Stock Market Strategy- Sell in May and Go Away: Fact or Fallacy?

InvestorEducation / US Stock Markets May 03, 2008 - 01:13 PM GMT “Where is the stock market heading?” is one of the questions most often asked by investors, especially as stock markets seem to be disconnected from economic activity.

“Where is the stock market heading?” is one of the questions most often asked by investors, especially as stock markets seem to be disconnected from economic activity.

It is therefore no wonder that even so-called “pop analysis”, including some legendary axioms, is resorted to in a quest for direction. And besides “buy low and sell high” few other axioms are more widely propagated than “sell in May and go away”. A Google search revealed an astounding 126 000 items featuring this phrase.

As stock prices are rising strongly, investors are justifiably questioning the longevity of the rally. And they nervously wonder whether this May will not only herald longer days in the Northern Hemisphere, but also live up to its reputation as the advent of a corrective phase in the markets.

The important issue, however, is whether this axiom actually has any scientific basis at all. While the figures obviously vary from market to market, long-term statistics seem to show that the best time to be invested in equities is the six months from early November through to the end of April of the next year (“good” periods), while the “bad” periods normally occur over the six months from May to October.

A study of the MSCI World Index, a commonly used benchmark for global equity markets, reveals that since 1969 “good” periods returned 8.4% per annum while investors were actually in the red during the “bad” periods by -0.4% per annum. Interestingly, this phenomenon – of “good” period returns outperforming those of “bad” periods – applied to all 18 markets where MSCI computed index returns.

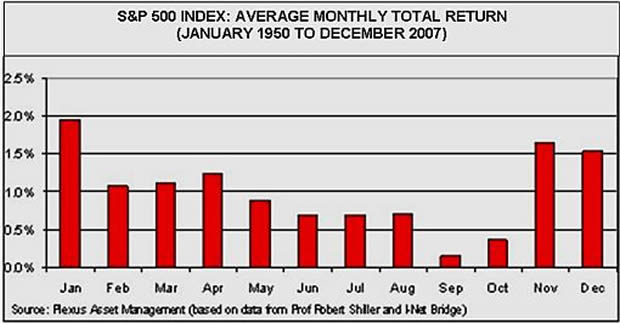

“Sell in May and go away” also holds true for the US stock markets. An updated study by Plexus Asset Management of the S&P 500 Index shows that the returns of the “good” six-month periods from January 1950 to December 2007 were 8.5% per annum whereas those of the “bad” periods were 3.2% per annum.

A study of the pattern in monthly returns reveals that the “bad” periods of the S&P 500 Index are quite distinct with every single one of the six months from May to October having lower average monthly returns than the six months of the good periods.

But what exactly does this mean for the investor who contemplates timing the market by selling in May and reinvesting in November?

Further analysis shows that had one kept the investment in the S&P 500 Index only during the “good” six-month periods, and reinvested the proceeds in the money market during the “bad” six-month periods, the total return would have been 11.2% per annum. But, the best strategy would in fact have been to discard the “sell in May” axiom and rather ride out the “good” and “bad” periods as the annual return on this investment was 11.9% per annum.

The difference of 0.7% per annum may seem insignificant, but over such a long period of time this would have made a very sizeable difference in monetary value.

These calculations also do not take tax into account, and as the returns on the money market have been calculated gross of tax, the result would have been even more in favour of remaining fully invested in equities. And, of course, every time one switches out of and back into the stock market there are costs involved, which would also reduce the returns for the market timer.

The axiom “sell in May and go away” in itself seems to be a rather doubtful basis for timing equity investments in the US. However, it may serve a useful purpose as input, together with other factors, to otherwise rational decision making.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.