Crash Proof your Stock Market Invesment Portfolio

Stock-Markets / Investing Mar 08, 2007 - 10:23 AM GMTYou buy home insurance to protect your home against fire, storm damage and theft ... auto insurance for your car ... and perhaps even long-term care insurance to prevent undue erosion of your assets in later years.

But do you take similar steps to protect your investment portfolios? Think it's not needed? Before you answer, consider these facts:

Fact #1. For many investors, the total amount at risk in their stock portfolio is similar to — or even larger than — the amount at risk in all their other assets combined.

Fact #2. Stock market declines that damage your portfolio are more frequent occurrences than storms or disasters that damage your home.

Fact #3. The dollar damages could be significantly greater!

In this special afternoon edition of Money and Market s, we have two solutions for you:

Short-term solution: Portfolio protection!

Long-term solution: More savings!

I will give you some pointers on the short-term solution. And Weiss Research's personal finance specialist, Amber Dakar, will give you a primer on the long-term solution ...

Your short-term solution: Portfolio Protection

Suppose you own stocks that are vulnerable to a decline. And suppose you're either unwilling or unable to sell. What do you do?

My recommendation is to allocate a modest percentage of your funds to a hedge — to generate profits that will help offset the possible losses.

You have three alternative instruments available to you:

Instrument #1. Inverse index mutual funds are designed to go up in value as the index they're tied to goes down.

For example, you can buy an Inverse index fund that's tied to the S&P 500 Index: If the S&P 500 goes down by 10 percent, the fund is designed to go up by 10 percent, and vice-versa.

Or, you can also buy the double-leverage variety: If the S&P 500 goes down by 10%, the fund is designed to go up by 20 percent .

Instrument #2. Inverse index ETFs serve the same function as the Inverse index mutual funds. They're designed to go up in value as the index declines. And you have the choice of buying double-leverage ETFs as well.

Plus, the ETFs offer some added advantages: You can invest with very small minimums. You can buy and sell them during the trading day. Since they trade like a stock, you can more easily buy and sell ETFs issued by different firms. And you can do so directly in your own brokerage account, either online or offline.

Instrument #3. Long-term put options (LEAPS) give you more leverage and more choices, allowing you to also hedge against individual stocks. Plus, unlike ordinary options, they don't expire for up to two years or more, giving you the time you may need to take advantage of longer term trends.

All three instruments involve risk of loss, especially if stocks or indexes are generally moving higher. So they're not appropriate for your core, long-term wealth building strategy.

But even in a bull market, you can use them to protect your wealth. In a bear market, they give you the potential to generate substantial profits. And no matter what happens, when you purchase mutual funds, ETFs or LEAPS, you can never lose more than you invest (plus any commissions you pay your broker).

The basic concept: If the stock market goes up, they will produce a loss, but your gains in your stock portfolio should easily cover it. If the stock market goes down, you will at least have one investment working in your favor.

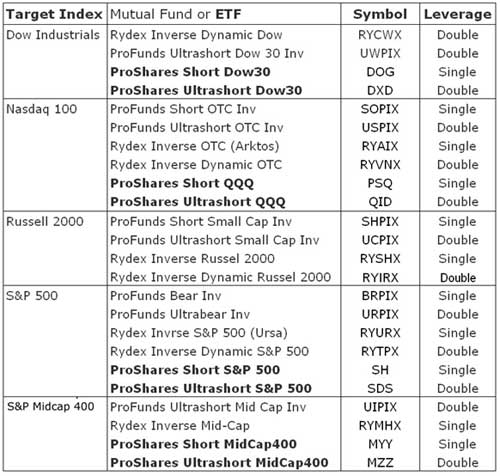

Here are some of the inverse mutual funds and ETFs currently available:

Your long-term solution: Manage and track all Your

Assets. Then Save More!

by Amber Dakar

If you didn't notice this shocking news last month, it's time to face it now: The U.S. Department of Commerce reported that America's personal savings rate in 2006 plummeted to negative 1 percent.

That's the worst since the most depressed year of the Great Depression, 73 years ago!

Why?

Because over the last three years, the Dow & the S&P are up a total of 23.3 percent and 27.4 percent, respectively. And although the depreciation in home values Mike Larson has been warning you about is beginning to take effect in many parts of the country, Americans are still sitting on an average 27.5 percent price appreciation in their homes since December 2002.

So it's only natural for most people to be complacent. It's human nature for the average American to be thinking: “Why should I save when I've got these great financial and physical assets?” What they're missing is that …

Real estate and stocks do not replace an accessible, liquid nest-egg— let alone well-managed finances!

That leads me to my second question: What can you do about it? I recommend the following steps:

Step 1. Don't confuse savings with investments .

Too many people think that socking money away in a stock mutual fund — or even investing in a high-tech wonder stock — is a form of savings. But I think that's a stretch.

Maybe I'm too traditional. But to me, savings must be in an asset that does not jump up and down in value, generates a steady income, and is available for unexpected emergencies or special opportunities. I'm talking about bank accounts, money market funds, Treasury bills, and, if you're worried about the sinking value of the dollar, perhaps even some money in a foreign currency account.

In contrast, stocks, stock mutual funds, and real estate are investments. They are not protected. They are certainly not guaranteed.

Don't confuse the two. It could get you into deep trouble.

Step 2. List and track all your assets.

List out your financial assets (that can be converted to cash in a relatively short period of time) and your physical assets (tangible items you own that have monetary value).

Don't leave one stone unturned. Be sure to include all of your:

- Bank accounts

- Stocks

- Bonds

- Mutual funds and ETFs

- Life insurance policies

- Company pension plans, and

- Annuities

Plus ...

- Your home

- Rental properties

- Cars and recreational vehicles

- Home furnishings

- Jewelry

- Antiques

- Artwork

- Other Collectibles

Step 3. List and track all your debts ...

- Automobile loans

- Credit card balances

- Other charge accounts

- Mortgages and other real estate loans

- Student loans

- Personal and business loans

This may be a tedious process. However, you can use it to help you settle insurance claims in case of a natural disaster or theft. You can use it in the settlement of your estate. And even if you never have to deal with any of these, it will be a very handy tool for you to plan your life.

Step 4: Calculate your net worth

That's easy and you no doubt know how. Just subtract your total debts from your total assets. (If it's in the red, you have some serious debt reduction work ahead of you!)

Step 5: Calculate your debt-to-income ratio

Monitoring your ratio also helps to avoid “creeping indebtedness.” If you're seeking to obtain a loan for a home, vehicle or business, lenders look at this ratio when they're considering extending a line of credit. To calculate your ratio, just follow these simple steps:

1. Add up your total monthly gross income . That could include your income from an employer, bonuses, tips, commissions, government benefits, child support, alimony and interest and dividends accruals.

2. Add up your total monthly debt payments . Needless to say, that includes your mortgage payments, your car payments and any minimum payments you make on your credit cards. It does not include your taxes or utilities.

3. Divide your debt payments by your monthly gross income.

According to the University Credit Union, a debt-to-income ratio of 36 percent or less is what most individuals should aim for. And given our concern for declining real estate values, we recommend that most Americans aim for 20 percent or less .

But here's how the University Credit Union evaluates this ratio:

37 to 42 percent: Your debts appear manageable. But they can get out of control. Start paying them down now. You may still be able to obtain credit cards, but acquiring loans may prove difficult.

43 to 49 percent: Your debt ratio is too high. Financial difficulties may be likely unless you take immediate action.

50 percent or more: Seek professional help promptly to make plans for drastically reducing debt before it's too late.

Important: Be sure to recalculate your ratio once each year or whenever you face a significant life event, such as a death in the family, a divorce, a change in jobs, etc.

So now you know if you're on sound financial footing or if your ship is likely to be sinking. (You probably had a good guess anyway, but the Debt-to-Income Ratio confirms it.) On to the next step ...

Step 6: Save!

Once you have a clearer vision of all your assets and all your debts, you open the path to steadier, bigger and more efficient savings.

Never forget: No matter how much money you make, you could get saddled with unexpected expenses at almost any time. The cost of quality health care can be especially devastating. And the danger of declines in your assets, such as real estate, is growing.

So, at a minimum, you should aim to have at least six months of income in the bank for those unpredictable times.

One simple way to build a nice nest-egg with little effort: Set up an automatic funds transfer from your checking to your savings account with your financial institution.

Just saving $300 per month at a 4.12% interest rate (the current average national statement savings account rate) for the next three years will result in a savings of $11,814.28.

Here's another approach: For each dollar you set aside this year for gift-giving, set aside another dollar for a gift to your own savings retirement account that you manage.

It's wonderful to be generous to others. But how will you sustain that generosity long term if the value of your assets decline and you don't have a solid cushion to fall back on?

That single step alone could help the average American build a respectable nest-egg in a few years, and could help higher-income families build a very substantial one.

Best wishes,

By Amber Dakar

Ms. Dakar has just written a primer with step-by-step instructions to achieve all of the above, and more — The Busy Person's Guide to Personal Finance . In it, she provides guidance not only on how to manage your finances and build a substantial nest-egg, but she also gives you her choice of ...

- The best bond fund for busy people who want to play it safe and still get better-than-money-market returns.

- The best mutual and exchange-traded funds for busy people who want to put some of their money in something with a little more risk and potentially much more reward .

- Seven funds for folks who have a little more time to figure out which ones work for them.

This is a primer for those new to investing. Plus, it contains specific investment recommendations you can be comfortable with without in-and-out trading. But the cost is just $12.95. Click here to order .

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.MoneyandMarkets.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.