Debt on Wheels - Subprime Loans and Auto Sales

Interest-Rates / US Debt Nov 08, 2014 - 06:42 PM GMTBy: Mike_Whitney

Soaring auto sales are not so much a sign of a strong economy as they are an indication of financial hanky-panky. We saw this same type of fakery play out in housing between 2004 – 2006, when prices went through the roof due to a mortgage-lending scam (“subprime”) that crashed the stock market and sent the economy reeling. Now the bigtime money guys are at it again, writing up auto loans for anyone who can sit upright in a chair and scribble an “X” on the dotted line. As a result, car sales have surged to over 16 million for the last 6 months. (A full 7 million more than the low point in January, 2009.) And it’s not hard to see why either. The finance gurus are packaging these sketchy subprimes into bonds, offloading them on eager investors, and recycling the profits into more crappy loans. It’s a perfect circle and it won’t end until the loans start blowing up, jittery investors head for the exits, and Uncle Sugar rides to the rescue with more bailouts.

Soaring auto sales are not so much a sign of a strong economy as they are an indication of financial hanky-panky. We saw this same type of fakery play out in housing between 2004 – 2006, when prices went through the roof due to a mortgage-lending scam (“subprime”) that crashed the stock market and sent the economy reeling. Now the bigtime money guys are at it again, writing up auto loans for anyone who can sit upright in a chair and scribble an “X” on the dotted line. As a result, car sales have surged to over 16 million for the last 6 months. (A full 7 million more than the low point in January, 2009.) And it’s not hard to see why either. The finance gurus are packaging these sketchy subprimes into bonds, offloading them on eager investors, and recycling the profits into more crappy loans. It’s a perfect circle and it won’t end until the loans start blowing up, jittery investors head for the exits, and Uncle Sugar rides to the rescue with more bailouts.

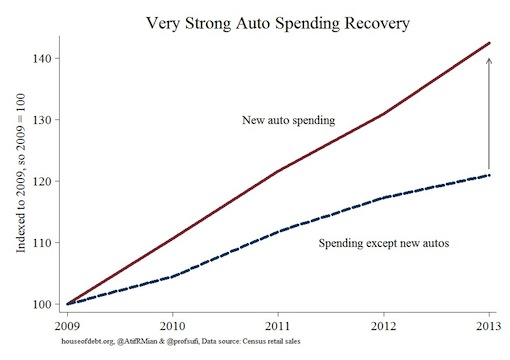

But we’re getting ahead of ourselves. First take a look at these charts by House of Debt which shows the disparity between auto spending and other types of spending since the end of the slump in 2009.

House of Debt: “New auto purchases have driven the consumer spending recovery to a large degree. The chart below shows the spending recovery for new auto sales and for all other retail spending….

From 2009 to 2013, spending on new autos increased by 40% in nominal terms. All other spending increased by only 20%. Further, excluding autos, 2013 saw lower growth in nominal retail spending than 2012…..

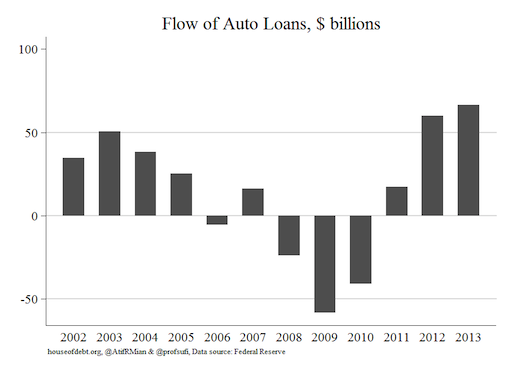

The concern is that a lot of auto purchases are being fueled with debt, given a strong recovery in the auto loan market. Below is the net flow of auto loans from 2002 to 2013. It is a net flow because it includes pay downs in addition to new originations. As it shows, auto lending in 2012 and 2013 tops any other year during the previous expansion from 2002 to 2007 (although it is still below the amount of new auto loans in 2000 and 2001).

(“Another Debt-Fueled Spending Spree?” House of Debt)

How about that? So there’s a bigger debt bubble in auto loans today than there was before the bust. But why? Is it because demand is strong, jobs are plentiful, wages are rising, the economy is growing, and people are optimistic about the future?

Heck, no. It’s because rates are low, credit is easy, and dealers are ready to put anyone with a license and a heartbeat into a brand-spanking new car no questions asked. Here are the details from an article in the New York Times titled “In a Subprime Bubble for Used Cars, Borrowers Pay Sky-High Rates” by Jessica Silver-Greenberg and Michael Corkery:

”Auto loans to people with tarnished credit have risen more than 130 percent in the five years since the immediate aftermath of the financial crisis, with roughly one in four new auto loans last year going to borrowers considered subprime — people with credit scores at or below 640.

The explosive growth is being driven by some of the same dynamics that were at work in subprime mortgages. A wave of money is pouring into subprime autos, as the high rates and steady profits of the loans attract investors. Just as Wall Street stoked the boom in mortgages, some of the nation’s biggest banks and private equity firms are feeding the growth in subprime auto loans by investing in lenders and making money available for loans.

And, like subprime mortgages before the financial crisis, many subprime auto loans are bundled into complex bonds and sold as securities by banks to insurance companies, mutual funds and public pension funds — a process that creates ever-greater demand for loans.

The New York Times examined more than 100 bankruptcy court cases, dozens of civil lawsuits against lenders and hundreds of loan documents and found that subprime auto loans can come with interest rates that can exceed 23 percent. The loans were typically at least twice the size of the value of the used cars purchased, including dozens of battered vehicles with mechanical defects hidden from borrowers. Such loans can thrust already vulnerable borrowers further into debt, even propelling some into bankruptcy, according to the court records, as well as interviews with borrowers and lawyers in 19 states.

In another echo of the mortgage boom, The Times investigation also found dozens of loans that included incorrect information about borrowers’ income and employment, leading people who had lost their jobs, were in bankruptcy or were living on Social Security to qualify for loans that they could never afford.” (“In a Subprime Bubble for Used Cars, Borrowers Pay Sky-High Rates”, New York Times)

Can you believe that this kind of chicanery is going on in broad daylight without the regulators stepping in? Think about it for a minute: If the NYT’s journalists can find “dozens of loans that included incorrect information about borrowers’ income and employment”, then why can’t the government regulators? It’s ridiculous. What we’re talking about here is a new version of “liar’s loans” where dealers are helping people who don’t have the means to repay the debt, to fudge the details on their loan application so they can drive off in a shiny new Impala.

Haven’t we seen this movie before?

Here’s more from USA Today: “In the first quarter of 2014, 24.9% of all new-car loans were 73 to 84 months long. Four years ago, less than 10% of loans were that long. In fact, such lengthy terms have pulled the average new-car loan to 66 months. That’s an all-time record.”

7 years to pay off a car? You got to be kidding me? It’s like a second mortgage. And there’s more, too. The average monthly payment and average amount financed hit record highs in the first quarter too. This is from Auto News:

“The average monthly new-vehicle payment was $474 in the first quarter, up 3.3 percent from a year ago. The average monthly used-vehicle payment was $352, up 1.1 percent, Experian Automotive said.

Also in the first quarter, the average amount financed on a new-vehicle loan was $27,612, an increase of $964, or 3.6 percent. For used vehicles, the average amount financed was $17,927, up $395 or 2.3 percent.”

(“Auto loan terms, monthly payments hit high in Q1, Experian says“, Auto News)

So Americans are not just loading on more debt, they’re also assuming that they’re financial situation is going to be stable enough to make these large payments well into the future. Good luck with that.

It’s also worth noting that, in many transactions, dealers are actually lending more than the value of the vehicle. According to Reuters David Henry,

“The average loan-to-value on new cars rose to 110.6 percent… On used cars it rose to 133.2 percent…

Auto lenders often provide loans that exceed the value of cars they are financing because borrowers want cash to pay sales taxes and fees.”

(“U.S. car buyers borrow more as rates fall and standards loosen“, David Henry, Reuters)

Let me see if I got this straight: You walk onto a car lot without a dime in your pocket, and drive off in a brand new car with everything paid for upfront? Such a deal! Can you see why we think that the sales numbers are a big fake? This isn’t the sign of a strong economy. It’s the sign of another gigantic credit bubble rip-off. But what do the dealers get out of this thing? Is it really worth their while to botch the underwriting when they know that eventually they’ll have to repossess the vehicle? Sure, it is, because there’s big money in stuffing people into loans they can’t afford.

Here’s how the Times explains it: ”Auto loans to borrowers considered subprime, those with credit scores at or below 640, have spiked in the last five years. The jump has been driven in large part by the demand among investors for securities backed by the loans, which offer high returns at a time of low interest rates. Roughly 25 percent of all new auto loans made last year were subprime, and the volume of subprime auto loans reached more than $145 billion in the first three months of this year.”

Bingo. So not only do they make dough on the high interest rates they charge their subprime borrowers, (Sometimes 23 percent or more.) they also make it by selling the loan to investors who are eager to buy any manner of crappy bond provided it offers a better return than US Treasuries. This is the mess Bernanke created by fixing interest rates at zero for nearly 6 years. Zirp (zero interest rate policy) unavoidably leads to excessive risk taking by yield-crazed speculators. The voracious appetite for subprime securities (ABS–Asset-Backed Securities) has even surprised the bond issuers who are constantly beating the bushes looking for sketchier products. This is from the same article by the NY Times:

“Investors, seeking a higher return when interest rates are low, recently flocked to buy a bond issue from Prestige Financial Services of Utah. Orders to invest in the $390 million debt deal were four times greater than the amount of available securities.

What is backing many of these securities? Auto loans made to people who have been in bankruptcy.

An affiliate of the Larry H. Miller Group of Companies, Prestige specializes in making the loans to people in bankruptcy, packaging them into securities and then selling them to investors.

“It’s been a hot space,” Richard L. Hyde, the firm’s chief operating officer, said during an interview in March. Investors are betting on risky borrowers. The average interest rate on loans bundled into Prestige’s latest offering, for example, is 18.6 percent, up slightly from a similar offering rolled out a year earlier…. To meet that rising demand, Wall Street snatches up more and more loans to package into the complex investments.” (NYT)

HA! Now there’s a good way to feather the old retirement fund; load up on bonds made up of loans to people who’ve gone bust.

This is the impact that zero rates have on investor behavior. The abundance of cheap and plentiful liquidity invariably leads to trouble. And there are victims in this Central Bank-authored gold rush too, namely the unsophisticated borrowers who pay prohibitively high rates on beater vehicles that are typically worth less-than-half the value of the loan. (Check the NYT article for examples.)

The Times also notes that the ratings agencies have been playing along with the finance companies just as they did during the subprime mortgage fiasco. Here’s more from the Times:

“Rating agencies, which assess the quality of the bonds, are helping fuel the boom. They are giving many of these securities top ratings, which clears the way for major investors, from pension funds to employee retirement accounts, to buy the bonds. In March, for example, Standard & Poor’s blessed most of Prestige’s bond with a triple-A rating. Slices of a similar bond that Prestige sold last year also fetched the highest rating from S.&P. A large slice of that bond is held in mutual funds managed by BlackRock, one of the world’s largest money managers.” (NYT)

Ask yourself this, dear reader: How are the ratings agencies able to give “many of these securities top ratings”, when the investigators from the Times found “dozens of loans that included incorrect information about borrowers’ income and employment, leading people who had lost their jobs, were in bankruptcy or were living on Social Security to qualify for loans that they could never afford”?

Let’s face it: The regulatory changes in Dodd-Frank haven’t done a damn thing to protect the victims of these dodgy subprime schemes. Borrowers and investors are both getting gouged by a system that only protects the interests of the perpetrators. The sad fact is that nothing has changed. The system is just as corrupt as it was when Lehman went down.

So, how long can this go on before the market implodes?

According to the Times:

“financial firms are beginning to see signs of strain. In the first three months of this year, banks had to write off as entirely uncollectable an average of $8,541 of each delinquent auto loan, up about 15 percent from a year earlier, according to Experian….

In another sign of trouble ahead, repossessions, while still relatively low, increased nearly 78 percent to an estimated 388,000 cars in the first three months of the year from the same period a year earlier, according to the latest data provided by Experian. The number of borrowers who are more than 60 days late on their car payments also jumped in 22 states during that period….” (NYT)

(According to Amber Nelson at loan.com: “In the second quarter, the value of all auto loans late by 60 days or more was more than $4 billion, up 27 percent from the prior year, according to Experian.”)

So, yeah, the trouble is mounting, but that doesn’t mean that this madness won’t continue for some time to come. It probably will. It’ll probably drag-on until the economy turns south and more borrowers start falling behind on their payments. That will lead to more defaults, heavier losses on auto bonds, and a hasty race to the exits by investors. Isn’t that how the subprime mortgage scam played out?

Indeed. But at least there are signs of hope on the regulatory front. Check out this clip from an article at CNBC:

“In August, both Santander Consumer and General Motors Financial Co. acknowledged receiving Justice Department subpoenas in connection with a probe over possible violations of civil-fraud laws. And the Consumer Financial Protection Bureau and the Securities and Exchange Commission have both stepped up their scrutiny of the auto-loan market.” (“New debt crisis fear: Subprime auto loans“, CNBC)

So the SEC, the DOJ, and the CFPB are actually investigating the underwriting practices of these behemoth finance companies to see if they violated “civil fraud laws”?

Will wonders never cease?

Just don’t hold your breath waiting for convictions.

By Mike Whitney

Email: fergiewhitney@msn.com

Mike Whitney lives in Washington state. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion (AK Press). Hopeless is also available in a Kindle edition. He can be reached at fergiewhitney@msn.com.

© 2014 Copyright Mike Whitney - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Whitney Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.