Very Strong Indirect Reasons To Buy Gold And Silver

Commodities / Gold and Silver 2015 Jan 10, 2015 - 04:11 PM GMTBy: Michael_Noonan

Got gold? Got silver? If not, you may not survive very well under the current and future regime[s] established in this country. Does price matter? Sure, everyone wants to buy reasonably near the lows, and there are many of us who paid substantially higher prices than currently exist. However, if there is no intent to sell but only hold as a form of wealth protection and/or a form of insurance against a worthless fiat paper currency, then price paid is really immaterial and focus should remain on purpose, not price. Owning and controlling either or both gold and silver are far more important.

Got gold? Got silver? If not, you may not survive very well under the current and future regime[s] established in this country. Does price matter? Sure, everyone wants to buy reasonably near the lows, and there are many of us who paid substantially higher prices than currently exist. However, if there is no intent to sell but only hold as a form of wealth protection and/or a form of insurance against a worthless fiat paper currency, then price paid is really immaterial and focus should remain on purpose, not price. Owning and controlling either or both gold and silver are far more important.

In a market that is forming a bottom, price usually moves sideways along the RHS of the chart [Right Hand Side]. What is known for certain is that the farther price moves along the RHS, the closer it gets to a final resolution: a final bottom and eventual reversal of trend. The same applies to the ownership of gold and silver.

No one, absolutely no one knows when a bottoming process will end, and in this regard, we refer to the ending process of the Federal Reserve fiat "dollar" being used as the world's reserve currency. [What that means is goods on the world market are price and settled in terms of dollars and no other currency, unless countries decide to trade using their own currencies and outside of the fiat "dollar" system.] The fiat "dollar" is still moving farther along the RHS of its ultimate demise.

This is where the elite's central banking system, through London and Washington DC, finds itself today. More and more countries are turning away from the fiat "dollar" and using alternatives. Think of London as the controlling financial arm and Washington D C as the military enforcement behind the money.

The Western financial central banking system is losing its control, and it continues to move along the RHS of that loss of control. When will loss of control be final? That is the same as asking when will gold and silver put in a final bottom? Unanswerable as to an exact date, and almost near impossible as to a reasonable window of time. Almost none of all the experts in the PM community foresaw the extent of the decline from the highs over three years ago, and since 2013 and 2014, almost none called for the recent lows currently prevailing. [There may always be one or two, but we do not know who they are.]

When the fiat Federal Reserve "dollar" finally loses its status as the world's reserve currency, gold and silver will have then begun to make an upward price adjustment or will begin to make the upward adjustment, and all who paid much higher prices for gold and silver will stop whining about price.

Here are a few examples of very strong, not so unrelated reasons for actively buying physical gold and silver.

More people need to be aware of the government under which they live in the United States. It is not "their government," as most assume. The United States has not been a Constitutional Republic for almost 150 years, when it became a de facto government on 27 March 1861, when 7 states from the South walked out of Congress that then lost its Constitutional quorum, sine die,[pronounced sy-nee dye, Latin for "without a day"] for reconvening Congress. Without the necessary quorum to reconvene, the Constitutional government ceased to exist.

On 15 April 1861, President Lincoln reconvened Congress entirely under the Executive branch by presidential proclamation, Executive Order 1, "I do hereby, in virtue of the power vested in me by the Constitution, convene both Houses of Congress."

What people do not know is this country has been a presidential dictatorship ever since.

Let that sink in.

What has since evolved is a fascist government with a primary goal of serving the ruling oligarchs. The terms will be defined simply so that everyone is clear as to meaning. A fascist government is one that is more important than any individual or group, as well as any provision for liberty[s]. Think of the Patriot Act and Obama's National Defense Authorization Act, both severely restricting individual freedoms in this country.

One need also consider the NSA and how its pervasive spying of every US citizen's phone calls, e-mails with express government approval and full budget support. There is also FEMA, DHS, and the hands on everyone everywhere TSA. To all of these can be added the recent militarization of local police forces that are often more heavily armed that real soldiers in combat. [Few people in this country are aware that police are not required to protect the public, per Supreme Court rulings.]

Under a fascist government is one person designated as leader, for which Obama qualifies. He rules however he wants with little regard for the established political process, one that has been totally corrupted, anyway. The entire de facto government has been under the direction of a shadow government, the ruling elite pushing for a one world government, via the United Nations. Those in control of the government are the oligarchs. An oligarchy is where a small group of people have all the power.

For anyone who believes this "governmental shoe" doe not fit the US, you are not paying attention, or the only attention being paid is to bought-and-paid-for-mainstream-news and announcements [almost always, if not always, lies] from the de facto government.

The Constitution does not exist in the de facto government, only a federal constitution exists, one where Rights have been replaced with privileges, where the will of one is protected against the majority has given way to the majority rules and Rights are subordinate or nonexistent.

The United States is recognized as the leading country transgressing the rights and sovereignty of its own citizens, and for those of the rest of the world. There is no country that conducts more wars than the US. The entire banking system has been protected by the government at the expense of all citizens. Today, any money held in a bank now belongs to the bank. It ain't your money any more! If a bank fails, you lose. This is how the federal government has set up the rules t protect the oligarch's banking system.

Here is a link to an article we found posted on the Shift Frequency web site entitled "America's War On Whistleblowers And Journalists Since 9/11." [If the hot link does not work, it is on our website under "Anything Goes" section.] If you want to know why you should own and hold gold and silver, this article is a mosaic of so many and on topics too numerous to mention. It provides an awareness of what this government is doing and how it will have a direct impact on your future, financial and otherwise. To not own PMs at any price is a huge gamble.

Back to the charts...

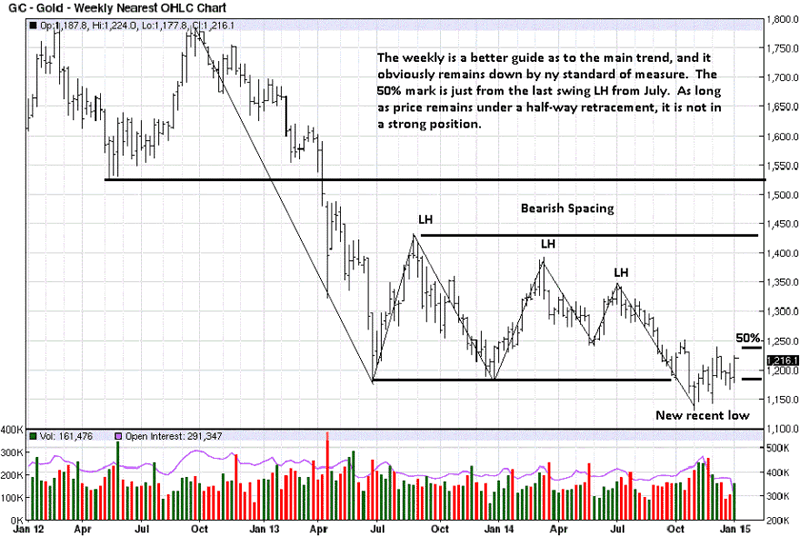

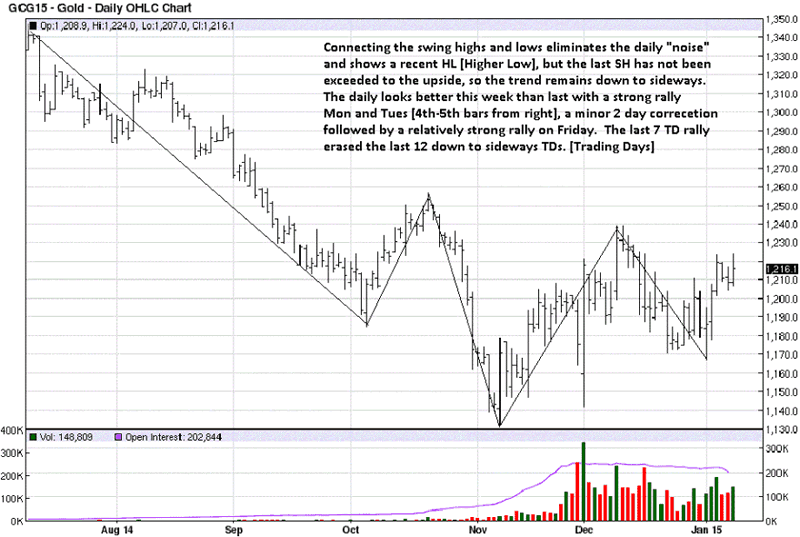

There are times when little can be added to what has already been said. The trend remains down in gold, and until there is evidence of a strong reversal, this market continues to move along the RHS of a weak TR [Trading Range]. This is why we do not engage in any "predictions" of what the market will do. It is an exercise in ego and folly, and a waste of time. One need only go back to those who are making predictions for 2015 and read what was predicted for 2014 for proof.

Continue buying the physical, but the paper market is dead in the water from the long side.

Gold Weekly Chart

Even with a decent rally to start 2015, look at where price is...locked within a TR. The market is not advertising any opportunity[s] at present.

Gold Daily Chart

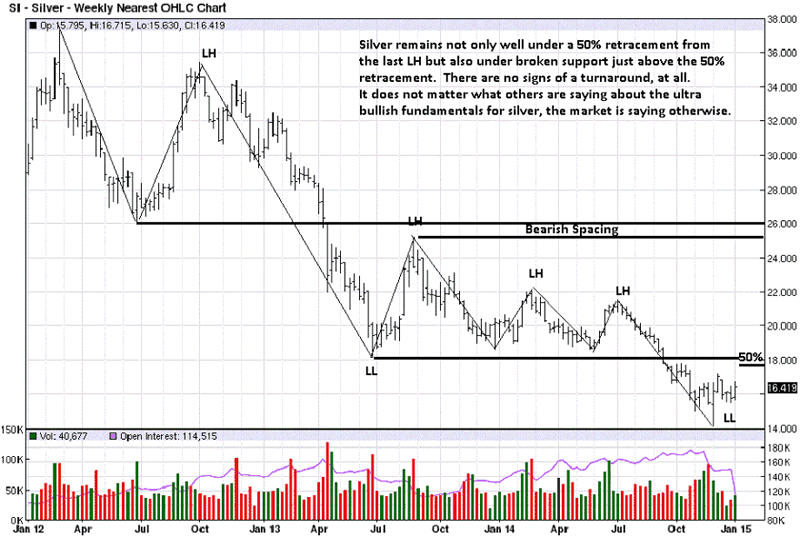

Since breaking under 18, silver traded sideways for 5 weeks and then made another break to the downside. It has been trading sideways for 11 weeks. It is from this kind of sideways activity that an opportunity can arise. The problem is the overhead resistance appears to be an impediment for an upside breakout. However, anything can happen. Best to wait and see what develops and the manner in which it does.

Silver Weekly Chart

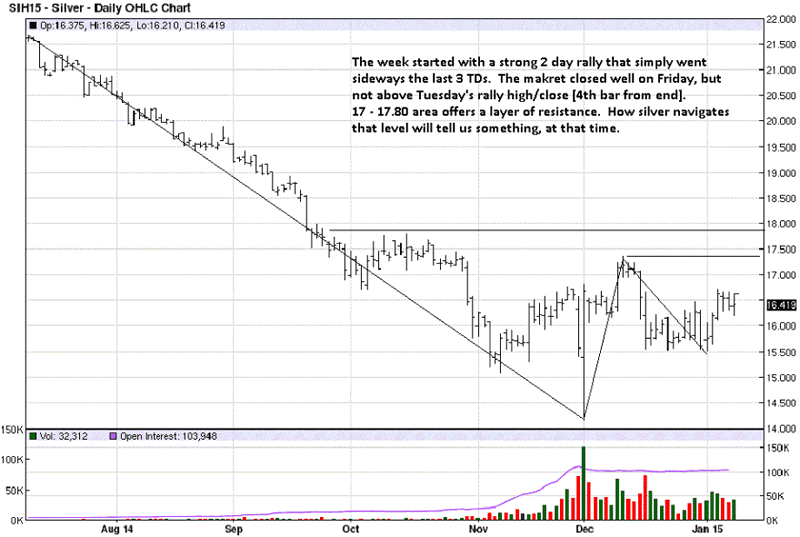

Interestingly, the sideways activity looks more promising on the weekly than on the daily. Until there are signs of strong upside movement with strong closes and increased volume, it is hard to get excited for the paper market.

Otherwise, keep staking.

Silver Daily Chart

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.