Technology and the Future of Jobs

Politics / Employment Apr 30, 2014 - 06:45 PM GMTBy: BATR

Quite a stir occurred with the academic presentation, How Technology Is Destroying Jobs, by Brynjolfsson, a professor at the MIT Sloan School of Management, and his collaborator and coauthor Andrew McAfee. Both "have been arguing for the last year and a half that impressive advances in computer technology—from improved industrial robotics to automated translation services—are largely behind the sluggish employment growth of the last 10 to 15 years. Even more ominous for workers, the MIT academics foresee dismal prospects for many types of jobs as these powerful new technologies are increasingly adopted not only in manufacturing, clerical, and retail work but in professions such as law, financial services, education, and medicine."

Quite a stir occurred with the academic presentation, How Technology Is Destroying Jobs, by Brynjolfsson, a professor at the MIT Sloan School of Management, and his collaborator and coauthor Andrew McAfee. Both "have been arguing for the last year and a half that impressive advances in computer technology—from improved industrial robotics to automated translation services—are largely behind the sluggish employment growth of the last 10 to 15 years. Even more ominous for workers, the MIT academics foresee dismal prospects for many types of jobs as these powerful new technologies are increasingly adopted not only in manufacturing, clerical, and retail work but in professions such as law, financial services, education, and medicine."

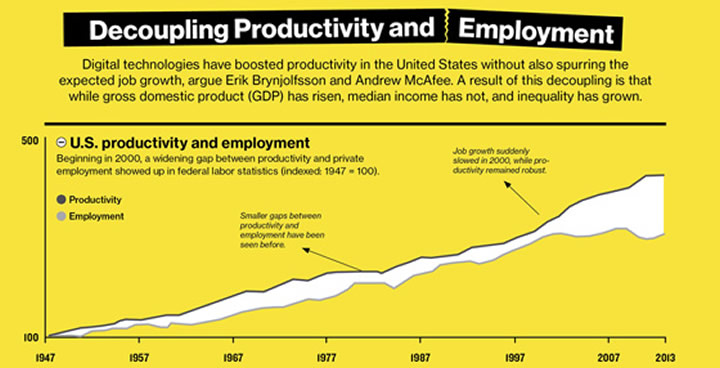

Building upon this study, MSM provides a three part series on, Loss of middle-class jobs compounded by tech advances. The following admission by the technological behemoth should give pause for future generations."Perhaps the most damning piece of evidence, according to Brynjolfsson, is a chart that only an economist could love. In economics, productivity—the amount of economic value created for a given unit of input, such as an hour of labor—is a crucial indicator of growth and wealth creation. It is a measure of progress. On the chart Brynjolfsson likes to show, separate lines represent productivity and total employment in the United States. For years after World War II, the two lines closely tracked each other, with increases in jobs corresponding to increases in productivity. The pattern is clear: as businesses generated more value from their workers, the country as a whole became richer, which fueled more economic activity and created even more jobs. Then, beginning in 2000, the lines diverge; productivity continues to rise robustly, but employment suddenly wilts. By 2011, a significant gap appears between the two lines, showing economic growth with no parallel increase in job creation. Brynjolfsson and McAfee call it the "great decoupling." And Brynjolfsson says he is confident that technology is behind both the healthy growth in productivity and the weak growth in jobs."

This reality is all around us, but the full impact yet appreciated, is that the cloud of computing is not increasing business employment for the main street economy. For more bad news look at the results from the Associated Press analysis of employment data from 20 countries in, Can smart machines take your job? Middle class jobs increasingly being replaced by technology, which found that "almost all the jobs disappearing are in industries that pay middle-class wages, ranging from $38,000 to $68,000. Jobs that form the backbone of the middle class in developed countries in Europe, North America and Asia.""Most of the jobs will never return, and millions more are likely to vanish as well, say experts who study the labor market. What's more, these jobs aren't just being lost to China and other developing countries, and they aren't just factory work. Increasingly, jobs are disappearing in the service sector, home to two-thirds of all workers.

The global economy is being reshaped by machines that generate and analyze vast amounts of data; by devices such as smartphones and tablet computers that let people work just about anywhere, even when they're on the move; by smarter, nimbler robots; and by services that let businesses rent computing power when they need it, instead of installing expensive equipment and hiring IT staffs to run it."

"In the United States, half of the 7.5 million jobs lost during the Great Recession paid middle-class wages, and the numbers are even more grim in the 17 European countries that use the euro as their currency. A total of 7.6 million midpay jobs disappeared in those countries from January 2008 through last June."

The article then goes on to cite that more information now crosses the Internet every second than the entire Internet stored 20 years ago. Other examples note that:

- The British-Australian mining giant Rio Tinto announced plans last year to invest $518 million in the world's first long-haul, heavy-duty driverless train system at its Pilbara iron ore mines in Western Australia.

- Dirk Vander Kooij's furniture-making company in the Netherlands needs only a skeleton crew — four people. The hard work at the Eindhoven-based company is carried out by an old industrial robot that Vander Kooij fashioned into a 3D printer.

Soon to come are pilotless airliners joining the several Japanese rail lines already run by themselves. Add the smart utility meter deployment and soon the employee reader, banished to a wax museum, becomes just another sign of "so called" progress.

Missing in all this corporate excitement for slashing payroll is the indisputable fact that the general standard of living is dropping like a rock for the average family. Couple this deadly trend with the unnerving prospects forecasted by Bob Lord in, Our First Trillionaire: Only a Matter of Time."The unavoidable result: Wealth at the top is growing at a faster rate than aggregate wealth. That’s where the arithmetic comes in to play. If the wealth of one group within a nation grows at a faster rate than the nation’s aggregate wealth, that group’s share of the aggregate wealth must increase over time. That’s a mathematical certainty. And the level of subsequent wealth concentration has no limit."

Technological development coupled with favorable political treatment is regularly the formula for massive accumulation of fortune. However, the horrendous social distortions that inexorably follows such distortions in income, much less the fact that the disappearance in living wage employment of the masses cannot be ignored without fundamental political upheaval.

Once innovated technology of a Henry Ford raised the living standards and was a benefit for society. Today’s objective is to remove or eliminate the middle class as the gap in meaningful employment widens. Added leisure time has no significance if spent on playing games on an IPAD, while living off welfare government programs.

Brynjolfsson and McAfee’s breakdown is a chilling look at a bleak future and the goodbye kiss to a populist beneficial economy.

James Hall – April 30, 2014

Source: http://www.batr.org/negotium/043014.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2014 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.