The U.S. Budget Box & Containing Debt and Deficit Craziness

Politics / US Debt Apr 02, 2014 - 09:23 AM GMTBy: DeviantInvestor

Imagine that the US government is, euphemistically speaking, locked in a box created by deficits, debts, and decisions. There are six sides to the box - each an exit. We can describe them as:

Imagine that the US government is, euphemistically speaking, locked in a box created by deficits, debts, and decisions. There are six sides to the box - each an exit. We can describe them as:

- Borrow more money and increase the national debt.

- The Federal Reserve monetizes the bonds - "prints" the money to pay for government.

- Tax ourselves into prosperity. (Just kidding, although some people actually believe this nonsense.)

- Cut spending. (No, no, a thousand times no!)

- Tell the truth - we can't afford our government and the political promises that have been made.

- Default!

Let's examine the six sides of this box in more detail.

-

Borrow more money to pay the bills. Sure, why not? Run that credit card up to the limit and then increase the limit. It has worked in the past and should work forever! But it seems that the Chinese, Japanese and Arabs are currently less interested in buying our bonds. There is a problem here. Maybe we should just print a few $Trillion - which leads to side two of the box.

-

Monetize the bonds. The Fed "prints" a few $Trillion, buys bonds from the Treasury, and government spends. When there are more dollars in circulation, each dollar is worth less and buys a smaller amount of food, gasoline, and other essentials. Gasoline now costs $3.50 to $4.00 when it used to sell for $0.15 - because many more dollars are now in circulation and that means higher prices.

Also, other countries and people might understand that "printing money" is another step down an already dangerous road. People and countries might realize that the dollar is weak, congress and the administration are undermining the dollar, not supporting it, and everyone will lose confidence in an already unpopular congress, administration, and Federal Reserve. Oops! History suggests this won't work for long, so it is time for side three of the box.

-

Tax ourselves into prosperity. This has never worked, and people are wise to this nonsense. Congress might sell the idea of borrowing and printing, but people do not want taxes increasing - taxes such as Obamacare, carbon taxes, more fees, more licenses, national sales taxes - whatever. Worse, the inevitable inflation acts like a nasty tax on the middle and lower classes. Our wages are stagnant or only rising slowly, our expenses are rapidly increasing, and our standard of living inevitably falls. Congress is wary of increasing taxes - the voters don't like it and might vote the politicians out of their cushy offices. This side of the box is very dangerous to contributions and reelection success. Bad as this side is, the fourth side of the box is even worse.

-

Cut spending. IMPOSSIBLE! More government employees, more spending, all programs funded forever, and we must maintain welfare for the poor, for the rich, for the large corporations, for congress, and for the administration. Everyone knows it is politically impossible to cut spending. Well, maybe we could agree to reduce planned increases by 0.04% over ten years, all in the last five years, of course, and only after a thorough review by politicians. Nobody can reasonably expect congress to cut spending. But the fifth side of the box is even more unacceptable.

-

Tell the truth! We can't afford our government and the promises our politicians have made. Wait! Radical answers are never popular and the truth is seldom necessary! We must refer this to a committee of career politicians for additional study. There is absolutely no need to address such truths as:

- Congress will never voluntarily cut spending or balance the budget.

- But borrowing cannot continue forever. The limit could be close.

- And debt cannot increase forever.

- There are ugly consequences to all of the above.

- Sacred programs, such as military spending, social security, foreign aid, medical care, prescription drugs, many departments, and so much more must be reduced, or even more dire consequences will occur.

- Enough! No more truth!

- Go to the final side of the box - the last possibility.

-

Default! Just admit it, they lied. The government refuses to pay its debts. Everyone who invested in government paper, and the plans and investments that depend upon those investments, such as money market funds, insurance companies, and pension plans will not be repaid. This is the big one - the ultimate in counter-party risk. That giant sucking sound is the sound of government default sucking the life out of the financial system and destroying most of our assets, our way of life, and our financial futures. Unthinkable!

We have examined all six exits from the budget box. Default and telling the truth are unacceptable. Increasing taxes and cutting spending are painful, especially to reelection dreams. Expect more borrowing and monetizing debt. Expect more spending as the national debt climbs to new heights of craziness. Expect higher prices for everything you need, and more talk-talk as the remaining choices become more painful.

How far will the prices for gold and silver rise after three to five more years of excessive spending, more debt, more "printing" and more scurrying around inside the budget box with no clue, no plan, no hope and no real change?

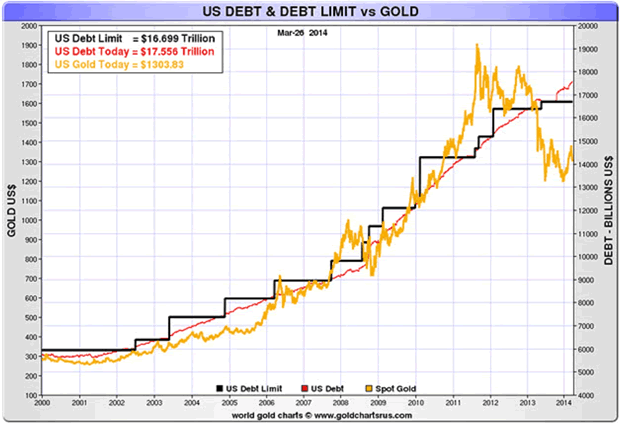

Gold, the national debt, and the "debt limit" have tracked each other fairly well since the year 2000. As you can see gold was "too high" in 2011, compared to the red line of national debt, and is now "too low." However, we can depend upon congress to borrow and spend, and gold prices will rise to reflect that reality.

In case you are interested, the data back to 1950 is similar - gold, the national debt, and the "debt limit" have followed each other, more or less, for over six decades.

Is there any reason to expect this pattern to change?

Buy gold for monetary insurance, invest in silver, maintain confidence in the fact that our political and monetary processes will force both gold and silver to rise substantially in price, and sleep well.

Additional reading:

- Richard Russell "Silver is the Greatest Buy in the World Today"

- The DI "Gold Investors: Take the Red Pill"

Good night and good investing,

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.