US Debt Reaches $18 Trillion; Surges 70% In ‘Recovery’ of President Obama

Interest-Rates / US Debt Dec 02, 2014 - 06:22 PM GMTBy: GoldCore

Total U.S. national debt hit a new record high overnight at over $18 trillion as the Obama administration continues to pile debt onto the back of the U.S. taxpayer at a rate that would have made George W. Bush look positively prudent.

Total U.S. national debt hit a new record high overnight at over $18 trillion as the Obama administration continues to pile debt onto the back of the U.S. taxpayer at a rate that would have made George W. Bush look positively prudent.

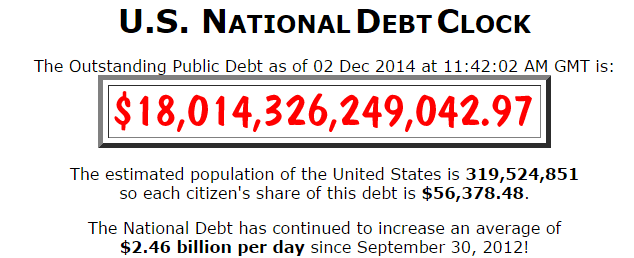

With the U.S. national debt or government debt now at over a staggering $18 trillion, it means that each household in the U.S. now carries the burden of $124,000 in national debt alone - or $56,378 per individual. This does not include the massive private debt or household debt burden - people’s mortgages, personal loans, credit card debt, student loans, car loans and other household debt.

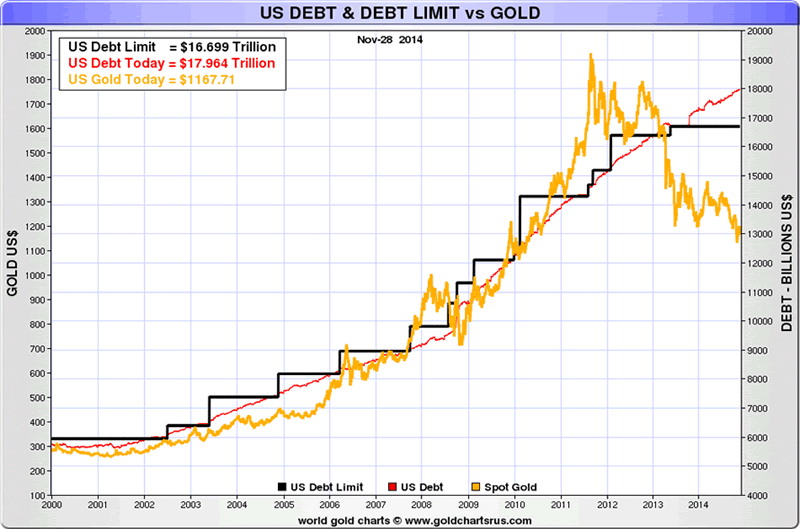

When Obama took office in 2009, the national debt had surged to $10.6 trillion up from $3 trillion at the beginning of Bush’s tenure in 2001.

The total U.S. debt has increased by 70% under Obama, from $10.625 trillion on January 21, 2009 to over $18.005 trillion today

In short, the federal government has borrowed, and spent, nearly $7.5 trillion more since President Obama took office than it has collected in taxes.

Obama’s policies have continued to favour Wall Street and corporate interests over Main Street.

As ever, historical context is all important. The U.S National Debt took 43 Presidents from 1789 until 2008 to reach $10 trillion. The National Debt rose $4.899 trillion during the two terms of the Bush presidency. It has now gone up nearly $8 trillion since President Obama took office.

The U.S. national debt is spiralling out of control, seemingly without any plan to ever reign it in and yet the rise above $18 trillion was not reported in mainstream media.

Brillig.com

Compared to this time last year, the national debt has grown by another $1 trillion.

Astoundingly, more than $7 trillion of additional US national debt will have been accumulated over the 8 year duration of Obama’s two presidencies, which is more than the accumulated U.S. national debt of all previous U.S. presidents combined.

This is not to mention the astronomical expenses of more than $200 trillion of U.S. government unfunded liabilities such as medicare, medicaid and social security.

Household debt--including mortgages, credit cards, auto loans and student loans -- remains close to $12 trillion.

The U.S. debt position increasingly has all the hallmarks of a Ponzi scheme. The Daily Treasury Statement that was released last Wednesday afternoon as Americans were preparing to eat turkey on Thanksgiving revealed that the

U.S. Treasury has been forced to issue $1,040,965,000,000 in new debt since fiscal 2015 started. This is just eight weeks ago. they had to do this in order to raise the money to pay off Treasurysecurities that were maturing and to cover new deficit spending by the government.

During those eight weeks, Treasury took in $341,591,000,000 ($341 billion) in revenues. That was a record for the period between October 1 and November 25. But that record $341,591,000,000 ($341 billion) in revenues was not enough to finance ongoing government spending let alone pay off old debt that matured.

A conservative measure of the U.S. National Debt to GDP ratio is now around 103%. The talking heads have, for many years, downplayed the out of control spending of successive administrations with the justification that it was below the “psychologically important” debt to GDP ratio of 100%.

Well, here we are now over 100% and all is quiet.

The Total U.S. Debt to GDP ratio is now over 300%. Such debt levels ordinarily give rise to debt crises and currency crises.

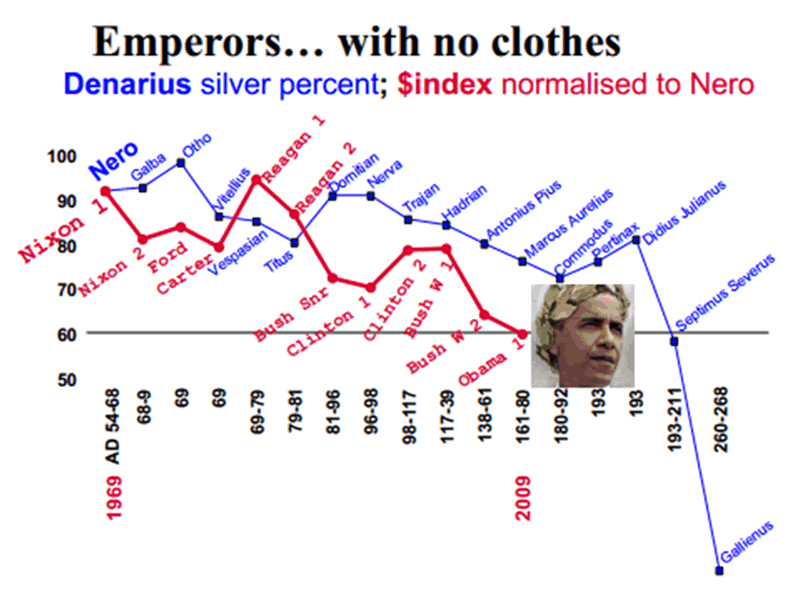

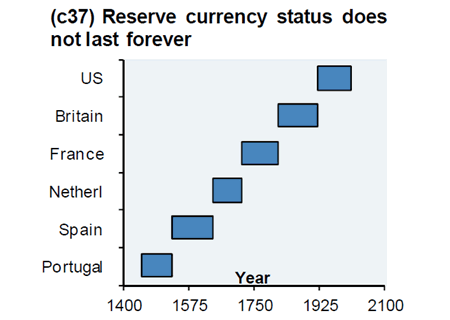

So how can we expect this scenario to play out? If it hasn’t mattered thus far why should it matter now? Well for one, U.S. government profligacy has been protected by the extraordinary status that the dollar has enjoyed as a reserve currency since the early 1970s and Nixon going off the Gold Standard.

Heretofore, almost all balance of trade deficits have been settled with dollars. All oil transactions have been settled in dollars. This has allowed the U.S. an “exorbitant privilege” in the words of Valéry Giscard d'Estaing, the former French Minister of Finance. It has allowed the U.S. to live beyond its means because its currency remained in demand regardless of its economic performance.

Over the course of this year, however, the dollar has taken what should be seen as an alarming series of blows to its status as trusted sole global reserve currency as currency wars intensify.

Increasingly, the new power bloc that are the BRICS nations are settling their trade deficits with domestic currencies, by-passing the dollar. Russia and Turkey have just signed a gas-line agreement to this effect. As have russia and the emerging superpower China.

There is a perception that the U.S. dollar is still strong and is still the reserve currency of choice.

This is based on the strong performance of the Dollar Index as of late. It is important to note the distinction between the dollar and the Dollar Index. The index rates the dollar relative to a basket of other mainly western currencies, primarily the euro. The recent “strength” of the dollar is merely strength against these other struggling currencies including the euro.

Russia’s foreign minister, Sergei Lavrov, pointed out last week that “the seven developing economies headed by BRICS already have a bigger GDP than the Western G7.” This drives home the message that the economic might of the U.S. is waning. It is doubtful whether it will be able to re-establish or indeed maintain the Bretton Woods paradigm which gave the dollar it’s preeminent status.

Another major cause for concern should be the impending rise in interest rates. The ability of the U.S. to service its debt will be drastically reduced if rates move higher. Already a number of states have defaulted. The luxury of determining interest rates may not be one that the Fed will enjoy for very much longer. When rates do finally rise we may witness the default of the U.S..

If this spectre comes to pass – and possibly independent of it – there will be demand for a new store of wealth. History teaches us, regardless of our own philosophical or economic outlook, that gold will be one such store.

The BRICs countries are major purchasers of gold - both their people and their central banks. If economic influence is moving East it would be prudent to emulate them and acquire gold as a store of value. As always, we advocate allocated and segregated gold coins and bars in secure vaults and in safe jurisdictions around the world.

This continuing surge in the U.S. national debt means that the U.S. is now the largest debtor nation in the world - by a significant margin. This profligacy will be paid back by the American people, and most likely by people every where, in the form of higher taxes, higher interest rates, inflation and almost certainly currency crises.

Get Breaking News and Updates On Gold Markets Here

MARKET UPDATE

Today’s AM fix was USD 1,197.00, EUR 962.68 and GBP 761.60 per ounce.

Yesterday’s AM fix was USD 1,178.75, EUR 945.46 and GBP 750.56 per ounce.

Gold climbed $45.60 or 3.91% to $1,212.60/oz yesterday. Silver soared $1.03 or 6.67% to $16.47/oz and surged nearly 17% from the interday low. Such volatility and intra-day reversals frequently presages a bottom.

Gold’s rally was likely due to technical buy signals and a short squeeze, robust demand from China and India with the potential for increased Indian imports. GOFO backwardation continues suggesting stresses in the physical inter bank market for large London good delivery bars.

A sudden fall in stock markets globally made traders nervous and likely contributed to gold’s safe haven bounce.

Gold has fallen marginally today and is testing the $1,200/oz level today. The greenback rose to the highest since 2009 yesterday amid continual hints and suggestions that the Federal Reserve will raise interest rates next year.

With the U.S. national debt surging another $1 trillion in recent months to over $18 trillion, it is difficult to see how interest rates can be raised in any meaningful way without creating an economic collapse. This is not too mention the huge levels of private debt at every level of American society and indeed the unfunded liabilities of between $100 trillion and $200 trillion.

The precious metals group climbed as crude oil went south and dropped to its lowest price in 5 years prior to a sharp bounce.

Silver for immediate delivery dropped 1.7% to $16.183 an ounce in London. It rebounded yesterday from a five-year low of $14.4235 to settle 6.5% higher, the biggest gain since January 2012.

Platinum slid 1.7% to $1,217.50 an ounce. Prices gained 3.2% yesterday, the most since August 2013. Palladium lost 0.7% to $802 an ounce.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.