Gold Surges 8 Per Cent In January On Reignited Global Risks

Commodities / Gold and Silver 2015 Feb 02, 2015 - 01:46 PM GMTBy: GoldCore

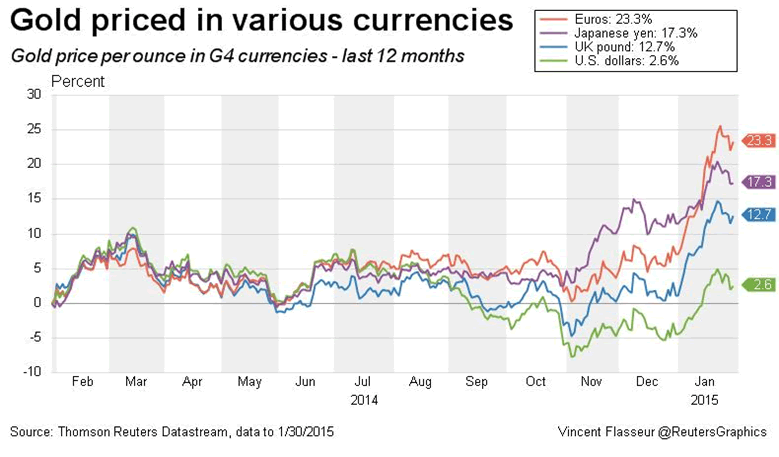

In January, gold surged 8 per cent in dollar terms, 11 per cent in pound terms and a very large 16 per cent in euro terms. January’s 8.4% gain for gold in dollar terms was the best month in terms of price gains in three years.

In January, gold surged 8 per cent in dollar terms, 11 per cent in pound terms and a very large 16 per cent in euro terms. January’s 8.4% gain for gold in dollar terms was the best month in terms of price gains in three years.

Thus once again, gold bullion performed its role as a hedging instrument and a safe haven asset in January as the outlook became decidedly more uncertain – particularly in the Eurozone.

Gold in Euros – 1 Month (Thomson Reuters)

Gold’s 8.4% gain in January is its largest single month rise since 2012. Figures released on Friday indicate that US GDP was down sharply to 2.6% in the fourth quarter of 2014, following a 3rd quarter surge at 5% as low oil prices begin to take their toll on the shale oil industry and the sectors that depend on it.

Unless the U.S. economy begins to grow more robustly, it is unlikely that the Federal Reserve will be able to raise rates any time soon. This should support sentiment towards gold and lead to further demand.

Meanwhile, this morning came further confirmation that Europe as a whole has sunk into deflation – year on year prices declined by 0.6%. The chronically fragile European banking system cannot afford a prolonged bout of deflation.

Gold in British Pounds – 1 Month (Thomson Reuters)

Central banks, including the Bank of England, have been fighting this process since 2008 – with very mixed success. We now appear to have reached a tipping point.

If the economies of Europe cannot reverse the trend and generate sustainable economic growth, the process will begin to feed on itself leading to company failures, bank failures and contagion – the ramifications of which will almost certainly include bail-ins.

However, given the intensification of currency wars, where countries devalue their currencies to gain a competitive advantage for their exports, it is difficult to envision a scenario where European prices will rise in the short term.

Gold is fulfilling its important role as safe haven in this environment. The toxic global macroeconomic picture, the overtly hostile language between the NATO and Russia, monetary uncertainty and currency debasement is boosting the appeal of gold and silver bullion.

The most dramatic exemplification of macroeconomic stress was the capitulation by the Swiss National Bank in removing its peg to the euro, followed by Mario Draghi’s announcement of a larger than expected ECB QE program.

Syriza have earned the hostility of the Troika while encouraging politicians and governments in the struggling European periphery. France have now given their backing to the new Greek government – a move which is bound to generate tension between France and German hawks and France and the IMF and ECB.

The warming Cold War has seen an intensification in brutality in the civil war in Ukraine. The future of the euro is in doubt with the accession to power of the new government in Greece. It appears intent and determined to looking after the interests of the Greek people and nation – rather than banks, and sections of the EU, the IMF and the ECB.

Bullion dealers, mints and refineries we spoke to at the World Money Fair in Berlin at the weekend all confirmed a marked increase in demand for gold and silver bullion in January.

Most expect this to continue in 2015 as the risks outlined are not going to abate anytime soon. Indeed, they are likely to deepen and intensify.

Diversification remains vitally important. Now is the time to reduce weightings to over valued risk assets such as equities and bonds, and increase allocations to undervalued safe haven gold bullion.

DAILY MARKET UPDATE

Today’s AM fix was USD 1,274.25, EUR 1,122.69 and GBP 847.92 per ounce.

Friday’s AM fix was USD 1,263.50, EUR 1,114.98 and GBP 837.42 per ounce.

Silver’s down 1% today, meanwhile, platinum’s down 0.5%,and palladium is marginally higher.

Gold in US Dollars – 3 Months (Thomson Reuters)

In Singapore, gold for immediate delivery steadied above $1,275 an ounce on Monday after posting its biggest monthly gain in three years in the prior session following weaker-than-expected U.S. economic growth in the fourth quarter. Bullion is likely to maintain its safe-haven appeal amid renewed concerns over the Eurozone and the global economy.

Gold prices have fallen marginally in early European trading, touching a session low just below the $1,275/oz mark, around 0.5% below where they ended Friday.

Gold and silver both rose on Friday but were lower for the week – gold by 0.7 per cent and silver by 5.7 per cent. Even after the falls last week, the precious metals had impressive gains for the month of January – gold surged 8 per cent and silver by 10.3 per cent in dollar terms and by more in other currencies.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.