Gold's Time Has Come

Commodities / Gold and Silver 2015 Jan 27, 2015 - 04:00 PM GMTBy: DeviantInvestor

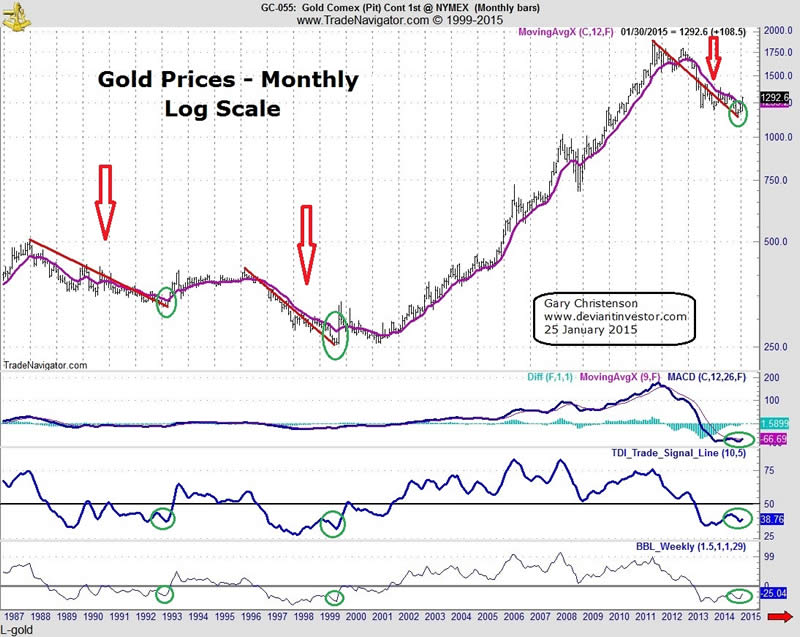

December 1987 to March 1993: Gold fell 36% in 5.3 years

December 1987 to March 1993: Gold fell 36% in 5.3 years

February 1996 to July 1999: Gold fell 40% in 3.4 years

August 2011 to November 2014: Gold fell 40% in 3.3 years

(price changes based on US Dollars)

Governments, confidence, and prices rise and fall. The current collapse in gold prices from August 2011 to November 2014 has been typical for a once-per-decade gold price decline.

What changed? Let’s look at the usual suspect:

- The US Dollar was strong during the 1996 – 1999 gold price collapse.

- The US Dollar was strong during the 2011 – 2014 gold price collapse.

but

- Gold bottomed in early November 2014 and has risen 13% (January 23 close) since then, even though the dollar index has also increased another 9% since the gold bottom.

There is more that will explain the rally in gold prices. By the way, gold is close to all-time highs in several other currencies, even though it is not in US dollar terms.

- The Swiss National Bank assured the world that their “peg” to the Euro was solid, but soon thereafter they abandoned the “peg” and assisted with billions in losses (still counting) globally. The Swiss just reconfirmed what has been evident for decades – central banks often lie to protect themselves as well as the political and financial elite. The Swiss traded their gold for a huge loss on euros while Asians have wisely been trading currencies for gold. Expect the Asian demand for more physical gold bars to continue.

- Crude oil prices have collapsed over 55% in six months. Certainly some oil companies were hedged against an oil price collapse, but not all of them. What happens when the hedges expire or the counter-parties can’t pay off on the hedges? How large are the derivatives that are at risk? Collateral damage to several oil exporting countries seems inevitable. Perhaps the elite see the negative consequences and are buying physical gold for protection.

- War is escalating in the Ukraine. Kissinger and Gorbachev have both warned this could lead to resumption of the US – Russian cold war and potentially a hot or nuclear war. War encourages massive debts, inflation, and purchases of gold.

- Gold has strengthened as a consequence of the delusion that “money printing” will help anyone but the political and financial elite. The Bank of Japan has been printing Yen like there is “no tomorrow,” which unfortunately may describe the rather bleak future of the Japanese economy. Perhaps the Japanese and other westerners are buying gold for protection from their central bank “money printing” policies.

- There are serious financial and political issues with Greece, Spain, Italy, the European Union and the euro. Ditto for the Middle-East and the United States. Gold purchases are accelerating.

- Interest rates are currently at multi-generational lows with some European rates negative out to five or more years. This is not a sign of economic health. Since the typical “solution” is more debt, “money printing,” bond monetization, and larger deficits, investors understand the consequences of such “money printing” and have finally realized they must buy physical gold for protection.

- Perhaps the common denominator is that Central Banks and indebted governments are desperate, scared, floundering in uncharted monetary territory, lying, and manipulating many markets. Investors appear tired of central bank and government lies. Their loss of confidence is reflected in market volatility and the relative but temporary strength in the US dollar. When the US dollar weakens again the urgency to purchase physical gold will increase!

Weakening confidence in currencies, central banks, and governments will focus attention upon real money, the money that has survived for thousands of years BEFORE AND AFTER the era of central bank promises, lies, manipulations, and monetary stimulation. Gold is making a determined come-back in financial markets because it is more real than paper fiat currencies backed only by the faith, credit, and the lies of insolvent central banks and sovereign governments.

Gold is approximately $150 higher than its early November low and still long-term UNDERVALUED. Paper promises, paper currencies, and official pronouncements from central banks and governments are looking less real, more vulnerable, and likely to weaken further in 2015 and 2016.

To paraphrase Churchill, central banks will (we hope)do the right thing (back their currencies with gold) after they have exhausted all other alternatives. How much collateral damage will occur in the meantime, and what can you do for self-protection?

GO FOR THE GOLD (and silver)! It has withstood the test of time, history, the ravages of paper money, and central bank lies.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.