The Real U.S. Unemployment Rate is 13.9%

Economics / Employment Apr 08, 2013 - 02:36 PM GMTBy: Money_Morning

Employers added just 88,000 jobs in March, according to the U.S. jobs report released Friday, hiring at the slowest pace since June 2012.

Employers added just 88,000 jobs in March, according to the U.S. jobs report released Friday, hiring at the slowest pace since June 2012.

The number was a huge miss. Analysts expected a gain of 200,000.

"We all over shot it," Austan Goolsbee, former chairman of the Council of Economic Advisors in U.S. President Barack Obama's first administration, said on CNBC. "This is a punch to the gut. I mean, this is not a good number."

Since the government's way of calculating unemployment is frighteningly inaccurate, even with such a small amount of jobs added the unemployment rate fell from 7.7% to 7.6%.

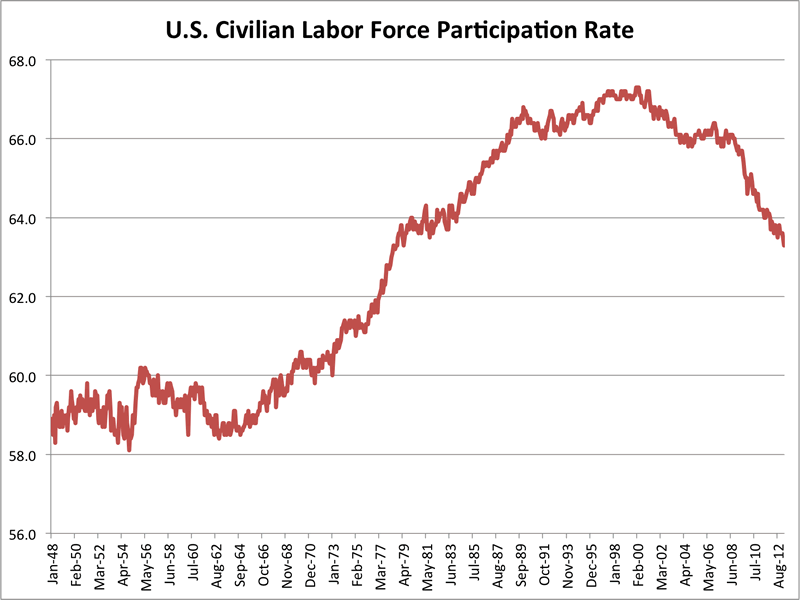

That's because the labor force participation rate slipped from 63.5% to 63.3% -- the lowest level since 1979.

Source: Business Insider

But if we look at the real number of people out of work, the U.S. unemployment rate is much higher.

The Real U.S. Unemployment Rate

The government reported that the civilian labor force was 155 million. The number of unemployed was 11.7 million - 7.6% of the civilian labor force.

A whopping 663,000 people dropped out from the month before.

But that's just in the actively counted numbers.

The harsh truth about U.S. unemployment is that more and more people are giving up on work altogether, or relying on disability or other entitlement checks instead of paychecks - and those people aren't counted in the unemployment number.

Also not counted were "marginally attached" workers, which totaled 2.3 million people. They weren't counted as unemployed because they hadn't looked for work in the past four weeks. Some had become discouraged, others were attending school or other commitments.

That brings the total number of Americans who aren't looking for work to 90 million.

This is why a more accurate number to measure U.S. unemployment is the U-6 rate, which counts total unemployed, all individuals marginally attached to the labor force and total employed part-timers for economic reasons.

That number was a striking 13.9% in March.

So while the public has been lead to believe the employment picture has brightened under the Obama administration's leadership, that's not the case.

Where'd the Jobs Go?

The impact of the forced fiscal cuts was a concern, but they didn't directly affect the March payroll figures too severely - yet. The federal government, excluding the U.S. Postal Service, shed only 2,200 positions.

But the cuts are weighing on businesses, Scot Melland, chief executive of global online recruiter Dice Holdings told CNN Money.

"They are still being very cautious about adding workers," he said. "They are still uncomfortable about the future."

The Congressional Budget Office cautioned sequestration could slash 750,000 jobs from the U.S. economy this year. It looks like we are quickly headed towards that projection. The nonpartisan group also trimmed GDP growth for 2013 by 0.6%.

Friday's glum data also highlights reduced consumer demand.

The retail sector, which averaged an increase of 32,000 jobs a month for the past six month, experienced the biggest decline in March, shedding 24,000 jobs.

Look for the next U.S. jobs report on Friday, May 3.

Source :http://moneymorning.com/2013/04/05/u-s-jobs-report-how-unemployment-is-really-14/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.