U.S. Debt Default? The Perversion of the Constitution

Politics / US Debt Oct 10, 2013 - 10:59 AM GMTBy: John_Mauldin

David Kotok, Chairman and Chief Investment Officer of Cumberland Advisors (and our host at "Camp Kotok" for the annual "Shadow Fed" fishing expedition), leads off today's Outside the Box by meticulously dissecting the roadkill that is our federal government's process for deciding whether they will continue to pay their bills and federal employees' wages.

David Kotok, Chairman and Chief Investment Officer of Cumberland Advisors (and our host at "Camp Kotok" for the annual "Shadow Fed" fishing expedition), leads off today's Outside the Box by meticulously dissecting the roadkill that is our federal government's process for deciding whether they will continue to pay their bills and federal employees' wages.

Will the US default? David doesn't think so, and neither do I; but oh, the foolishness, even to tempt the economic fates (read: the markets) this way. David notes that global investors think differently about US default risk than we US-centric types do. Well, David Zervos is with me here at Barefoot, and we just heard that one foreign prime broker (and now maybe two?) is calling hedge funds to say they will not take short-term T-bills as collateral and will mark T-bills down to zero in the event of an actual default. The ultimate risk-free asset is now full of risk? REALLY? This is an unthinkable event. This broker is a Primary Dealer, and I assume they will very shortly get some irate phone calls; but these things start with one bank and then it turns into a herd.

David Zervos, Managing Director at Jefferies, gives us his own slant on the ups and downs and ins and outs of default in today's second OTB selection. He fills us in on some key constitutional history regarding default and makes it clear what is legal, what is illegal, and what is downright perverted about the process playing out in Foggy Bottom. David remains confident that the Fed is the "one adult in the room that can (and will) put a stop to the madness if we go down the highly unlikely path to default." We'll see.

David Zervos, Managing Director at Jefferies, gives us his own slant on the ups and downs and ins and outs of default in today's second OTB selection. He fills us in on some key constitutional history regarding default and makes it clear what is legal, what is illegal, and what is downright perverted about the process playing out in Foggy Bottom. David remains confident that the Fed is the "one adult in the room that can (and will) put a stop to the madness if we go down the highly unlikely path to default." We'll see.

As we confront that possibility, let's note that Social Security is a trust fund, so the money is set aside in bonds. Not to make Social Security payments would be an administrative decision, not one due to a lack of funds. Other entitlements, you can argue. It will be interesting to see what gets priority if it comes to that, as money comes into the Treasury every day, so there is plenty to cover the interest on the debt, and rollovers could be done under the limit.

However it shakes out, we can only hope that the parties who made the decision to close down the public memorials as a way to demonstrate the “costs” of the government shutdown will not be allowed to come anywhere near the decisions on prioritizing payments. Those idiots should be fired and barred from ever having any level of public responsibility. It cost far more to put up barricades and man them than it would have cost simply to leave the memorials open. To tell WW2 veterans that they cannot see their own public memorial when they have come, perhaps for the last time, to acknowledge the lives of those with whom they served, is beyond appalling. The Tomb of the Unknown Soldier? The Lincoln Memorial? These are public places that could and should have been left open. To barricade them was a petty, punitive act with the most venal of political motives.

It is one thing to disagree on budgets and process and the constitutional order of things. I know that many of my readers are very passionate about which side the bulk of the blame belongs to. But I come down on both sides with almost equal frustration. I understand the American political process and know some of the history of how business gets done in Washington, but some things are just beyond the pale. I would say to our "leaders," cultivate some perspective and get a grip.

And since we're getting all the nitty-gritty on federal sausage-making today, I just had to toss in a note from the incomparable, indomitable Joan McCullough, who dredges up for us an esoteric but not irrelevant gem called the Feed and Forage Act of 1861. I will let Joan explain, as only she can.

I get to spend the next three days at the Barefoot Ranch, partaking of an intensive economic/investment festival (calling it a conference simply misses the energy in the room). All hosted Texas-style by Kyle Bass. His connectivity is astounding: the people gathered represent some of the finest thinking anywhere – and he has managed to get them in one room. Some of the names are old friends to this letter (Lacy Hunt, Niall Ferguson, Anatole Kaletski, Jon Sundt, Mark Yusko, Larry Lindsey, and David Zervos), and others are names that ride under the radar, yet run some of the best trading funds in the world. I can’t tell you how excited I am to be allowed in the room. I will report back this weekend on what I learn.

And now I'm off to try to figure out where the world is going, eat a lot of BBQ and chuckwagon food, and just have some fun. Life can be so good at times.

Your forever amazed at the US political process analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

Moving Chess Pieces

By David Kotok October 7, 2013

As the political strategists move their chess pieces, the government shutdown is morphing into the bigger, long-expected fight about the debt ceiling. The agreement to pay government workers back pay, and the recall of most defense workers next week, basically means the impact of the shutdown is quite limited and no longer a political issue of great importance. The real fight is now focused on what concessions can be extracted for raising the debt ceiling and avoiding default – supposedly on October 17th, but certainly by November 1st when the next large social security payment is due. – Michael Drury, Chief Economist, McVean Trading, October 6, 2013

Fishing Pal and Global Interdependence Center colleague Mike Drury has correctly identified the change in pressure points. Having suffered political heat, Republicans and Democrats have found ways to shift the intensity of the budget fight. The non-game game continues as we are moving to the debt limit fight where the Republicans perceive themselves as holding a stronger advantage. They’re wrong. Obama does not run for re-election. They do. So do the Democrats, and this is all a game of finger-pointing in order to have the voters find fault with the other guy in next year’s elections. “What a country!” said the comedian Yakov Smirnoff. Talk about an understatement.

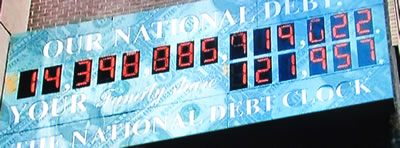

The United States is the world’s largest debtor (almost $17 trillion), and the US dollar is the world’s reserve currency. Actual default on the payment of interest and principal is an unthinkable course of action. Tom Donlan of Barron’s writes that the US must borrow about $700 billion over the next year just to keep ”doing everything it did last year.” He then adds that it “must borrow more than $5 trillion in the next 10 years” and “more than $14 trillion over the next 25 years." These projections do not include rising “inflation, higher interest rates, slower GDP growth, longer life expectancy, and new spending programs.” Default and cascading consequences are not factored into the Donlan estimate. If we actually do fail to pay on our Treasury debt, those future years' borrowing numbers will become much larger.

US market agents focus on the US Treasury interest rates and see them trending lower since the crisis evolved. They do not often consider how the market is pricing US default risk. Most of us are US-centric and focused only on the yield.

Global investors think differently. We can gauge their view by examining the pricing of the credit default swap (CDS) of the US. It is denominated in euros and trades outside the US, with major market making in London. Foreigners view the US interest rate as the yield they will receive, less the cost they incur by insuring that the US does not default. That is what the CDS is about. Its price is rising and has surged up sharply over the last two weeks. It spiked again today. Foreigners do not like what they see in Washington any more than we do. That is why they use insurance and hope they do not need it. Note that the US CDS market is not as liquid as other CDS markets, so reference prices have to be taken with a grain of salt. That said, they are certainly up from where they were before these political shenanigans started. They are a warning sign. Will Washington even take notice?

Another indicator of default risk is the spike in yields on the very short-term Treasury bill. It was trading to yield a pittance of 3 or 4 basis points. It spiked as high as 20 basis points before falling back to a trading range in the 12-13 level. That was last week. Assurances by politicians that they will not let the US default have had only limited effect.

So what is an investor to do?

If you actually believe that the US will default, then you need to prepare for a catastrophic event. Markets could experience another TARP moment like they did about 5 years ago.

In our view the US will not default. It has an absolute ability to pay. This is a political fight, not an economic one. The credit of the US is not the same as Detroit’s or economically risky like Puerto Rico’s. The country is not dismembering like Argentina or unable to support budgets like Greece. Comparisons between the US and these others are not valid.

That said, the US could run out of cash by November if it cannot legally borrow. We do not fully understand the October 17 date. But we do see November 1 looming as a massive entitlement payment date and we do have November 15 as a key date for substantial payments on US Treasury bonds and notes. No increased debt limit means the government would have to choose who gets paid and who is deferred.

The failure to authorize borrowing would cause an immediate budgetary reduction of roughly 4% of GDP. That is an annualized rate. That is also a massive and abrupt shift. Our citizens will not like the fallout. We would encounter a replay of the recent airport-slowdown reaction with much greater intensity. Our politicians know this, so they may play the brinkmanship game, but in the end they will not permit default. That’s our view. They never have defaulted in more than two centuries of American history.

That said; the risk is higher than zero even though it is quite small. We do not expect default. But we recognize that some lunatics are driving the nations’ policy decisions and some of them are willing to experience a default. We elected them. Let’s not forget that….

In economic terms, the budget battle and debt-limit showdown, with all the political shenanigans either side can muster, will be a setback in broad-based GDP (gross domestic product) accounting terms. Since this setback takes place in the middle of a quarter, there will likely be a recovery once matters are resolved. And we know that the clock is ticking, so they must be resolved. By the middle of next year, a historian might look back at data for the fourth quarter of 2013 and conclude that very little happened.

Meanwhile, the profit share out of the US GDP remains very high. That profit share translates into earnings momentum and reflects itself in the valuation of stocks. Stocks are neither cheap nor rich. They are sort of in the middle ground.

The Fed (Federal Reserve) is more worried about the real economy than it is about the price of the stock market. It knows that the real economy has suffered a setback because of the political brinksmanship of Congress and the White House. That means any tapering will come slowly and tepidly.

We expect the tapering issue to continue to surface at the Fed. Tapering, when it takes place, will be staged in incremental steps over a period of 1 year, 18 months, or even 2 years. Tapering from $80 billion to zero at a pace of $5 billion per meeting would take 2 years, given the Fed’s schedule of 8 meetings a year. Such an announcement would be well received by market agents. The Fed could reserve the ability to change the path at any time and would likely do so, but it would also start on a path of gradualism that would be calming to markets. Will they? "Only the Shadow knows."

The Shadow may know the outcome of the debt limit and budget fight, too, but he ain’t tellin'. It is this simple: We either default, and our politicians do lasting damage to our country. Or we don’t, and markets resume a trend higher, and we go on in our unique American political way. We will know soon. I’m betting on the latter. Right now we are holding a cash reserve and deploying it in periods of weakness.

The Perversion of the Constitution

By David Zervos

We the people are the rightful masters of both Congress and the courts, not to overthrow the Constitution but to overthrow the men who pervert the Constitution. – Abraham Lincoln

The threat of defaulting on government obligations is a powerful weapon, especially in a complex, interconnected world economy. Devoted partisans can use it to disrupt government, to roil ordinary politics, to undermine policies they do not like, even to seek political revenge. Section Four was placed in the Constitution to remove this weapon from ordinary politics." – Jack Balkin, Yale University (http://balkin.blogspot.com/2011/06/legislative-history-of-section-four-of.html?m=1)

Last week I reprinted a commentary from early 2011 that discussed the importance of Section 4 of the 14th Amendment to US Constitution in the great debate on the debt ceiling. In that note I stated that my view remains the same today as it has for the last few years: a default on a US Treasury security would be a violation of Section 4. If the POTUS instructs the US Treasury to default on a UST payment, he will be violating the Constitution. And, if the Federal Reserve does not pay a maturing UST coupon or principal payment from the Treasury general account, even if there is a zero balance, it is a violation of the Constitution.

As it stands the POTUS cannot unilaterally issue debt above the debt ceiling as that would also be a violation of the law. And the Federal Reserve cannot unilaterally extend credit to the Treasury general account as that is a violation of the Federal Reserve Act. That's the dilemma! There are of course gimmicks such as a trillion dollar coin, premium bonds and 13.3 extensions of credit by the Fed to the Treasury. But all of these bypass the problem temporarily, and create much more political uncertainty down the road. There are really only two solutions: legislation or prioritization.

Congress controls the purse and at any time they can legislate by:

1. Passing an increase in the debt limit, or

2. Passing something like H R 807 which allows debt issuance above the limit for certain payments such as interest payments, Social Security, etc. etc.

Either action would solve the problem immediately. Baring any legislative move from Congress, the POTUS and Treasury must prioritize or violate the law. There is no other choice. Of course there remains plenty of disagreement on the timing of tax receipts against timing of coupon and principal outlays, but given the creativity thus far at the Debt Management Office, one would surmise this will not be an issue (interest on the debt is still a modest portion of total tax revenues). Prioritization also solves the problem.

The real issue comes if the POTUS claims that it is impossible to prioritize and that Congress (ie the House Republicans) have forced him to instruct the Treasury (and the Fed) to default on the debt. The finger pointing would then begin – House Republicans would point to H R 807 and blame the Senate Democrats and the POTUS, while the Democrats and POTUS would say that the House Republicans did not appropriate the funds to make payments. It is not clear who wins the public relations battle, but thus far the Republicans' marketing team seems to have been schooled by the old marketing team that helped roll out "New Coke" in the 80s. A fracture in the Republican Party seems like a highly likely outcome. But sentiment could also turn sharply on the POTUS.

The fact is that both political parties are violating the spirit of Section 4. It is a disgusting display of partisanship that our Constitution has outlawed. Senators Benjamin Wade and Jacob Howard are surely rolling over in their graves. Of course, that does not mean that we cannot see this illegal, immoral and powerful activity enter the marketplace. If blowing up markets and blaming the opposition is the path to short term political success, it has to be at least priced into asset prices. That is why we are seeing some modest drops in risk asset prices and some more serious dislocations in the front end of the Treasury curve.

That said, I remain convinced that there is a less than 1 percent chance the POTUS pulls the nuclear trigger and instructs a politically motivated and entirely unnecessary Treasury default. And further, if he does the unthinkable, there is less than 0.001 percent probability the Fed will go through with it. The Fed will not be seen as the entity that pulled the trigger on a default of Constitutionally mandated outlays. As with so much of our global financial and political system, the Fed remains the ultimate backstop. So as everyone sits around thinking about how to profit from Constitutionally outlawed action by our highly partisan legislative and executive branches of government, remember there is at least one adult in the room that can (and will) put a stop to the madness if we go down the highly unlikely path to default. Good luck trading.

An excerpt from "Numbahs Plus"

By Joan McCullough

October 7, 2013

Social security checks are funded automatically. What about the people who process them? That’s where it gets dicey. Because one side of the equation would have you think that they are “non-essential”. And the other side will be citing the Feed and Forage Act of 1861. (To keep these employees working as well as others.You’ll see.) This popped up during the Civil War. Some story about the troops scroungin’ around the countryside, “borrowing” groceries. You get the picture. The Union soldiers just ate your crops. And watered their horses. Although there was no funding in place to pay for this. No problem once the Feed and Forage Act of 1861was cited. They weren’t stealin’, just tryin’ to stay alive. Dig?

Huh? Right. The last time this gem popped up was back in 2007.When the Bush WH pulled it out of the hat. Why? Related to a supplemental appropriations bill to fund military campaigns in Iraq and Afghanistan.

Under the guise of wanting to “feed” our troops (which in modern times is more than grits and H2O, i.e., it encompasses all kinds of supplies), they cited this gem.

Here’s the problem with that:

The Feed and Forage Act of 1861 “turns the federal budget world on its head. The standard procurement process is for obligations to be incurred by a federal department or agency only after an appropriation is enacted.” ... Source:http://www.foreffectivegov.org/files/budget/feedandforageact.pdf

See the deal here? The Feed and Forage Act of 1861 is viewed as an emergency gig. And so it allows the executive branch to run up a tab in emergency situations only ... before the appropriation has been voted in by Congress. Who is supposed to control our purse strings.

Can you make any case into an “emergency”? Absolutely. Think back now to the Exchange Stabilization Fund. Opened by Roosevelt to stabilize the buck. Rubin raided it. To stabilize those massive US funds who got caught in Mexican debt with their pants down. Wise guy that he is, he cited stabilization of the Peso which, in turn, would stabilize the dollar. And bingo, nobody said “boo” about this abuse.

Allow me to digress for clarity. Lucius Wilmerding, Jr. wrote a book back in 1943 called “The Spending Power: A History of the Efforts of Congress to Control Expenditures”. In that book, he coined a phrase known as “coercive deficiency”. This is perfect. Because it means that the executive branch goes out and makes a deal. For which there has been no appropriation yet agreed by Congress. But once Congress gets backed to the wall by this brazen tack, they cave and vote the appropriation positively, having been coerced/embarrassed by the executive branch.

John Mauldin

subscribers@MauldinEconomics.com

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2013 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.