The Definitive Proof That QE is Not Effective At Creating Jobs

Economics / Employment Nov 11, 2013 - 05:32 AM GMTBy: Graham_Summers

For over four years now, the mainstream media continues to parrot the Federal Reserve’s assertion that QE is in fact a monetary tool that will create jobs.

For over four years now, the mainstream media continues to parrot the Federal Reserve’s assertion that QE is in fact a monetary tool that will create jobs.

This assertion overlooks Japan, where QE efforts equal to over 25% of GDP have failed to improve the unemployment situation significantly, as well as the UK where QE efforts equal to over 20% of GDP have proven similarly ineffective.

We now can definitively add the US to the list of QE failures.

It’s been 14 months since the Fed announced QE 3 and nearly 12 months since it announced QE 4: both open ended programs that have run continuously since they were announced.

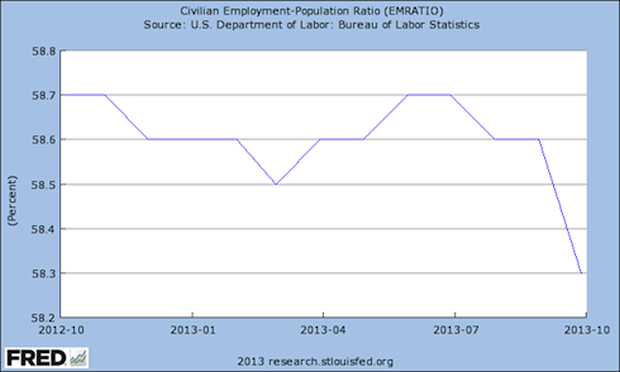

And yet through this period the employment population ratio (which measures the percentage of working age adults who are in fact employed) has in fact FALLEN.

The above graph shows in clear terms that the US is not creating jobs at a rate that can account for population growth. QE 3 and QE 4 have failed to have any significant effect. In fact, if you consider that the chart has dropped dramatically in the last quarter (giving QE 3 and QE 4 a year to have an effect) one can definitively say that QE has been a total failure as far as jobs growth is concerned.

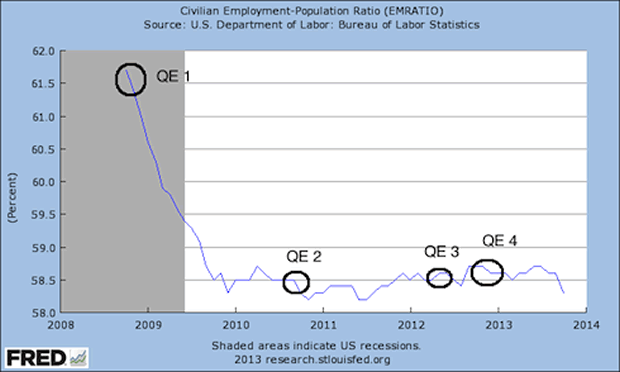

This is nothing new. If you look at the five-year chart you cannot with a straight face say QE has succeeded in any meaningful way.

QE does not create jobs. It has been a total failure. And yet, five years after the Fed embarked on this policy we continue to hear people talk about how the real problem is that we need MORE QE.

QE failed for Japan. It has failed for the UK. It ha failed for the US. Collectively, countries comprising over a third of the world’s GDP have proven QE doesn’t work.

However, this is not to say that there are not tremendous opportunities for stock pickers in this environment.

To take out an annual subscription to Cigar Butts & Moats…

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2013 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.