Gold and Silver - Playing Their Game

Commodities / Gold and Silver 2015 Feb 04, 2015 - 10:11 AM GMTBy: Peter_Degraaf

My Subscribers and I were prepared for Thursday’s and continuing assault on the Precious Metals – here is how we knew to expect a pullback:

My Subscribers and I were prepared for Thursday’s and continuing assault on the Precious Metals – here is how we knew to expect a pullback:

In the long run we anticipate that gold and silver will offer reliable protection in an environment where governments are using the printing press to meet expenses.

This experiment (fiat money), has already failed in a number of countries; here are just a few: USA 1863-1864, (‘not worth a Continental’), France 1790s, Germany 1922-1923, Hungary 1945-46 (price inflation at 19,000% per month), 1950’s serious price inflation in Austria, Hungary, Greece, Poland, Russia, Argentina, Bolivia, Brazil, Peru, Ukraine, Zaire, Georgia, Nicaragua, , 1993 Romania, in 2002 Argentina again, and 2004 Zimbabwe (the final banknotes issued were for a trillion dollars!). In all of these countries gold and silver offered protection against currency destruction!

According to Professor Antal E. Fekete: “Unbacked (fiat) paper money loses 90% of its purchasing power every 35 years.

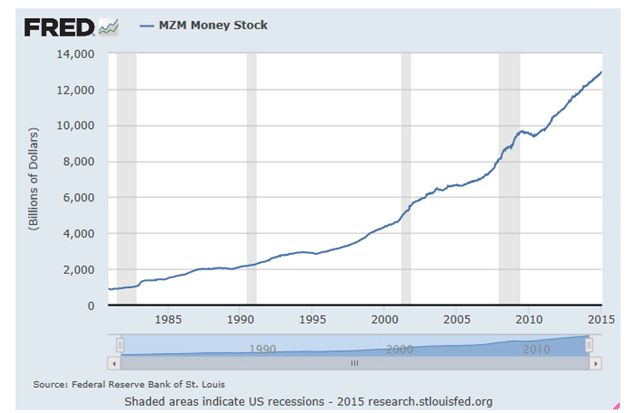

This chart courtesy Federal Reserve Bank of St. Louis shows the US FED is involved in ‘currency destruction’. Its mandate is to protect the US dollar. Instead it is destroying the value of the dollar, by increasing its supply.

To measure the loss in purchasing power of the US dollar you are invited to visit bls.gov/data/inflation_calculator.htm

According to Ayn Rand, “Determine what is best for the government, and know that is exactly what the ‘powers that be’ are working to make happen. Inflation is what is best for a government with enormous debt.”

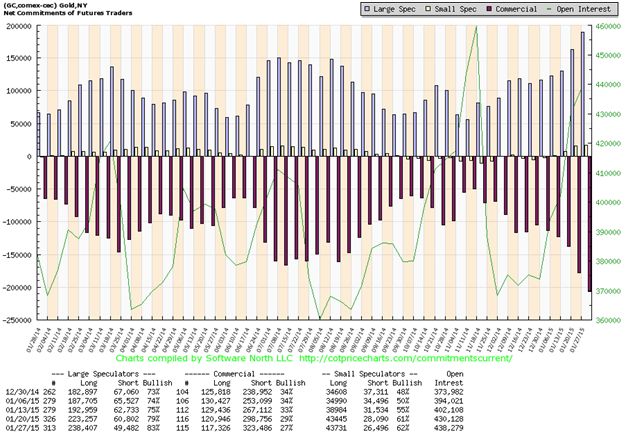

While we invest to protect our nest egg against inflation, by owning gold and silver, we are aware that when the commercial gold and silver dealers are heavily ‘net short’ in the futures market, they will spend hundreds of millions of dollars MORE, in the form of futures contracts, in an effort to drive the price down so that the previous short positions can be covered. When the futures market becomes a casino, without honest supervision (as now), the entity with the deepest pockets can control the price (in the short run). They can do this until the demand for physical gold forces them to finally run for cover.

This chart courtesy Cotpricecharts.com shows the ‘net short’ position of commercial gold dealers, bullion banks for the most part. At 206,000 contracts, this is the largest number since December 2012. During the months that followed, into 2013, the commercials succeeded in driving the price of gold lower, while they reduced their ‘net short’ position.

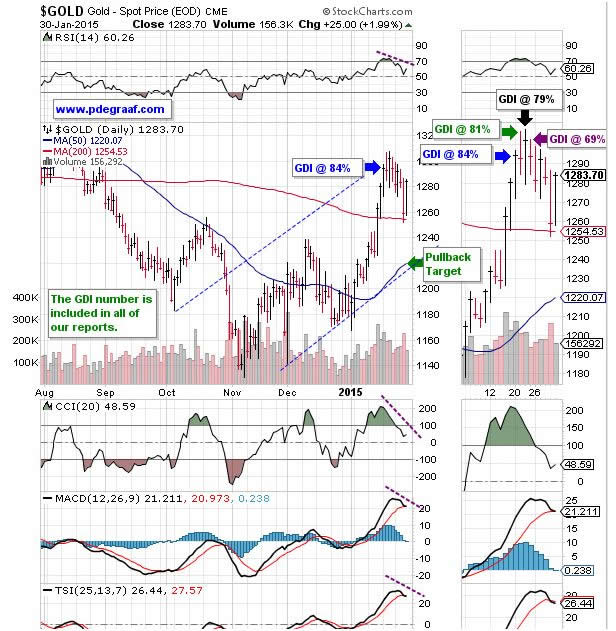

In addition to watching the COT Reports, we also calculate our Gold Direction Indicator. The GDI is comprised of a number of sub-indicators, such as GDX:GLD. We buy when the GDI is low, and take profits when it is high. On Tuesday Jan 20th the GDI had climbed to 84%. On the 21st it slipped to 81%, on the 22nd it registered 79% and this slippage warned us to take some profits on Friday the 23rd.

This chart courtesy Stockcharts.com shows the position of the Gold Direction Indicator during the week ending Jan 23rd. It also shows a ‘pullback target’. The purple dashed lines indicate that the supporting indicators are turning negative. As soon as this pullback is finished, we will go back to being as bullish as ever.

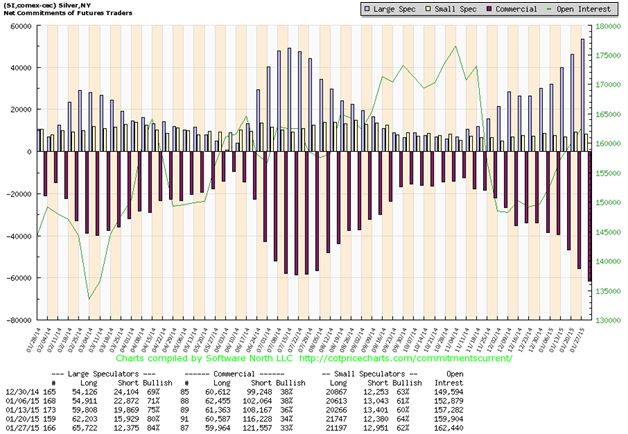

This chart courtesy Cotpricecharts.com shows the ‘net short’ position of commercial silver traders. The situation here is similar to gold in that the number of ‘net short’ positions at 62,000 the number is slightly higher than the 59,000 in July of 2014. The price of silver then declined until the commercials reduced their exposure.

Once we understand the game that is played by the commercial dealers, the best course of action is to learn to play their game. ‘Buy low – sell high.”

Peter Degraaf has been a successful investor for over 50 years. He publishes 5 market letters a week, for his many subscribers. For information please visit www.pdegraaf.com, or send him an Email: itiswell@cogeco.net.

Please do your own due diligence. Investing involves risks. Peter Degraaf is not responsible for your trading decisions. Happy trading!

By Peter Degraaf

Peter Degraaf is an on-line stock trader with over 50 years of investing experience. He issues a weekend report on the markets for his many subscribers. For a sample issue send him an E-mail at itiswell@cogeco.net , or visit his website at www.pdegraaf.com where you will find many long-term charts, as well as an interesting collection of Worthwhile Quotes that make for fascinating reading.

© 2015 Copyright Peter Degraaf - All Rights Reserved

DISCLAIMER:Please do your own due diligence. Investing involves taking risks. I am not responsible for your investment decisions.

Peter Degraaf Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.