Gold Correction Continues Lower on Break Below $900

Commodities / Global Stock Markets Apr 01, 2008 - 09:02 AM GMTBy: Mark_OByrne

Gold is down in Asian and early trading in London this morning. Gold was down $14.40 to $916.20 per ounce in trading in New York yesterday while silver was down 62 cents to $17.16 per ounce. The London AM Gold Fix at 1030 GMT this morning was at $897.00, £453.90 and €572.32 (from $937.25, £472.17 €592.82 yesterday).

Gold is down in Asian and early trading in London this morning. Gold was down $14.40 to $916.20 per ounce in trading in New York yesterday while silver was down 62 cents to $17.16 per ounce. The London AM Gold Fix at 1030 GMT this morning was at $897.00, £453.90 and €572.32 (from $937.25, £472.17 €592.82 yesterday).

Oil's sharp fall to nearly $100 a barrel yesterday and further dollar strength today created selling pressure on gold and with many stop losses positions just under $905, gold swiftly fell to $895 per ounce. A close below $905 will be negative from a technical point of view for gold's short term prospects and may result in the need for some more consolidation.

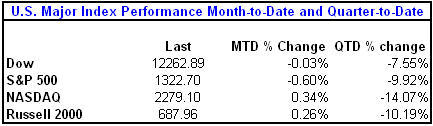

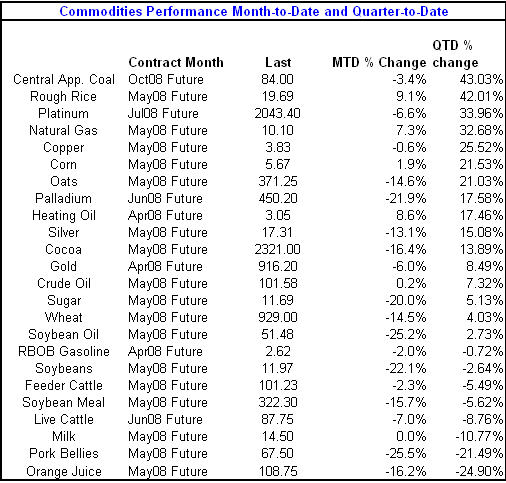

Gold's sell off may have been exacerbated due to it being the last day of the first quarter. End of quarter sell offs in commodity markets are often misleading and go against the long term trend as traders book profits for the quarter. Conversely, equity markets can often rally at the end of quarter as traders, pension funds and institutions who are primarily long and overweight equities“paint the tap” and engage in window dressing. ( See End of Quarter Performance Tables Below)

As usual, gold will likely take its cue from the dollar, oil and wider markets which will be looking to the manufacturing ISM for March, construction spending and car and truck sales for February.

| 01-Apr-08 | Last | 1 Month | YTD | 1 Year | 5 Year | ||

| Gold $ | 895.65 | -7.99% | 7.48% | 35.07% | 167.35% | ||

| Silver | 16.79 | -15.16% | 13.67% | 25.76% | 278.15% | ||

| Oil | 100.76 | -1.01% | 1.60% | 53.29% | 238.34% | ||

| FTSE | 5,755 | -2.20% | -10.56% | -8.77% | 56.17% | ||

| Nikkei | 12,656 | -6.95% | -17.32% | -26.79% | 58.46% | ||

| S&P 500 | 1,323 | -0.59% | -9.92% | -6.90% | 54.07% | ||

| ISEQ | 6,295 | -1.87% | -9.22% | -32.85% | 58.97% | ||

| EUR/USD | 1.5678 | 3.29% | 7.49% | 17.39% | 43.37% | ||

| © 2008 GoldandSilverInvestments.com | |||||||

It is prudent and wise to focus on the extremely sound economic fundamentals driving the precious metal markets and focus on the long term and ignore short term corrections which happen in all bull markets.

Gold saw similar corrections in 2003 (falling from $382 to $319 - 15%), in 2005 (falling from $536 to $489 - 9.6%), in 2006 (falling from $725 to $567 - 8%), and in 2007 (falling from $841-$778 - 8%). After all these corrections there were short sighted analysts who claimed the end of the bull market and the ‘bubble' had burst. They will be proved wrong again. Commodities follow long term cycles of which are normally of some 15 to 20 years. This would see gold peaking in price sometime between 2015 and 2020 which seems likely given the extremely favourable macroeconomic and geopolitical fundamentals and the very tight supply demand situation.

Indian demand provides a very strong floor of demand or support floor below this market and after every single correction the sub continent has emerged as a huge buyer of physical gold and this is likely to be the case again. Reuters reports that “India's demand for gold revived on Tuesday as prices fell below a key psychological level.” Marketwatch's extremely perceptive John Brimelow examined this crucial phenomenon and how the Federal Reserve was subsidising gold for the Indians – ‘Indians buying up gold? Commentary: Gold bugs think Fed, other central banks making it available': http://www.marketwatch.com

Whether gold and precious metals or equities, bonds or property or in a bubble is irrelevant as now more than ever it is critical that all investors are properly diversified and do not merely pay lip service to diversification which is so often the case.

Gold will become a bubble as all asset classes do after a long bull market. But this will not happen until it has at least reached its 1980 inflation adjusted high of over $2,300 per ounce.

Asset Class Performance in Q1 ‘08

Support and Resistance

A close below $900 and $906 will be a breach of support and will mean that support falls to previous resistance at the 1980 record nominal high of $860. Resistance is at $970, $1,000 and the recent new record nominal high of $1030.80.

Silver

Silver is trading at $16.75/16.80 at 1030 GMT.

PGMs

Platinum is trading at $1932/1942 (1030 GMT).

Palladium is trading at $432/437 per ounce (1030 GMT).

Continuing pullbacks in all the precious metals are almost certainly short term corrections as the supply demand fundamentals remain very favourable to all the precious metals.

Goldman Sachs JB said in a research note to clients today that "supply constraints in South Africa and robust demand from the automotive sector were pushing the market for platinum group metals into "deep structural deficit."

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.