Gold Price Reaches Potential Support Zone, Ready for a Bounce

Commodities / Gold and Silver 2015 Feb 15, 2015 - 05:20 PM GMTBy: MarketsToday

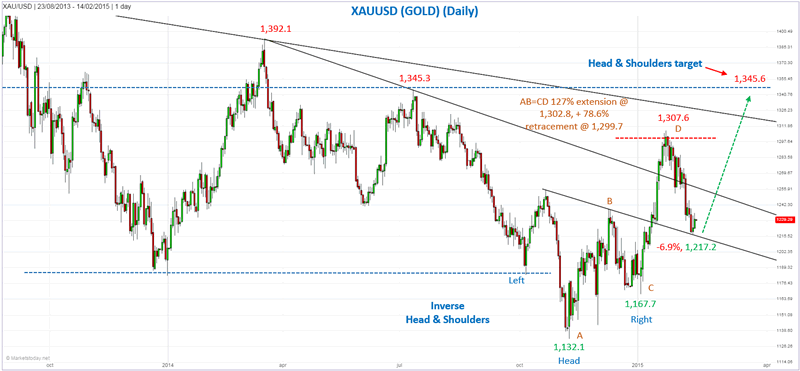

Gold (XAU/USD) declined as much as 6.9% recently, after hitting a swing high of 1,307.6 three weeks ago. That high was right in the area of the 127% AB=CD extension (1,302.8), and the 78.6% retracement (1,299.7) of the downtrend measured from the 1,345.3 peak.

Gold (XAU/USD) declined as much as 6.9% recently, after hitting a swing high of 1,307.6 three weeks ago. That high was right in the area of the 127% AB=CD extension (1,302.8), and the 78.6% retracement (1,299.7) of the downtrend measured from the 1,345.3 peak.

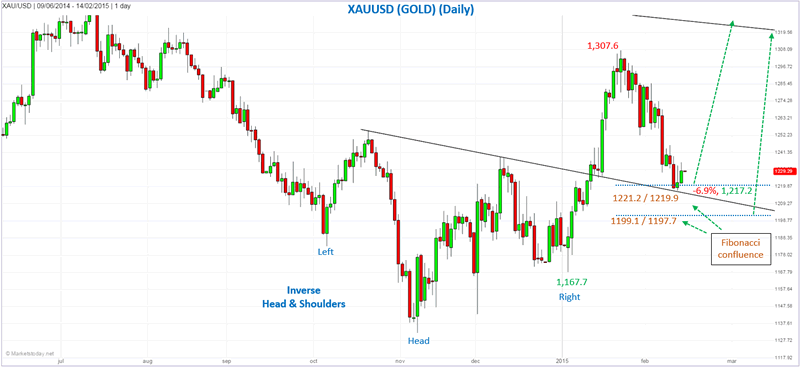

So far support was found at 1,217.2, right in the area of neckline support of the Inverse Head and Shoulder pattern. The probability that the retracement may be complete for now is increased by the fact that there is also the confluence of two Fibonacci retracement levels in the same price area. Both the uptrend measured from the bottom of the head (50% at 1,219.9) and the uptrend from the bottom of the right shoulder (61.8% at 1,221.2) indicate support in the same general price area.

Alternatively, if the recent low is broken to the downside watch for support at the next area of Fibonacci confluence, 1,199.1 (61.8%) to 1,197.1 (78.6%).

If gold is able to rally from current levels it has a good chance of getting up to at least the Head and Shoulders target, which is at 1,345.6. That price area is right in the area of the July 2014 peak. However, it first will need to get over the 1,307.6 peak.

By Bruce Powers, CMT

About MarketsToday.net: MarketsToday.net® is an online financial portal covering the Middle East stock markets, plus spot Forex, oil, and precious metals, published in both Arabic and English. It is designed to help keep investors and traders up-to-date with the latest news, quotes, performance trends, and market developments in the Middle East stock markets.

Copyright 2015 © MarketsToday - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.