U.S. Employment - The Bed-Pan Economy

Economics / Employment May 12, 2014 - 12:24 PM GMTBy: Fred_Sheehan

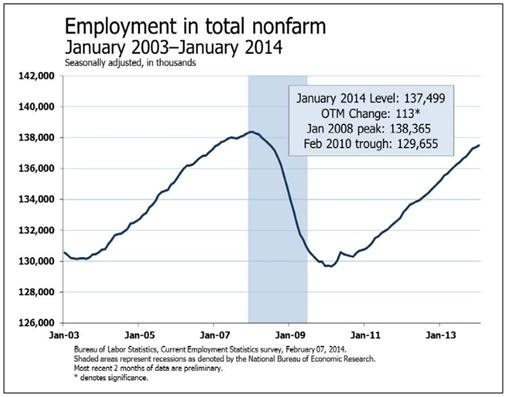

Data portrayed in the "Employment in Total Non-Farm" payroll (NFP) chart is used by central bankers and Wall Street strategists to assert economic strength. They either think the trend demonstrates morning in America, or, they know otherwise, but cannot fashion anything better.

Data portrayed in the "Employment in Total Non-Farm" payroll (NFP) chart is used by central bankers and Wall Street strategists to assert economic strength. They either think the trend demonstrates morning in America, or, they know otherwise, but cannot fashion anything better.

The Federal Reserve chairman, probably any Fedhead for that matter, whip off cheerleading spiels supported by numbers that make no reference to historical comparison. For that matter, they use numbers that make no reference other numbers, and numbers without reference have no meaning. Fed chair Yellen recklessly disregarded context in her March 31, 2014 speech in Chicago: "Since the unemployment rate peaked at 10 percent in October 2009, the economy has added more than 7-1/2 million jobs and the unemployment rate has fallen more than 3 percentage points to 6.7 percent. That progress has been gradual but remarkably steady - February [2014] was the 41st consecutive month of payroll growth, one of the longest stretches ever."

Yellen's data, in reference, offers no promise of recovery. There have been no jobs "added" since the unemployment bottom in 2009. Yellen is spoken of as a "great labor economist." She either knows her statement is misleading, or, she is demonstrating how little economists know. It was not too long ago Simple Ben was ordained "the Greatest Economist of the Greatest Depression," after which, he ushered us into The Great Recession and created The Protracted Depression.

In "April 2014 - Castles in the Air," I wrote the "span from December 2007 to March 2014 is 75 months. Seventy-five months after jobs peaked in 1990 (as we entered the 1900-1991 recession), there were 10 million net new jobs. Seventy-five months after the post-2000 job peak, there were five million net new jobs. In March 2014, we are still half-a-million jobs south of the zero bound."

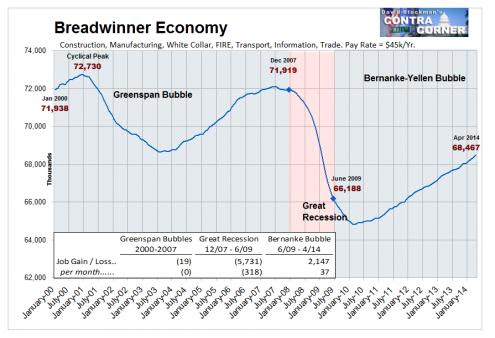

More important is whether jobs can support a family. The nearby "Breadwinner Economy" chart is designed for this purpose. The chart is from David Stockman's ContraCorner website as is the discussion of what constitutes a breadwinner job in "The Born Again Jobs Scam: The Ugly Truth Behind 'Jobs Friday,'" and "The Fed's Labor Market Delusion."

Only one aspect of the delusion will be discussed here. This is the quality of breadwinner jobs created since NASDAQ 5000. As such, this does not directly address the problems of those who have lost an $80,000 job for $40,000 employment, the long-term unemployed, the part-time employed, and the misleading data that accompanies headline news. For instance, people who work one hour a week are counted as "part-time workers" in U.S. government data.

From "April 2014 - Castles in the Air":"The Greenspan NASDAQ Bubble peaked in 2000 and breadwinner jobs reached 72.7 million. After Greenspan and Bernanke artificially revved up the mortgage-finance economy through 2007, jobs topped out at 71.9 million in December 2007. By June 2009, the deflated mortgage bubble had cost five million jobs: there were 66.2 million NFP workers in June 2009. By March 2014, there were 68.3 million breadwinner jobs, 3.6 million fewer than in December 2007, a level achieved during the second Clinton Administration. The quality within the breadwinner industries has deteriorated significantly and the population has grown."

A major change in the composition of breadwinner jobs since 2000 has been the shift from production to service. More specifically, jobs from the goods-producing economy (manufacturing, construction, mining, and energy) have declined from 24,627,000 in January 2000 to 18,941,000 in March 2014. The largest relative growth of jobs has been within the Health, Education, and Social Services (HES) area. From 24,382,000 jobs in January 2000, HES jobs have sprouted to 31,505,000 in March 2014.

Goods-producing jobs pay much better than those within health, education, and human services. HES jobs are highly dependent on fiscal solvency, with the exception of hospital employment which is vulnerable when the government loses its exorbitant privilege of funding its promises for free. Less hospitals, 75% of the revenue supporting these jobs comes from local, state, and federal funding. The average pay within the HES assembly is $35,000. Yellen is not going to achieve "escape velocity" without HES employees shuffling their accounts faster than Charles Ponzi.

Even given the deep contraction in 2009, the re-emergence of HES positions is much slower than the years leading up to the Greenspan Famine. From January 2000 to December 2007, 4.8 million, or 51,000 HES jobs, were added each month. Since the bottom of the Great Recession (stage 1 in Bernanke's Protracted Depression), 1.5 million, or, 26,000 jobs have been added each month. "Restored," not "added," which is Yellen's claim. (Breadwinner jobs also include "Core Government" employment, which excludes Post Office and Education. There were around 11 million in 2007 and in 2014. Uncle Sam's workers receive around $60,000 on average.)

The April employment numbers released on May 2, 2014, were greeted warmly. Front-page headlines from the Wall Street Journal ("Job Growth Gathers Steam") and Financial Times ("U.S. Jobs Growth Exceeds Expectations") were as untutored as Chairman Yellen's claims.

By Frederick Sheehan

See his blog at www.aucontrarian.com

Frederick Sheehan is the author of Panderer to Power: The Untold Story of How Alan Greenspan Enriched Wall Street and Left a Legacy of Recession (McGraw-Hill, November 2009).

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Frederick Sheehan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.