Protect Your Money From U.S. Debt Crisis

Stock-Markets / US Debt Oct 31, 2013 - 04:34 PM GMTBy: EWI

Dear Reader

Dear Reader

Ever heard of a wedding crasher? You know -- that distant “cousin” who shows up uninvited, hangs around the open bar all night, chugs down double-everythings and falls on his butt on the dance floor -- all before mysteriously vanishing and leaving his night of indulgence on the father of the bride’s tab.

You don’t want to be around when that bill comes due!

Well, as a quasi-government organization with the authority to suck down your hard-earned money through the act of inflation, the U.S. Federal Reserve is “that guy,” and you could be the responsible one left with its bill.

Did you know that the Fed has been inflating the supply of dollars at a stunning 33% annual rate over the past five years? Or that it plans to continue inflating the supply of dollars at least into 2014 and has kept open the possibility that it will do so indefinitely?

When the Fed’s party is over, who do you think will be left with the bill?

Not the Wall Street bankers! We’ve learned that lesson already.

It’s Main Street investors like you who get the bill.

But you can protect yourself -- though your window of safety is closing rapidly.

Robert Prechter, market forecaster and leading opponent of the Federal Reserve, has just released a report that that will help you understand the risks of deflation that most mainstream sources cannot see because they are blinded by decades of inflationary Fed policy.

At just 8 pages, "How to Protect Your Money When the U.S. Debt Bill Comes Due" is a quick read -- well worth any independent investor’s time.

Follow this link to download your free deflation-protection report now >>

Report Excerpt:

The Federal Reserve's efforts to rescue the economy have been historically aggressive, starting with the initial round of quantitative easing in 2008 and continuing through 2013.

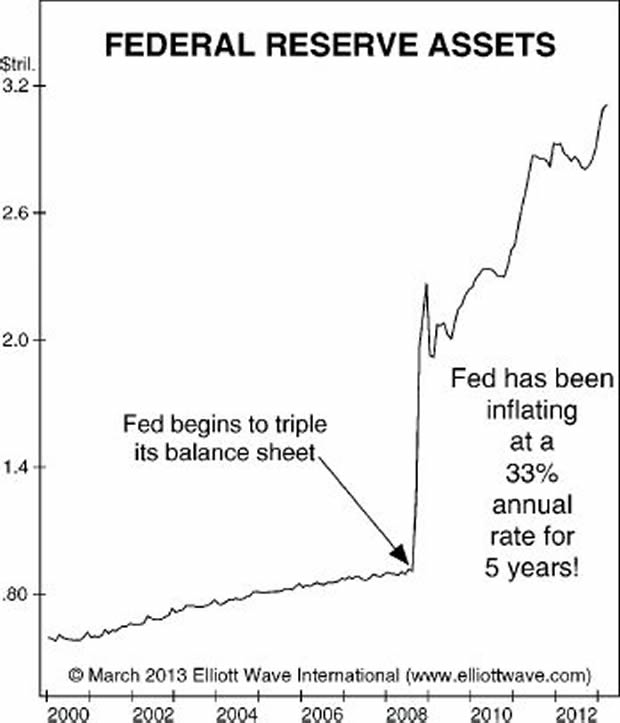

The central bank's assets have skyrocketed due to the Fed's bond purchases, which you can see clearly in this eye-opening report that Robert Prechter presented to the Market Technicians Association and his Elliott Wave Theorist subscribers.

The main reason investors are expecting runaway inflation is illustrated in [the chart above], which shows the value of assets held at the Federal Reserve. The Fed has been inflating the supply of dollars at a stunning 33% annual rate over the past five years. ... [N]o wonder investors expect inflation and have aggressively positioned for it.

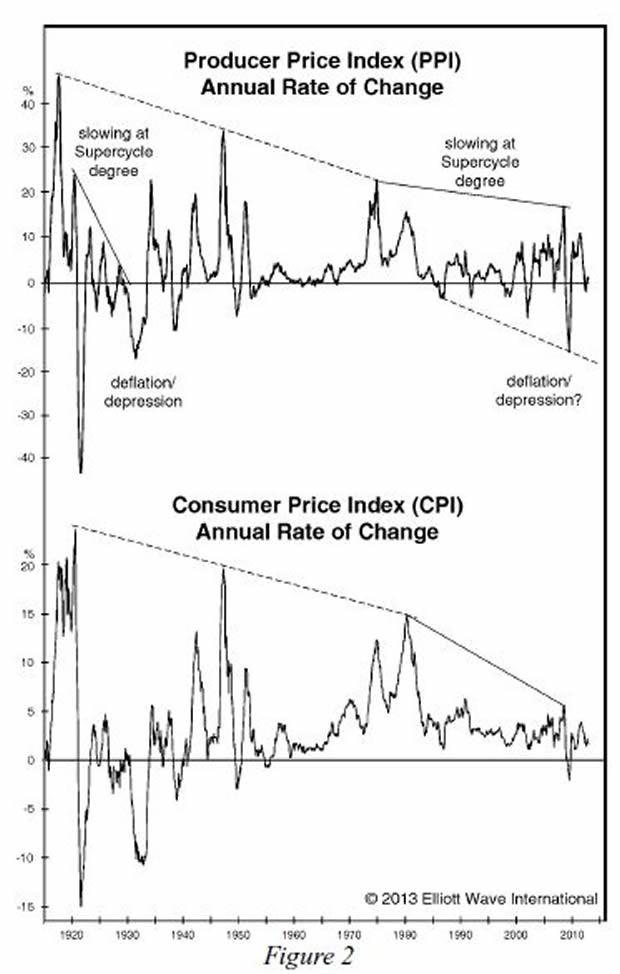

Look just about anywhere else, however, and you will see subtle evidence of deflationary pressures. Given knowledge only of the Fed’s inflating, many people would expect the Producer and Consumer Price Indexes to be rising at a rate of 33% annually. But, as you can see in Figure 2, the PPI’s annual rate of change is stuck at zero and the CPI has been rising at only a 2% rate.

In an interview at the recent San Francisco Money Show with financial author Jim Mosquera, EWI's Chief Market Analyst Steven Hochberg explains why the Fed has gotten so little in return from its stimulus programs. Here's a brief excerpt from the interview published on Aug. 18 on the Examiner.com website.

Question: The Fed wizards have been pushing buttons and pulling levers rather furiously since 2008. The discount rate is rock bottom, and the Fed balance sheet has swelled to the tune of trillions. What button is left for them to push?

Steve Hochberg: That is a really interesting question the way you phrased it because the fact that they have been pushing buttons and have gotten very little in return tells us … that the Fed is not in control. The Fed does not control the markets, and it doesn’t control the economy. Both are bigger than the Fed.

You say they have been doing this furiously. They have been doing this historically! Yet if you look at inflationary measures, such as the Personal Consumption Expenditures, which is the Fed's favorite way of measuring inflation, it's bumping along at 1%.

We have had historic fiscal and monetary stimulus and yet no inflation. Why? The forces of deflation are overwhelming the forces of inflation. The Fed dropped interest rates in 2000 to 2002 and that did not stop the Nasdaq from dropping 78%. The Fed dropped rates from 2007 to 2009 and it did not stop the Dow from going down 59%. There is historical evidence that the Fed does not control the markets but that the markets control the Fed.

As the next leg of the bear market starts unfolding, they are going to do more unconventional things. Things will accelerate to the downside when the public realizes the central banks aren't in control.

For a limited time, you can read Robert Prechter’s 6-page report to prepare for what EWI sees ahead. In this report you'll learn why the risk of deflation is mounting and how you can see it coming in the prices of gold, gas, real estate, crude oil and other markets. See below for full details.

How to Protect Your Money When the U.S. Debt Bill Comes DueRead this new FREE report from Robert Prechter The Federal Reserve has been inflating the supply of dollars at a stunning 33% annual rate over the past five years. You don’t want to be unprepared when that bill comes due! Read this free report from Robert Prechter, market forecaster and a leading opponent of the Federal Reserve, and learn how you can protect yourself. As a result, you will understand today’s biggest risks to stocks, commodities, precious metals and the economy – risks that most mainstream sources cannot see because they’re blinded by decades of inflationary Fed policy. Download your FREE report by Robert Prechter now - for a limited time >> |

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.