Stock Market Price Action vs Central Bank Speak Since Bernanke Taper Talk

Stock-Markets / Global Stock Markets Jul 14, 2013 - 12:49 PM GMTBy: Richard_Shaw

Benjamin Graham once said that markets are voting machines in the short-term and weighing machines in the long-term — sentiment vs fundamentals.

Benjamin Graham once said that markets are voting machines in the short-term and weighing machines in the long-term — sentiment vs fundamentals.

These days, the primary driver of sentiment tends to be central bank statements and actions — with mere statements having huge impact.

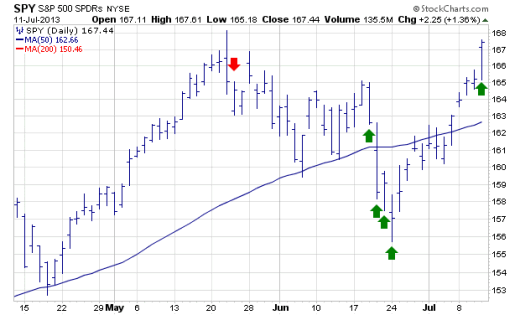

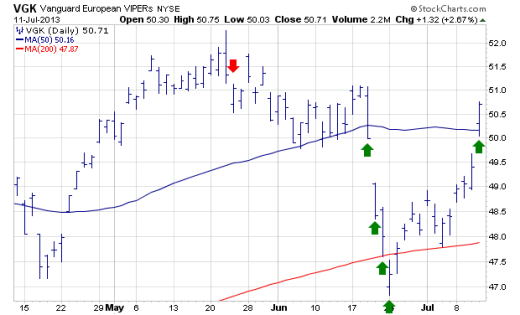

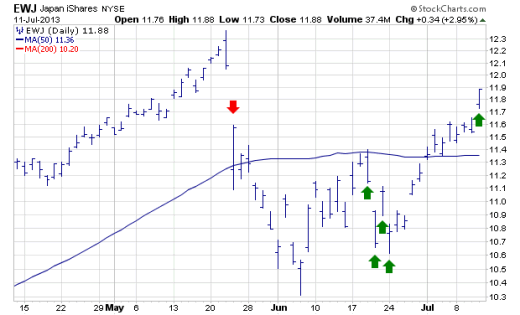

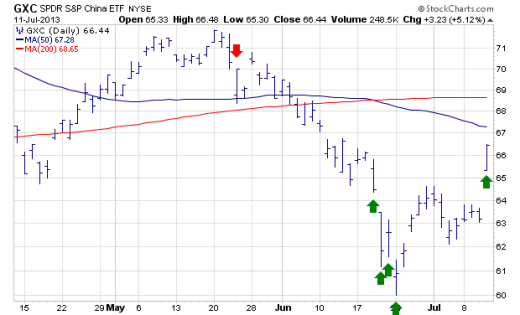

If you have doubts about the market impact of central-bank-speak, just take a gander at this calendar of central bank statements compared to market price action:

- 05/22 Federal Reserve president Ben Bernanke said that a tapering of quantitative easing could begin later this year if conditions warrant

- 06/18 European Central Bank president Mario Draghi said he had an open mind to doing what was necessary

- 06/19 Bank of Japan president Haruhiko Kuroda said they are taking steps and felt things would work out

- 06/20 Peoples Bank of China governor Zhou Xiaochuan added liquidity to their banking system to relieve a liquidity crunch

- 06/21 St. Louis Fed president James Bullard said QE could actually be increased if inflation slows

- 07/10 Federal Reserve president Ben Bernanke said the economy needs the Fed’s easy-money policy “for the foreseeable future.”

Now let’s look at price movements on the day after each of those statements/actions:

US Stocks

European Stocks

Japanese Stocks

Chinese Stocks

Bernanke frightened the markets, and other central banks stepped in with voice and cash to stem the decline, followed by a dovish “clarification” by Bernanke yesterday.

It appears that all is well for now, at least as far as central bank driven sentiment is concerned.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2013 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.