Deflation and the Year Ahead

Stock-Markets / Financial Markets 2015 Jan 07, 2015 - 03:27 AM GMTBy: Clif_Droke

Stocks were hit by selling pressure on Monday as the S&P 500 (SPX) declined 1.83% and the Dow 30 shed 1.86%. The energy sector bore the brunt of the selling with the NYSE Oil Index declining 4.61%. Crude oil prices also dropped nearly 5% for the day to close at 5 ½-year lows.

Stocks were hit by selling pressure on Monday as the S&P 500 (SPX) declined 1.83% and the Dow 30 shed 1.86%. The energy sector bore the brunt of the selling with the NYSE Oil Index declining 4.61%. Crude oil prices also dropped nearly 5% for the day to close at 5 ½-year lows.

Fears that Greece may exit the euro zone are being blamed on the latest broad market decline. Upcoming elections in Greece have spooked many investors, who feel that the country's exit from the euro zone would be disastrous. The most likely reason for the market decline, however, is the fact that investor sentiment has been excessively bullish in the last couple of weeks. A pullback in the major indices should remove much of the excess optimism and pave the way for a sounder market environment.

Many investors are also concerned over the potential for a bad year based on the so-called January Barometer. This indicator is predicated on the belief that as goes the month of January, so goes the entire year. Some even place emphasis on the first five days of January as having prognosticative value. Yet the January Barometer was wrong in 2014 - the month of January last year was resoundingly negative, yet the year as a whole was positive.

As discussed in previous commentaries, the year ahead should be a bullish one overall based on the Year Five Phenomenon, notwithstanding the possibility of a volatile January. This particular market maxim has held true for over 100 years, namely that there has never been a losing year in the fifth year of the decade. The reason for this is that the 10-year Kress cycle bottoms at the end of the fourth year and the resultant upward pressure from the new-born 10-year cycle is beneficial for equity prices.

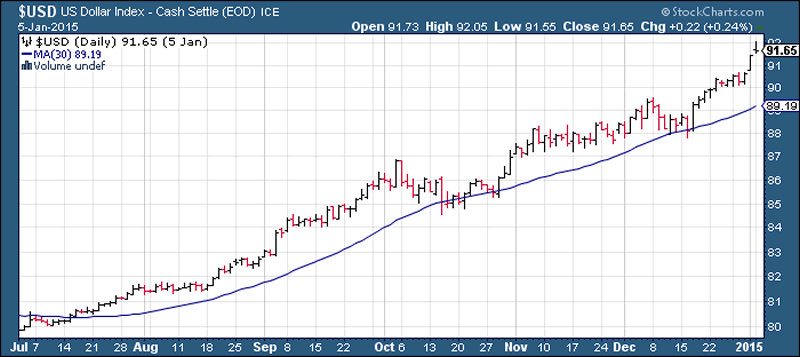

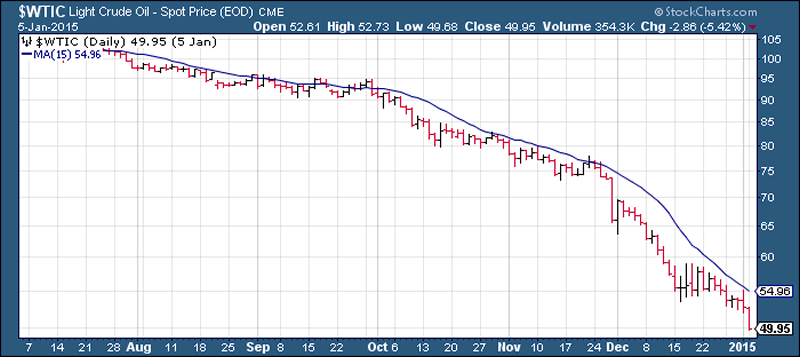

Turning our attention to the crude oil collapse, weakness was once again in the oil price on Monday. The crude oil price was 3% lower for the day after hitting a 5 ½-year low. Adding to pressure against crude oil prices has been persistent strength in the U.S. dollar index (see chart below). Recent dollar strength and oil price weakness has once again stirred up concerns among investors that deflation could be a problem in 2015.

$SUD US Dollar Index - Cash Settle (EOD) ICE

While I don't envision deflation being a dominant theme for most of 2015, it could be problematic during the early part of the year. When the 60-year Kress cycle of inflation/deflation entered its final "hard down" phase in 2008 it created major problems for the U.S. financial sector in 2008-2009. Yet except for a brief period in 2008 and early 2009, it failed to deliver the anticipated deflationary collapse in essential commodity prices and the corresponding increase in the dollar's value. Many investors jumped to the conclusion that the long-term Kress cycle was either broken or else mitigated by the monetary policy actions of the Federal Reserve.

Bud Kress always used to say that ultimately "Mother Nature and Father Time" would prevail when it came to the financial market. That is, the natural forces of inflation and deflation will always manifest sooner or later - even when central bankers do their utmost to stifle it. Viewed from this standpoint, the recent oil price collapse, dollar rally and overseas turbulence can be attributed to the cycle somewhat belatedly having its way despite the efforts of central banks. Central bankers thought they could completely eliminate the impact of the cycle but it would seem that the cycles are having the last laugh.

On the subject of the oil price collapse, a recent Bloomberg article entitled "Oil below $60 tests U.S. drive for energy independence" provided some background for the ongoing crisis. Asjylyn Loder, who wrote the article, observed: "The U.S. shale boom that's brought the country closer to energy self-sufficiency than at any time since the 1980s will be challenged in 2015 as never before."

$WTIC Light Crude Oil - Spot Price (EOD) CME

The article also pointed out that some of the largest U.S. shale drillers "have been spending money faster than they make it, borrowing to pay for their expansion." It would appear then that the fracking boom which provided a much needed stimulus to the U.S. economy at a time when it was needed most will face its first major obstacle in the coming year. The oil price collapse and dollar rally has been a boon for consumers - Goldman Sachs analysts have said that cheaper U.S. gasoline will boost economic growth by 0.5 percentage points this year. Economist Mark Zandi of Moody Analytics estimates that if oil prices stay at $60/barrel it will result in $150 billion in savings on gasoline for consumers.

However, the oil price collapse will also eventually run headlong against the old market bromide that "low prices cure low prices."

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. Far more than a simple trend line, it's a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you're trading in.

In my latest book, "Mastering Moving Averages," I remove the mystique behind stock and ETF trading and reveal a completely simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today's fast-moving and sometimes volatile market environment. If you're interested in moving average trading techniques, you'll want to read this book.

Order today and receive an autographed copy along with a copy of the book, "The Best Strategies For Momentum Traders." Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.