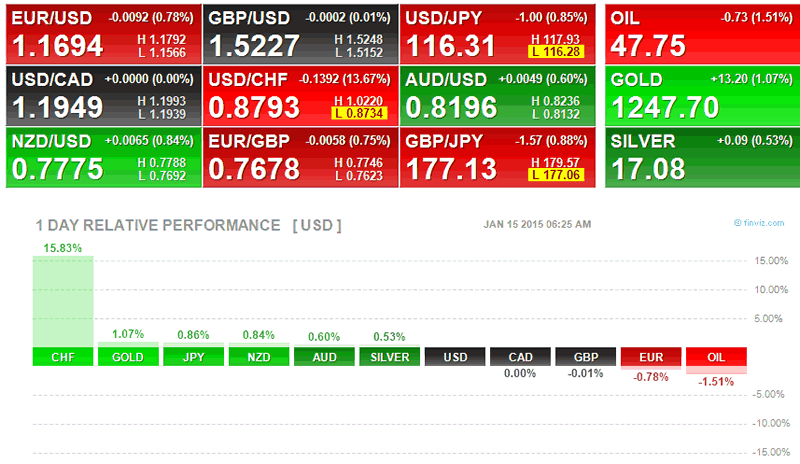

Market Chaos as Swiss Franc Surges 30% In 13 Minutes, Gold Rises Sharply

Commodities / Gold and Silver 2015 Jan 15, 2015 - 06:26 PM GMTBy: GoldCore

Chaos was seen in financial markets today as participants were thrown a curveball when Switzerland surprised the world by removing its three-year cap on the Swiss franc, unpegging it from the euro. This sent the undervalued currency soaring and Europe’s shares and bond yields tumbling.

Chaos was seen in financial markets today as participants were thrown a curveball when Switzerland surprised the world by removing its three-year cap on the Swiss franc, unpegging it from the euro. This sent the undervalued currency soaring and Europe’s shares and bond yields tumbling.

In just 13 minutes, from 0930 to 0952 BST, the franc collapsed by 30%. Swiss shares fell more than 12% – their largest crash since 1987. Stock markets around Europe fell with investors buying “safe haven” assets such as German bunds and gold bullion.

Gold rose in all major currencies and approached a three-month high following Switzerland’s unexpected decision to decouple its currency from the euro.

In a chaotic few minutes on markets after the SNB’s announcement, the Swiss franc jumped to a record high against the euro, rocketed nearly 30 percent in a few minutes. The franc broke past parity against the euro to trade at 0.8052 francs per euro before trimming those gains to stand at 88.00 francs – it removed the 1.20 per euro cap it has had in place since late 2011. It also gained 25 percent against the dollar to trade at 74 francs per dollar.

Gold in USD, 1 Day, January 15, 2015 – (Thomson Reuters)

The SNB ended a three-year-old policy designed to shield the economy from the euro area’s sovereign debt crisis, prevent the Swiss franc appreciating and pricing Swiss exports out of markets. The central bank lowered the interest rate on sight deposit account balances that exceed a given exemption threshold to minus 0.75 percent from minus 0.25 percent, it said in a statement today.

This is likely a coordinated move by the SNB in conjunction with the ECB in anticipation of a move against the flood of money that will likely materialise with the ECB in Frankfurt looking likely to start quantitative easing.

Gold in USD, 5 Day, January 15, 2015 – (Thomson Reuters)

Gold climbed on the news and bullion for immediate delivery increased 2.3 percent to $1,257.01 near a 12 week high, as the dollar weakened. Gold is higher for a fifth day, the longest streak since June.

The move by the SNB is a dramatic one and smells of an emergency measure. Ultra loose monetary policies are here to stay and the SNB actions suggest loose money policies will intensify in the coming months.

The revaluation of the Swiss franc versus the dollar, pound and euro is a harbinger of what will happen to those same fiat currencies versus gold in the coming months and years. The Swiss franc is one of the safest fiat currencies in the world but gold remains the ultimate safe haven asset and form of money as has been seen throughout history and in recent years.

REVIEW of 2014 – Gold Second Best Currency, +13% in EUR, +6% GBP

OUTLOOK 2015 – Uncertainty, Volatility, Possible Reset – DIVERSIFY

Today’s AM fix was USD 1,235.25, EUR 1,055.41 and GBP 811.76 per ounce.

Yesterday’s AM fix was USD 1,228.75, EUR 1,044.99 and GBP 808.76 per ounce.

Spot gold in Singapore was flat and yesterday spot gold fell $2.40 or 0.2% to $1,228.00 per ounce yesterday and silver slipped $0.18 or 1.06% to $16.83 per ounce.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.