The US Government Has Nearly As Much Debt As The World Has Wealth

Economics / US Debt Jun 11, 2014 - 12:34 PM GMTBy: Jeff_Berwick

According to a study by the Boston Consulting Group, privately held wealth increased to $152 trillion globally in 2013.

According to a study by the Boston Consulting Group, privately held wealth increased to $152 trillion globally in 2013.

Compare this to estimates putting the US federal government's total debts and liabilities alone at anywhere from $78 trillion to $200 trillion and you can see just how untenable the US government's debt is. The US government is nearly indebted to the equivalent of all the privately held wealth in the world and possibly more!

Remember that the next time someone says, "The US is the richest country on Earth". It is much more accurate to state that the US is the most bankrupt and indebted country in the history of the world.

TALLYING UP THE TOTALS

We are dealing with massive, incalculable numbers here, of course. Certainly it is impossible to calculate the value of all wealth in the world but the Boston Consulting Group's number of $152 trillion is reasonable. Zero Hedge calculated the total amount of global wealth at $223 trillion.

.jpg)

What should be much easier is calculating the total debt and liabilities of the US government... but even this is mostly a guessing game. Even the US government's own Government (Un)Accountability Office (GAO) which is slated with the task of trying to find out where all the money in the government is going has said that it is impossible to fully audit the government.

"The U.S. Government Accountability Office (GAO) cannot render an opinion on the 2012 consolidated financial statements of the federal government because of widespread material internal control weaknesses, significant uncertainties, and other limitations," the agency said. "As was the case in 2011, the main obstacles to a GAO opinion on the accrual-based consolidated financial statements were: Serious financial management problems at the Department of Defense (DOD) that made its financial statements unauditable. The federal government’s inability to adequately account for and reconcile intragovernmental activity and balances between federal agencies. The federal government’s ineffective process for preparing the consolidated financial statements."

However there have been some estimates of the total debt and liabilities of the US government. Former US Comptroller General David M Walker argues total US government debt is $73 trillion. Some consider it to be higher: The Washington Post asked if the US has $128 trillion in unfunded liabilities. That means the US government is nearly as indebted as the world is wealthy, if not more.

This means that all the wealth in the world - every stock, bond, bar of gold, piece of real estate - couldn't even pay off the US debt and liabilities at this point.

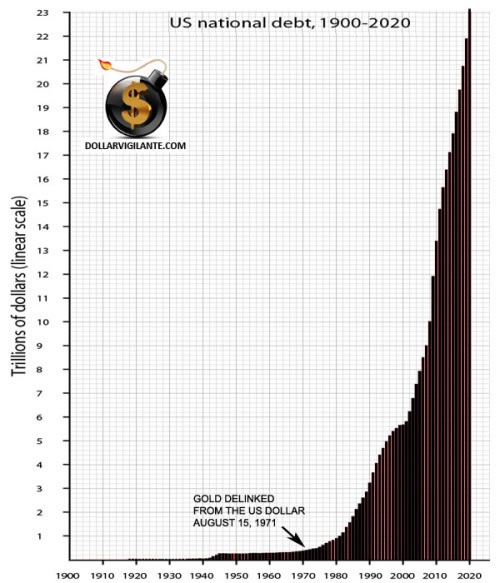

Actual debt owed via Treasury bonds currently stands over $17 trillion and as can be seen in the following chart has gone fully parabolic.

That total doesn't take into account the liabilities of the federal government. These are funds that have been extorted in the past for programs such as Medicare, Medicaid and Socialist Insecurity that are theoretically supposed to be paid back. If accounted for under Generally Accepted Accounting Principles (GAAP), like every other company in the US does, total US government debt and liabilities stands above $90 trillion and is rising at about $5 trillion per year.

.png)

THE ONLY THING KEEPING THIS GAME GOING

This is a truly record-breaking amount of debt for an empire. Compare this to the Soviet Union which, in comparison, barely had any debt at all... mostly because no sane person would lend a communist government money. The total amount of debt of the Soviet Union upon its collapse was $45 billion and was quickly paid off once Russia had become more capitalist and actually created wealth in 2006. $45 billion is equivalent to what the US government goes into debt every 15 days currently!

The only thing keeping this system alive is the never-ending printing of money of the Federal Reserve and the continued acceptance of dollars by foreigners in the form of Treasury bonds.

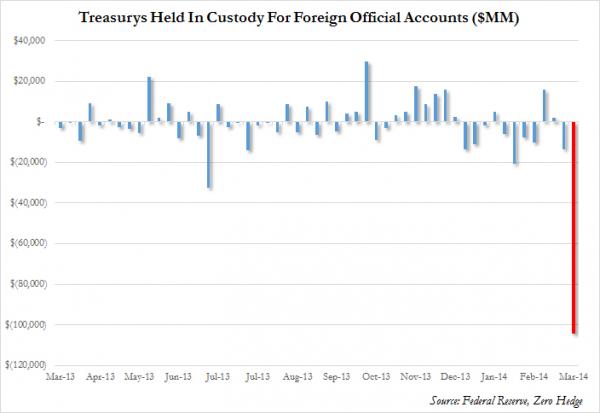

In March of this year, Treasuries held by the Federal Reserve on the behalf of foreigners recorded the biggest drop in history.

In other words, this game is coming to an end. And all the wealth in the world couldn't even pay off the debt and liabilities of the US government at this point.

Yet, the great majority of people are not even aware of the possibility of The End Of The Monetary System As We Know It (TEOTMSAWKI) much less prepared for it. Stay tuned at The Dollar Vigilante for info, news and analysis on how to survive and prosper during and after the collapse of the US dollar.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2014 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.