Will Fed Actions and American Culture Prevent a Soft Depression?

Economics / US Economy Apr 19, 2008 - 01:17 AM GMTBy: John_Mauldin

The Muddle Through Question

The Muddle Through Question - Clowns to the Left of Me, Jokers to the Right of Me, Here I am Stuck in the Muddle Through Middle With You!

- A Soft Depression? Not.

- South Africa and Swiss Mountains

A few weeks ago I asked for readers to send me questions and said I would try and answer them while I was in Switzerland. Some of them were quite good and have given me ideas for whole newsletters but will require a lot of research. But a lot of them fell into two basic camps. This week we look at a number of questions from readers about my thoughts on the Muddle Through Economy.

One group basically asked, "John, given all the bad news [insert your favorite bearish statistic on housing, the credit crisis, inflation, doom and gloom, etc.] how can you be so optimistic and think we will only see a modest recession and a Muddle Through Recovery? Don't you think we will actually have a serious recession and/or a soft depression?"

The second group asks the obverse of the coin: "John, how can you see a long, slow recovery? Look at all the good things like [insert your favorite bullish statistic: low interest rates, a rising stock market, the worst of the credit crisis behind us, the stimulus checks just now getting to consumers, etc.]. Don't you think that means we will get back to a full growth economy by the end of the year?"

I have given both questions some thought as to which I should answer first. I think it makes more sense to start with the bullish question first and then go into why things are not as bad as many analysts suggest.

Clowns to the Left of Me, Jokers to the Right of Me,Here I am Stuck in the Muddle Through Middle With You!

I take some comfort in being in the middle. It is when you get on the edge that you are most often wrong, but that also means you have the most people who disagree with your position. And there are a lot of people who disagree with me. But then, a lot of people disagreed when I said the subprime crisis would be serious enough to cause a recession. As to whether I am right about Muddle Through this time, we will see. But It is where my thinking comes out.

So, let's make the case for a recession which will last at least for two if not three quarters and then a slow recovery of at least a year and half where GDP is in the range of 2% on average.

First, this recession is fundamentally a consumer recession, brought on by a bursting of the housing bubble and a credit crisis. Consumer spending is under pressure from several main areas.

First, as the housing market stalled and then began to drop, we saw a fall in housing related spending, in construction, furniture, mortgages, etc. Remember when most economists and analysts wrote last summer that there would not be a recession from the housing crisis because housing was only 5% of the economy? The rest of the economy was doing just fine, they opined. Don't worry. Be happy.

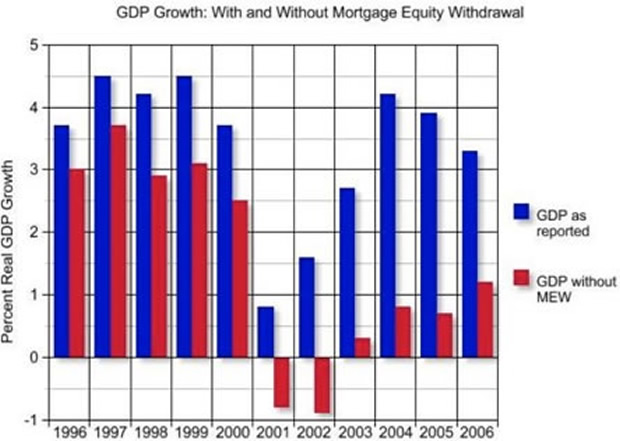

The problem is that the resulting fall in housing prices produces a negative wealth effect. I have used the following chart many times, but it is good to review it again quickly.

Notice that without mortgage equity withdrawals the US economy would have been in outright recession for two full years in 2001-2, and would have been quite sluggish for the next two years. That is what you should expect from the bursting of a major equity market bubble and 9/11. But because the value of the US housing stock was rising and doing so rapidly, people felt comfortable borrowing against the ever-rising value of their homes. We borrowed and spent our way out of that recession. Coupled with the Bush tax cuts (a very important element!) and low Fed rates, we bounced backed rather handily.

But now, home values are falling and will likely do so for another year at the least. As Woody Brock pointed out in this week's Outside the Box, we are at the beginning of a reversion to the mean on national wealth. We are getting a reverse wealth effect. People either can't or won't borrow as much and thus we get negative stimulus from housing prices. It is likely that people are going to start saving more, which while a good thing from an individual stand point, it is a drag on overall consumer spending.

Second, even though core inflation is tame, real inflation that includes the things you and I actually buy is high and rising. I drove past a gas station in La Jolla where the price of gas was over $4 a gallon. Money that is spent on gas and rising energy bills is money that cannot be spent on discretionary items. Rising food bills means that there is less money left over to buy entertainment and other modest luxury items.

Third, rising unemployment clearly means that a small but growing segment of the population has less money to spend. Unemployment is at 5.1% and is likely to rise to over 6%. That is clearly bearish of consumer spending.

All of these factors suggest a recession of at least two quarters if not three. While lower Fed funds rates and the efforts by Congress to stimulate lower mortgage rates will eventually help, it will not be an immediate panacea.

As to a slow and prolonged recovery, the "Muddle Through Recovery," the reasons to me are clear. The cause for the current recession is the bursting of the twin bubbles of the housing markets and the credit crisis. These are problems that are going to take several years to solve, not matter that the Fed does to interest rates and opening the discount window to investment banks for all sorts of mortgage and other asset backed paper. While doing so is a good thing, we still have to work our way through 3.5 million excess homes, 2 million of which are vacant. That will take a few years.

Further, we have to develop new sources for the buying of debt. We vaporized 60% of the market for debt in the implosion of CDOs, SIVs, CLOs, etc. These buyers are never going to come back. It took 15 years to create that market. It will take a few years to create its replacement. (More thoughts on how we do that in a later letter.)

Let me offer one caveat. If the Bush tax cuts are not kept largely intact you will see the recovery that I think will be coming in late 2009 and 2010 evaporate quickly. If an Obama (probably) or a Clinton (small chance) get their way, we will see the largest tax increase in history. That is not the medicine that the economy needs when it is weak already. It could easily push the economy back into recession as it will make the consumer even weaker.

A Soft Depression? Not.So, if things are all that bad, why won't we roll into the soft Depression that Bill Bonner and others predict? It is quite easy to make a very bearish case with a falling dollar, rising inflation, a seemingly never-ending rise in oil and commodity prices, a nasty housing market crash, a frozen credit market and more.

To establish a basis for my relative optimism, I have to re-visit what is for me a painful moment in my forecasting life. This is just between you and me, gentle reader, and I would appreciate you keeping this just between us.

Back in 1998, I thought the US and the world would drift into a recession caused by the failure of some large computer programs not being fixed on time for the Y2K rollover. I did not think it would be the disaster some thought, but I did see the potential for problems.

Why? Because of one statistic that was very clear. 50% of all major software projects for 40 years did not finish on time, and a large percentage of those missed their targets by years. That number had not changed for decades.

The Y2K software problem was very real. There were thousands of huge software projects under way by late 1998 to fix the problem. I went to many software conferences and talked with the software developers and management who were quite distressed. Their concern was real.

How, I asked them (and myself), could we expect all the projects to be done on time when the clear record said that software was difficult and managers very poor at getting things done on time. While I expected most things to be fixed, it seemed reasonable to think that there would be some problem areas. And I generally got agreement from very serious managers and consultants.

I remember talking about this with the late Harry Browne, a true friend and a very wise investment writer (and the nominee of the Libertarian Party for President for two elections). Harry was generally bearish on many things. But he told me there would be no Y2K problem. I confronted him with my evidence and research.

"John, you are missing the main point. A free market figures out how to solve problems. This is a problem that we know about well in advance. It is not slipping up on us. If it must get solved in order for a company to survive, it will get solved. End of story."

I just shook my head and took comfort in my research. And I was wrong, of course. Interestingly, all the investment advice in that book ended up being right as the stock market did drop, long term interest rates fell, and the economy did go into a recession and so on. I ended up being right for the wrong reason. And some of my very first and now long term readers met me through that book, so all was not lost.

But in looking back on it, I realize what I had missed. Whenever I talked to managers at these conferences (and I talked to a lot of them), they all told me privately that they were going to meet their deadlines, but the real concern was other companies or projects. I missed the forest for the trees. Everyone was busy making sure they were going to be fine. I look back now and wonder how did I miss it?

As it turned out, Harry was absolutely right. Because there was a literal drop dead date on each of the projects, management became very focused. It seems now that we know software projects can be finished on time if the motivation is survival of your company.

It is a lesson that has been burned into me.

Now, let me throw out a very important and interesting point. Today I am in Switzerland speaking on behalf of Bank Sarasin to their mainly institutional clients. (I should note my hosts at Sarasin were most thoughtful. It is a very impressive bank with very good people.) The conference was in German except for my speech and one by a Swedish Economics professor named Dr. Kjell Nordstrom. I attended that session and am glad I did. It was a fascinating presentation.

When I travel around the world, I am used to a certain amount of America and/or Bush bashing. It is just part of the background noise.

So, I was somewhat surprised to see the professor, in the middle of a talk on why some businesses succeed and others fail, put up a rather large flag of the United States and went on to say that the US would be the dominant developed country for his life, the life of his children and the life of their children's children. You could feel the surprise in the room. It is not what they were expecting to hear. I certainly did not.

He started out saying that someone could come to the US and within 3-5 years you could become a citizen. Making a long story short, in his native Finland it took 3-4 generations before you would be considered Finnish. He went on around the world. There are very few cultures where an immigrant can become a naturalized citizen and be accepted into the culture. China? No. Japan? No.

In Germany, the professor recently talked to the top 100 managers of Siemens. This is a company that employs 462,000 people doing business in 192 countries. In that room of the top management there were 99 Germans and one Austrian. Think of similar multi-national companies in the US. Such a room would be full of diversity.

A young lady Ph.D in physics in Lajore, Pakistan does not dream at night of immigrating to China or Germany, where opportunities would be very limited. No, she and millions more like her dream of coming to the US. He said that 85% of the people living in Silicon Valley were immigrants. The best and brightest in the world choose to go there.

Because for him, America is not a country, but an idea. It is the idea that any person can come and make a life for themselves as an equal. And it is that freedom to rise or fall that makes the US what it is.

So, what does this have to do with Muddle Through? Let's return to the original question.

First, things are not as bad as they seem. Most of the US economy is doing just fine. Businesses have not overbuilt capacity, have large cash positions and lower debt than is normal at the end of a business cycle. In the 70's and 80's, we were much more dependent upon manufacturing for employment, and thus were subject to large increases in unemployment when too much capacity met slack demand and businesses cut back as quickly as they could. Even if we rise to 6 or 7 percent unemployment, that does not rise to the level of a major recession. (And yes, I know if you lose your job it seems like a depression.)

Second, the Fed has responded, if a little late, to the credit crisis, buying time for banks to find capital. While there will be many more write-offs from bad debts and mortgage paper in the future, most banks will survive in some form. The key is that the Fed did buy us time. The banks and pension funds are still going to have to write off about twice what they already have, but not all at once. It will be several years before we are through this mess, but that is why we Muddle Through and not crash. I still contend that if the Fed had allowed Bear Stearns to crash that we would experience a soft depression. It would have been ugly. But they didn't and we won't.

And while the housing crisis is really bad if you are trying to sell a home, it is also an opportunity if you are a buyer. We will work through the excess homes that are in the market, as US population is growing and the natural demand that stems from that growth will help pick up the slack.

And the credit crisis? It will get solved, because like the Y2K problem, it must be solved if we are to survive. (I am working on a paper in which I will outline how I think this will work itself out.) And the creativity that infuses this country will rise to the occasion. Yes, I know that it was that creativity coupled with greed which caused the problem in the first place. But hopefully we will get it right this time. Again, for reasons I will outline in later letters, I have reason to believe we will.

So, I think my position in the middle is the right one. We do have very real problems and will suffer a recession. The problems will not be solved quickly. But they are not fatal problems. Time is required for the markets to heal themselves. And during that time, things will be slower than has been the case in recoveries from "normal" recessions.

And let's close with a quick commercial. Investing in this environment is tricky. The speakers at my recent Strategic Investment Conference in La Jolla gave us some very good insights, and I intend to post their speeches over time. If you are an accredited investor (net worth over $1.5 million), and would like to see some of the specific recommendations and presentations of the hedge and commodity funds that presented, you can go to www.accreditedinvestor.ws , and my partners at Altegris Investments will be glad to show you the world of commodity and hedge funds. (In this regard, I am president and a registered representative of Millennium Wave Securities, LLC. Member FINRA.)

I spent part of this week in London with my partners there, Absolute Return Partners, and am quite excited about what we are doing in the area of alternative investments for those of you that are in Europe. You can also sign up at the same site mentioned above.

And now, for those who have a net worth of less than $1.5 million, as we announced a few weeks ago, I am now working with my friend Steve Blumenthal and his team at CMG to offer a variety of investment managers who can work directly with you. I am proud of the managers we have on the platform. To see the managers and their returns, and how they are doing lately in this turmoil, just click on the following link and fill out the simple form. The minimum account size is $100,000. http://cmgfunds.net/public /mauldin_questionnaire.asp

South Africa and Swiss MountainsI am seriously struck by the beauty of Interlaken. The mountains are simply magnificent. The Eiger and the Jungfrau are awesome on their beauty. Tomorrow we will tour the area courtesy of a local guide who is a reader and return next Monday. And the Victoria Jungfrau Hotel deserves is reputation as one of the finest in the world. I highly recommend it if you are in the area.

I will leave in two weeks for South Africa. If you would like to come to the presentations I will be making there, you can go to www.investmentpostcards.com and click on the link to write Prieur du Plessis a note.

The mountains and local attractions are waiting, and I think I am going to hit the send button a little early and go be tourist for the weekend. They have had bad weather up until I arrived, and I hope that luck holds for a few more days. Have a great week.

Your glad to be stuck in the middle with you analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.