U.S. Jobs Report – To Work or Not to Work, That is the Economic Question

Economics / Employment Jan 10, 2014 - 12:48 PM GMTBy: PhilStockWorld

We're waiting on the Jobs Report.

We're waiting on the Jobs Report.

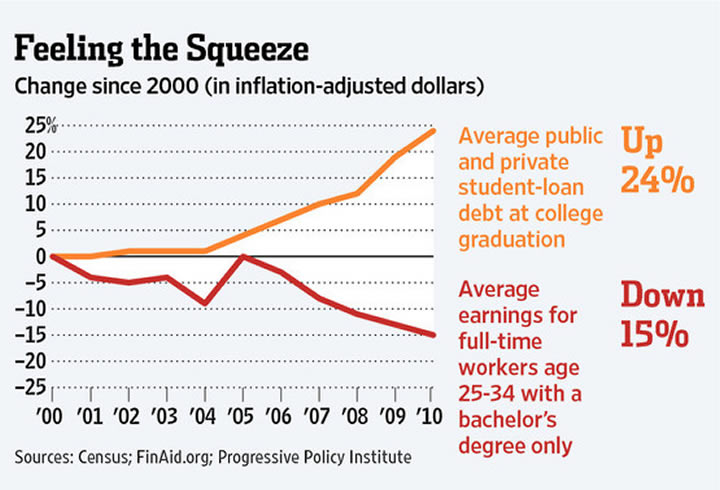

I don't think it's going to matter, whether or not we employed more or less than the expected 200,000 new people in December doesn't matter as much as what we had to pay them. Hourly earnings are, so far, up 0.2% for the year and the average work-week for "employed" people is 34.5 hours and that's GOOD news for Corporation, who are spending 15% less per worker than they did in 2005.

Now, you may wonder how the workers feel about that but, if you do, then you are some kind of LIBERAL and you have to leave right now because this is a stock newsletter and we should care no more about the feeling of labor as we do about the feelings of a barrel of oil – the second biggest cost for our beloved Corporate Masters.

Of course, there are some Corporations that do own oil, and they do care about the price of each and every barrel they own, but there are no Corporations who own people (not legally, anyway) - so f*ck them, right?

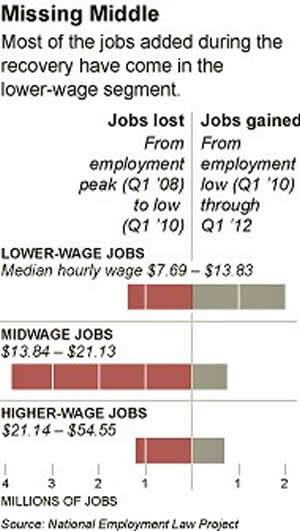

Our current trickle down economic policy guarantees us a steady supply of cheap labor. Labor costs were, in fact, rising in 2007 but "accidentally" wrecking the economy wiped out over 9M jobs and, at an average of 100,000 jobs a month added since Obama took over in Jan, 2009, we've now added back 5M of them – leaving plenty of people still scrambling for work – so many, in fact, that Congress wisely decided that they are just lazy and cut off their unemployment benefits.

Our current trickle down economic policy guarantees us a steady supply of cheap labor. Labor costs were, in fact, rising in 2007 but "accidentally" wrecking the economy wiped out over 9M jobs and, at an average of 100,000 jobs a month added since Obama took over in Jan, 2009, we've now added back 5M of them – leaving plenty of people still scrambling for work – so many, in fact, that Congress wisely decided that they are just lazy and cut off their unemployment benefits.

And, the best part is, we've replaced all those nasty high-paying jobs with cool low-paying jobs – leading to record corporate proifts – Yay Capitalism!!!

8:30 Update: And here's the number - just 74,000 jobs added, a 63% miss from what Economorons were estimating and the lowest positive figure since 1978. Will that tank the market? Hardly – because it means the Fed will have an excuse to give us MORE FREE MONEY!!! Again, we're buying stocks, we're capitalists, we don't give a crap if 126,000 people couldn't find jobs – just more people we can threaten to replace our current employees with should they dare to ask for a raise.

Despite the fact that we're not hiring any actual people, Unemployment dropped from 7% to 6.7% aided in large party by a drop in the Labor Force Participation Rate to 62.8%, the lowest rate of participation since the recession of the 70s, wiping out 40 years of progress. And a whopping 7.8M people who are "employed" are employed in part-time jobs only because there was no full-time work available – that's called "working part-time for economic reasons" with that reason being your employer would rather put the money in his pocket than yours.

Best news of all, hourly earnings for ALL the people who are employed dropped 50%, to an annualized 1.2% gain over last year from the previous 2.4% as more and more people are forced to take lower and lower wage jobs as Congress cuts their unemployment insurance (by the way, it's called insurance because you PAY for it while you are working).

Although this is great news for Corporate America, I already put out a note to our Members to short the Russell at 1,160 because the ADP report showed strong jobs and the market went up. Clearly, it went up under false pretenses, so we can expect at least a little bit of a re-adjustment. In fact, despite the markte being "flat" yesterday, we still pulled off another big win in our Member Chat on the same TZA trade we did on Tuesday, going back to the well at 10:11 yesterday for and taking a 350% and running at 11:09 – not bad for an hour's work if you can't play the Futures.

This is not going to be a day to play the markets (other than fun trades like those two), this is more of a watch and wait day to see how this jobs data is interpreted and our very, very cashy position let's us sit back and relax – there will be plenty of good opportunities (like SHLD, CLF and AA already) to pick up good companies cheap during earnings season.

Have a great weekend,

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.