gold holdings was small in tonnage terms and in percentage terms – especially when viewed in the light of the recently launched ECB’s EUR 1 trillion QE monetary experiment.

Nevertheless, the rise in Euro-area gold holdings shows how the ECB continue to view gold as an important monetary asset. Mario Draghi said of gold in October 2013 that gold is a “reserve of safety” that “gives you a value-protection against fluctuations against the dollar.”

Draghi told an open forum at Harvard’s Kennedy School of Government, why central banks want gold and what value it offers. He said that there were “several reasons” to own gold including “risk diversification”.

The increase in reserves came at a time, January, of rising gold prices amidst the reemergence of the Greek debt crisis.

It may signal that the ECB and Eurozone are set to embark on a gold accumulation programme. More likely, it is simply a way to bolster confidence in the euro due to increasing doubts about the viability of the single currency.

Russia sold a very small amount of gold in January for the first time since March. Russia lowered its reserves to 1,207.7 tons from 1,208.2 tons, ending nine months of consecutive purchases, the IMF data showed.

Russia, the world’s fifth-biggest gold holder, had been adding to its holdings for many years in order to bolster the rouble.

Before last month, Russia had bought at least 18 tons a month since September and more than tripled its holdings since 2005.

Turkey’s gold reserves fell marginally last month along with Mexico and Belarus, the data showed.

Kazakhstan increased gold reserves for the 28th straight month, while Ukraine added to holdings for the first time since August, the data showed. Kazakhstan boosted holdings to about 193.5 metric tons from 191.8 tons a month earlier as Ukraine’s rose to 23.9 tons from 23.6 metric tons.

Kazakhstan’s hoard rose 33 percent in the past year alone and more than doubled in the past three years.

Ukraine’s assets dropped in November to the lowest level since 2005 as its foreign currency reserves contracted and the hryvnia slumped amid the conflict and collapsing economy. There were also concerns that the newly installed government had acquired the gold and moved it offshore, out of Ukraine.

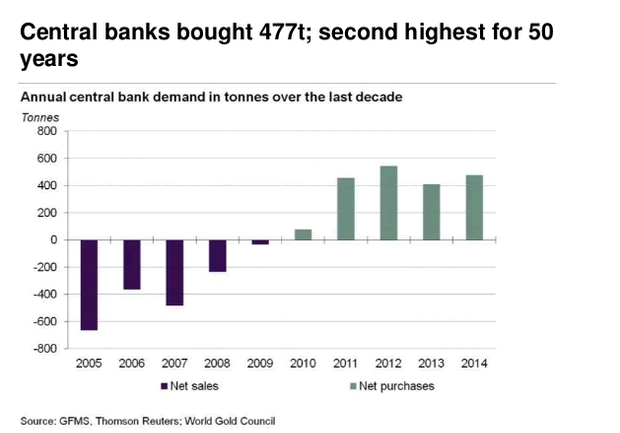

Central banks are some of the largest buyers of gold today – see table above. Central banks have been adding to their gold reserves for the past five years, a reversal from two decades of selling since the late 1980s. They were net buyers in 2014 and are set to be net buyers again 2015.

Governments bought 477.2 tons of gold bullion in 2014, the second-biggest increase in 50 years, and purchases will be at least 400 tons this year, the World Gold Council has estimated.

The smart money will continue to follow the lead of central banks internationally and gradually accumulate gold and dollar, euro or pound cost averaging into an allocated and segregated physical gold position.

Daily and Weekly Updates Here

MARKET UPDATE

Today’s AM fix was USD 1,195.50, EUR 1,057.97 and GBP 774.59 per ounce.

Yesterday’s AM fix was USD 1,193.50, EUR 1,055.17 and GBP 777.12 per ounce.

Gold rose 0.09% percent or $1.10 and closed at $1,202.10 an ounce on yesterday, while silver climbed 0.56% percent or $0.09 closing at $16.32 an ounce.

Gold in US Dollars – 5 Years (GoldCore)

Spot gold was down 0.4 percent at $1,196.80 an ounce in late morning in London, after prices were flat in Singapore. Silver was down 0.3 percent at $16.24 an ounce, platinum slipped by 0.2 percent to $1,158.55 and palladium fell 0.2 percent to $783.15.

Gold slipped below $1,200 an ounce today but recovered from its 7 week low hit yesterday as optimism is abound that the Greek bail-out deal will be finalized today.

The close above $1,200/oz yesterday was encouraging from a technical perspective.

Some speculated that Federal Reserve Chairperson Janet Yellen’s pending congressional testimony added some pressure on the yellow metal and strengthened the U.S. dollar.

Yellen will address the Senate Banking, Housing and Urban Affairs Committee at 10 a.m. on Tuesday (EST) and the House Financial Services Committee on Wednesday.

Market participants are looking for any further guidance on the timing of when the U.S. Fed may raise interest rates.

Yellen’s European counterpart ECB chief Mario Draghi is also set to make a speech today at 3 p.m. CET unveiling the new €20 banknote in Frankfurt.

The world’s second largest consumer of gold, China, is still celebrating its Lunar New Year holiday today and returns tomorrow which should be gold supportive.

Gold had its biggest monthly advance in three years in January prior to giving up those gains in recent weeks.

Gold climbed 8.4 percent in January in London as policy makers in Europe and Asia signaled more stimulus to battle slowing economic growth and investors speculated that Greece may be forced to quit the euro.

Bullion traded at $1,195.80 an ounce on today. With gold being some 37 percent below the nominal record high set in 2011, contrarian investors continue to accumulate on weakness.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.