Argentina in Bad Economic Shape Again - Debt Rattle 2014

Economics / Global Debt Crisis 2014 Jan 24, 2014 - 05:06 PM GMTBy: Raul_I_Meijer

Argentina is once again in very bad shape. It rose out of the ashes of its 2002 crisis, when it went through presidents like they were popsicles, and large swaths of the middle class ended up living in Villa Miseria shanty towns around Buenos Aires, but it did so through issuing debt. So there we go again.

Argentina is once again in very bad shape. It rose out of the ashes of its 2002 crisis, when it went through presidents like they were popsicles, and large swaths of the middle class ended up living in Villa Miseria shanty towns around Buenos Aires, but it did so through issuing debt. So there we go again.

The no. 1 problem, again, is the lack of foreign reserves. How the country can escape its fate this time is hard to see. People have kept storing their wealth abroad, afraid as they were for the very thing that now happens; a little self fulfilling, one might say. The cost of borrowing shot up, prices for its export products, meat, soy, wheat, plunged, et voila, the squid’s your uncle!

More Argentinian families will be forced – back – into the Villa Miserias, and you got to feel for the kids and grandparents losing everything. Makes you wonder if the Shock Doctrine has ever stopped.

• Specter of Default Stalks Argentina (Bloomberg)

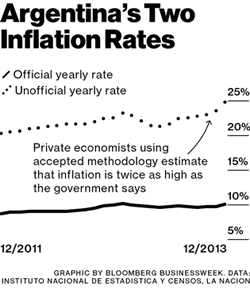

President Cristina Fernández de Kirchner is running out of time to avert another crisis. The policy that Fernández and her late husband and predecessor, Néstor Kirchner, used to propel 7.2 percent average annual growth over the past decade – higher government spending financed by printing money – is unraveling. The peso has fallen 26% in the past 12 months, its worst rout since the devaluation that followed the 2001 bond default.

The biggest financial problem is the loss of foreign reserves. They’ve dropped 44% in the past three years, to $29.5 billion, as prices for soy and wheat exports slumped and Argentines changed pesos to dollars and stashed them abroad. The government says it will shore up reserves in 2014.

The country’s average bond yield of 12% is the highest among major developing nations after Venezuela. Trading in swap contracts that insure bonds against nonpayment shows a 79% probability of default over five years. “We’re seeing some sort of day of reckoning,” says Diego Ferro, co-chief investment officer in New York at Greylock Capital, which has invested in the country’s debt. “The adjustment will have to happen if Argentina doesn’t want to hit a wall before 2015.”

One of the effects of Argentina’s crisis is probably as surprising as it is obvious: orders from Amazon etc. have a hard time coming through, since no foreign currency is supposed to leave the country.

• Argentina restricts online shopping as foreign reserves drop (BBC)

Argentina has introduced new restrictions on online shopping as part of efforts to stop foreign currency reserves from falling any further. Anyone buying items through international websites will now need to sign a declaration and produce it at a customs office, where the packages have to be collected. The procedure will need to be repeated for every new purchase.

Argentina’s reserves of hard currencies dropped by 30% last year. The government of President Cristina Fernandez de Kirchner has introduced a number of restrictions on transactions with foreign currency. Items imported through websites such as Amazon and eBay are no longer delivered to people’s home addresses. The parcels need to be collected from the customs office.

Priceless quote: “Investor confidence has taken a blow amid persistent claims of fraud and inefficient auditing standards at some of the Chinese units.” Meanwhile, at US units …

• SEC suspends Chinese units of ‘Big Four’ accountants over audit secrecy (RT)

A US Security and Exchange Commission (SEC) judge has suspended the Chinese units of the so-called ‘Big Four’ accounting firms including Deloitte and KPMG for refusing to release audit information on China-based firms listed in the US. SEC Administrative Law Judge Cameron Elliot suspended the Chinese subsidiaries of Deloitte & Touche, Ernst and Young, KPMG, and PricewaterhouseCoopers, saying they united had “willfully violated” US laws.

The China-based affiliates – BDO China Dahua, Deloitte Touche Tohmatsu Certified Public Accountants, Ernst & Young Hua Ming, KPMG Huazhen, and PricewaterhouseCoopers Zhong Tian refused to present data about companies based in China and listed in the US, saying they tried to comply with Chinese secrecy laws.

The US Securities and Exchange Commission (SEC) said it was satisfied with the decision. “These records are critical to our ability to investigate potential securities law violations and protect investors,” said Matthew Solomon, the chief litigation counsel in the SEC’s Enforcement Division, as quoted by the BBC.

But the four firms in China called the decision “regrettable” and said they will appeal. “In the meantime the firms can and will continue to serve all their clients without interruption,” Deloitte Touche, PricewaterhouseCoopers, KPMG and Ernst & Young announced in a joint statement. The ruling does not go into effect immediately.

Analysts, meanwhile, are concerned over the consequences if the initial ruling stands, which could complicate audits of many Chinese firms listed in the US, as well as American companies doing business in China. “This decision will be a huge shock in Beijing,” Paul Gillis, an accounting professor at Peking University in Beijing, told the BBC. “The Securities and Exchange Commission has pushed a lot of chips out on the table.”

I’ve written extensively on China lately, of course; this Oftwominds piece has more on the severity of corruption in both China and India. Much of which takes place at government levels. Just you wait till the growth hossanah collapses on a bed of unpayable leverage. And CHS is obviously right: it won’t be (just) the peasants revolting, it will be the more affluent hundreds of millions who got a taste of money and freedom, and won’t want to let it vanish into the distance again. I think you simply can’t rule over a profit oriented society with a centralized total control state system. It doesn’t have the necessary dynamics.

A lot of people think the Communist Party will “do whatever it takes” to clamp down on unrest, but I think they no longer have what it takes, because what it takes has changed so much. The party structure was never going to be able to change as fast as society itself, it’s still mired in its ways of old. It’s either “back to the stone age” or relinquish control to those who think in profit terms.

You can’t just take 1 billion people back in time for what in US terms would be 100 years or so (looking at the speed of change in China), not going to happen. And don’t forget, over the past 10-20 years China’s seen the by far largest human migration in history. There’s no place for them anymore where they came from. Most of them have moved forever. You either keep the customers satisfied or they’ll get a new store owner.

• Two Powder Kegs Ready to Blow: China & India (Charles Hugh Smith)

The conventional view of China and India sports not one but two pair of rose-colored glasses: Chindia (even the portmanteau word is chirpy) is the world’s engine of growth, and this rapid economic growth is chipping away at structural political and social problems.

Nice, especially from a distance. But on the ground, China and India (not Chindia–there is no such entity) are both powder kegs awaiting a spark for the same reason: systemic corruption in every nook and cranny of both nations. The conventional rose-colored view is that corruption will inevitably decline with modernization and economic growth. This is simply wrong on multiple levels: as the opportunities for crony/neofeudal skimming increase, so does corruption. As the scale of the economy increases, so does the scale of corruption.

When Mark Carney became BOE Governor, one of the first thing he did was borrow the “forward guidance” tool from the Fed and Ben Bernanke. Well, it was short lived. At his very first opportunity to show the world the value of the principle, Carney retreats without even a hint of grace about it. Perhaps he thinks he can get away with it, but the guidance chicken may yet come to his home and roost in it. I ask myself what influence Carney’s show of hollow will have on Janet Yellen and her credibility. If Carney wears no clothes, why would anyone believe she does? (Thinking of pictures of Yellen, I realize this may be a somewhat unfortunate metaphor, apologies)

• Bank of England governor: interest rate rise not on the agenda (Guardian)

An early increase in borrowing costs was ruled out by the governor of the Bank of England as he insisted that this week’s faster than expected fall in unemployment will not lead to an automatic interest rate rise that might choke off the recovery. All but burying his “forward guidance” policy of linking an interest rate rise to a fall in the rate of unemployment to 7%, Mark Carney vowed to keep borrowing costs at their record low of 0.5% for the time being. He was speaking a day after it emerged that the unemployment rate fell to 7.1%.

Interviewed on BBC’s Newsnight, Carney rejected the idea that plunging unemployment was a headache for the Bank. “If our forecast is going to be wrong it’s better to be wrong in that direction,” he said. Carney also said that when the Bank decided to raise interest rates for the first time since the onset of the financial crisis in 2007, the moves would be gradual. Economists have warned that a rise to around 3% in the interest rate would lead to huge increases in mortgage costs and a wave of repossessions, as well as damage business.

The JPMorgan board had a hard choice this week: blame Jamie Dimon for the 20+ blatant frauds committed by the bank on his watch – and that’s just the ones they were fined (what is it, $30 billion now?) for -, or give him a pay raise for so craftfully keeping down the damage from these frauds in settlement negotiations with various US government offices. Guess which option they picked.

Do kids still learn in school these days that crime doesn’t pay?

• Fined Billions, JPMorgan Chase Will Give CEO Dimon a Raise (NY Times

A year after an embarrassing trading blowup led to millions of dollars being docked from Jamie Dimon’s paycheck, the chairman and chief executive of JPMorgan Chase is getting a raise.

JPMorgan’s board voted this week to increase Mr. Dimon’s annual compensation for 2013, hashing out the pay package after a series of meetings that turned heated at times, according to several executives briefed on the matter. The raise — the details were not made public on Thursday — follows a move by the board last year to slash Mr. Dimon’s compensation by half, to $11.5 million. [..]

Mr. Dimon’s defenders point to his active role in negotiating a string of government settlements that helped JPMorgan move beyond some of its biggest legal problems. He has also solidified his support among board members, according to the people briefed on the matter, by acting as a chief negotiator as JPMorgan worked out a string of banner government settlements this year.

Also under his leadership, the bank has generated strong profits and its stock price is up more than 22% over the last 12 months. Some board members fault what they consider to be overzealous federal prosecutors for the hefty fines, rather than Mr. Dimon or the bank, arguing that JPMorgan is being penalized for the sins of firms like Bear Stearns that it scooped up during the financial crisis. But many of those very problems arose under Mr. Dimon’s watch, including $1 billion in fines from regulators over the trading blowup.

The Swiss bank secrets. Anytime I’ve read something over the past few years about pressure being applied on the government in Bern by the Americans, the Germans, et al, I have always thought: the boys must have found other, better places to stash the loot. You got enough dough, you can afford a place to hide it in.

• Secret’s out on the Swiss bank account (USA Today)

The secret Swiss bank account is no longer what is used to be. For years the accounts were the basis of plots both real and imagined in which people hid cash to avoid the taxman or the police if the gains were from crime. But prior to a midnight New Year’s Eve deadline, many of the Swiss banks agreed to divulge to the U.S. government which Americans have accounts here to avoid prosecution on charges of helping them evade taxes.

As many as 40 of Switzerland’s approximately 300 banks are reported to have said publicly that they would voluntarily hand over closely guarded client information to the Department of Justice in return for prosecutorial immunity. After decades of facilitating, even if not explicitly engineering, the shielding of undeclared assets from foreign tax authorities, a Swiss banking industry built on a legacy of absolute secrecy on behalf of customers may start singing like a canary.

The sadness of the Spanish situation illustrates once more how little any word out of the IMF is worth. There is no recovery with 26% unemployment. Period. The saddest piece of data of the lot, no competition, is that youth unemployment went down because so many young Spaniards decide to flee their country. No doubt, the IMF sees that simply as the market at work.

• Spain’s unemployment rise tempers green shoots of recovery (Guardian)

The International Monetary Fund may have sighted some green shoots of recovery in Spain – but the country’s unemployment rate has risen above 26%, according to official figures. Data published on Thursday by Spain’s statistics office show a further 198,900 jobs were lost in 2013. The total number of unemployed is now 5.9 million.

Although unemployment fell by 65,000 over the course of last year, the percentage has risen because the working age population has fallen by 267,900, through retirement or migration. About 260,000 people left Spain in 2013, around 40,000 of them Spanish nationals, the rest departing foreign migrants.

Migrants have been hard hit by the economic crisis in Spain, with an unemployment rate of 36.6% compared with 24.3% for Spanish nationals. Youth unemployment is down slightly at 55.06%, a fall explained by young people either returning to education or leaving the country.

A nice compilation from New Zealand of the debate over Crash on Demand: David Holmgren and Nicole Foss, plus Dmitry Orlov et al, with a few nice angles thrown in. Good weekend reading.

Kunstler quote: ” … accounting fraud pervades public and private enterprise, everything is mis-priced, all official statistics are lies of one kind or another, the regulating authorities sit on their hands, lost in raptures of online pornography (or dreams of future employment at Goldman Sachs), the news media sprinkles wishful-thinking propaganda about a mythical “recovery” and the “shale gas miracle” on a credulous public desperate to believe, the routine swindles of medicine get more cruel and blatant each month, a tiny cohort of financial vampire squids suck in all the nominal wealth of society, and everybody else is left whirling down the drain of posterity in a vortex of diminishing returns and scuttled expectations.”

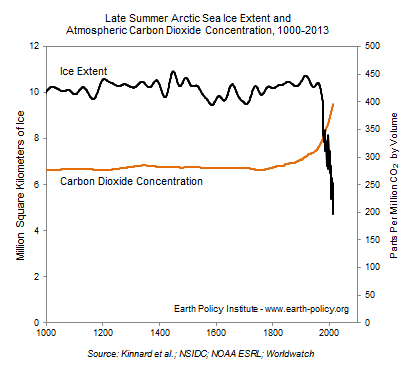

No matter what anybody says – and/or exaggerates – on whatever side of the debate they’re on, the principle remains deceptively simple. More CO2 means more trapped heat. And more modern human activity means more CO2. Cool graph, spread it around!

• Arctic Sea Ice Freefall is Mirror Image of Carbon Dioxide Ascent (Earth Policy)

The amount of Arctic sea ice has plummeted in recent decades—a bold manifestation of the rise in temperature resulting from the rapid increase in carbon dioxide (CO2) in the atmosphere. After staying below 300 parts per million (ppm) for some 800,000 years, the concentration of CO2 in the atmosphere skyrocketed as humans started burning more and more fossil fuels. In 2013, atmospheric CO2 averaged 396 ppm.

Carbon dioxide traps heat, reducing the amount escaping into space, thereby warming the globe. Together with other heat-trapping gases, the additional CO2 has so far raised the Earth’s temperature by 1.4 degrees Fahrenheit (0.8 degrees Celsius) since the late 19th century. The extra heat is melting snow and ice around the world, including Arctic sea ice, changing the face of the planet as we know it. For some 1,500 years the late summertime size of the North Pole’s ice cap fluctuated narrowly around 10 million square kilometers; in recent summers, ice covered half that area. The ice pack is expected to keep shrinking as temperatures continue to rise.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.