Lackluster U.S. Non Farm Payrolls Employment Report Leaves Fed on Hold

Economics / Employment Oct 23, 2013 - 10:08 AM GMTBy: Victoria_Marklew

The sluggish hiring pace visible in the September employment report justifies the Federal Reserve’s decision to postpone tapering of asset purchases. Data for the September report were gathered prior to the government shutdown, but October employment numbers will contain distortions arising from not collecting data during the typical survey period, rendering comparisons difficult.

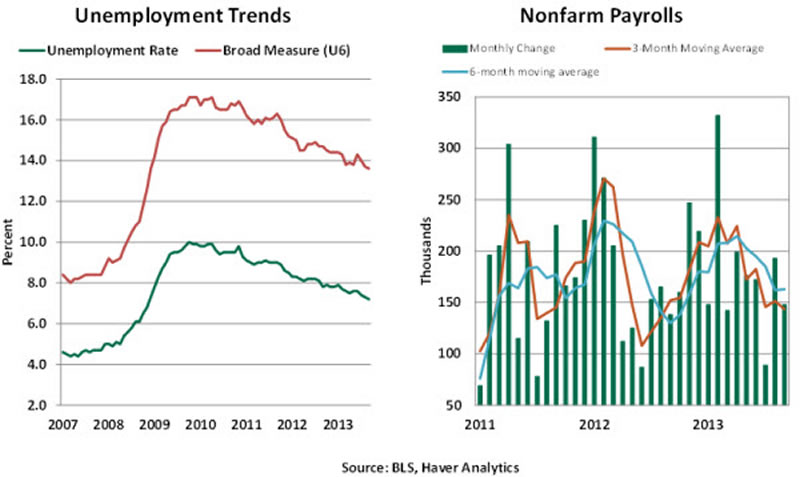

The civilian unemployment rate edged down to 7.2% in September from 7.3% in the prior month, with the readings reflecting rounding of decimals (7.235% versus 7.277% in August). The participation rate (63.2%) and employment-population ratio (58.6%) were both unchanged. Year-to-date, the participation rate has dropped 0.4 percentage points, while the employment–population ratio has held steady

The broad measure of unemployment, including marginally attached workers and part-timers who would prefer full-time work, declined to 13.6%, the lowest reading for the recovery. The percentage of unemployed looking for work for more than 27 weeks fell to 36.9%, the second lowest since the recovery commenced in June 2009.

Non-farm payroll employment rose 148,000 in September following a revised increase of 193,000 jobs in August. Revisions of July and August data resulted in 9,000 new jobs. The latest numbers failed to lift the three-month (143,000) and six-month (163,000) moving averages meaningfully. In the first nine months of the year, 1.599 million jobs were created, marginally higher than the 1.567 million new jobs reported for the same period in 2012.

Factory payrolls rose 2,000 in September, while construction employment advanced 20,000 in September. The 100,000 gain in private service sector jobs is the smallest monthly increase since June 2012. State and local government payrolls rose 28,000 in September, but federal government employment fell 6,000.

The overall workweek (34.5 hours) and the factory workweek held steady in September. Hourly earnings increased 3 cents to $24.09, putting the year-to-year gain at 2.1%, which is a tad lower than the 2.3% gain registered in August. The payroll and earnings numbers point to a tepid increase in personal income during September. The factory man-hours index slipped slightly and augurs poorly for factory production in September.

Although more economic information will be available between now and the December Fed meeting, likely data distortions and an uncertain fiscal outlook lower the probability of the Fed reducing asset purchases at the December meeting. Assuming upcoming fiscal deadlines are met, tapering in early-2014 is most likely.

A legitimate question is how long the Fed can continue the asset purchase program. The minutes of the Federal Open Market Committee meeting indicate policy-makers are concerned about the benefits and costs of the program. But they also suggest that the Fed will start reducing asset purchases only after data confirm that a solid economic outlook is in place, with labor market developments leading the improvement.

By Victoria Marklew

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Victoria Marklew is Vice President and International Economist at The Northern Trust Company, Chicago. She joined the Bank in 1991, and works in the Economic Research Department, where she assesses country lending and investment risk, focusing in particular on Asia. Ms. Marklew has a B.A. degree from the University of London, an M.Sc. from the London School of Economics, and a Ph.D. in Political Economy from the University of Pennsylvania. She is the author of Cash, Crisis, and Corporate Governance: The Role of National Financial Systems in Industrial Restructuring (University of Michigan Press, 1995).

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Victoria Marklew Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.