Deflating Housing and Credit Bubbles Will Lead to DisInflation

Economics / Credit Crisis 2008 Mar 08, 2008 - 12:05 PM GMTBy: John_Mauldin

The BS from the BLS

The BS from the BLS - 2,500,000 "Lost Jobs" and Counting

- Taking a Long-Term Perspective

- Leverage in Reverse Gear

- What's That Hissing Sound?

The official number for employment suggested a loss of 63,000 jobs. But could it have been more like 200,000? And I will make a case for 2,000,000 lost jobs last month. This week we will take a look at the confusing labor-market picture in the US. We will also look at the debate over the money supply. Is the Fed increasing the money supply at a reckless rate, fueling inflation fears down the road? All this and a lot more as we look at how the recession in affecting everyone and everything, from individuals to large businesses. (The letter will print a little long, but there are a lot of charts.)

This week's letter is triggered by an amusing (but very flattering) note from a reader. Matt M. wrote:

"John, you have been my rock for the last few years. Will this decline be equal to the 1970's, the 1930's or the 1900's when we had a similar wealth disparity? I must use a line from Star Wars, 'Help me Obi-John, you're my only hope.'"

Well, Matt, there may be some who say that I am on the Dark Side of the Economic Force, but I don't think we are in for a repeat of the early 1900s or even the '70s. Yes, the economy is in recession and it is likely to get worse. Oil is at $106. Gold is close to $1,000 and the dollar is in the tank. Inflation has everyone looking for their old bell bottom pants and '70s disco music. But there are fundamental differences between now and the early 1900s or 1970.

The recession we are in is going to be its own unique event. Comparisons are not always useful and can be dangerous if you look back at what happened in 1973 and expect it to repeat. There are some things that in general accompany a recession, like a falling stock market and rising unemployment. But other events will likely unfold in different ways. We will not see as large a drop in manufacturing jobs as we did in the '70s, partly in that we have a lot fewer manufacturing jobs and also because many manufacturing jobs are tied to exports, which are rising, helped by the falling dollar. And we did not have two major asset bubbles deflate in the '70s.

A New Program for All Investors

So, with those things in mind, let's look at some of the data from this week. But first, a brief commercial. As I have been hinting for two years, I am excited (finally!) to announce that we have a program in place to help investors who have a net worth of less than $1.5 million find money managers who have an absolute return focus. I will be working with Steve Blumenthal and his team at CMG in Philadelphia to help you find money managers we have researched and can recommend to you.

We have a growing platform of quality managers you can choose from, or you can choose an account with multiple managers, to diversify your portfolio. Basically, you invest in one account and the managers do the work, but it is your personal account and not a fund. The minimum account size is $100,000. To see the managers and their returns (some of them are up in the midst of this turmoil), you can click on the following link, fill out the simple form, and then see the managers on the platform. http://cmgfunds.net/public /mauldin_questionnaire.asp

If you are a manager and would like to be considered for the platform, you can email P. J. Grzywacz, who heads up research at CMG at pjg@cmgfunds.net with your information, and he will get back to you. And we will eventually work with investment advisors to give your clients access to these managers.

And as always, if you are an accredited investor with a net worth of over $1,500,000, you can go to www.accreditedinvestor.ws and sign up there, and my partners at Altegris Investments in the US, Absolute Return Partners in Europe, or Plexus Asset Management in South Africa will be able to show you a wide variety of hedge funds, commodity funds, and other alternative investments. (In this regard, I am president and a registered representative of Millennium Wave Securities, LLC, member FINRA.) And now back to our regularly scheduled letter.

The BS from the BLS

The BLS non-farms payroll report showed a loss of 63,000 jobs, which was considerably different than the positive 25,000 that the consensus expected. But the news is in the revisions. This month's report now shows 196,000 fewer jobs in the last three months than was originally predicted. But I predict that by next year the number for this February will be worse, for two reasons.

One, the BLS estimates that 135,000 jobs were created in their birth/death model. Remember, this is the "fudge factor" number to take care of jobs created by new and small businesses that are not part of the establishment survey. Because it is based on past performance, it tends to understate growth in employment when the economy is recovering from a recession, and overestimate it when the economy is going into a recession.

That 135,000 number includes an estimate of 9,000 new construction jobs and 10,000 new jobs in the financial world. It is far more likely these were negative numbers. Job loss will probably be revised to down over 100,000 by this time next year.

Remember, this is a survey of businesses. Once a year they look at actual data and revise the numbers from their original estimates. We will see the next annual revision March 11. It is likely to show further declines in employment in the last half of the year. But the BLS data is lagging. For instance, California does their own estimate of employment in their state. The data is basically one month "fresher" when it is released.

Let's take the estimate for the Riverside-San Bernadino area of California. The BLS estimated that there were 32,400 new jobs in December in the area. But California, with more thorough methodology, saw job losses totaling 10,100. BLS estimates 56,000 more total jobs than California does in that one area alone. The data is even more stark in the major metropolitan areas. Now, this will all get resolved over time with revisions, but it does distort the current data. (Thanks to John Burns Real Estate Consulting for giving me that data.)

2,500,000 "Lost Jobs" and Counting

The reality is that there were probably closer to 2,500,000 "lost jobs" in February. How so? The Liscio Report notes that:

"Net changes in total employment over time are a function of gross job losses and gains. For example, in 2006, there was a net gain of 1.7 million jobs in the private sector, according to the BED program. (This number differs from the establishment survey.) But

that net gain came from a gross gain of 30.8 million jobs, and gross losses of 29.1 million jobs. That's quite a furious pace of turnover under a rather placid surface."

If we take those losses for the year of 29.1 million and divide by 12 months, something like 2.5 million jobs were lost in an average month in 2006 (while 2.6 million jobs were found).

The Liscio Report goes on to show that total job turnover in the US was a remarkable 13.2% of the total labor market last year. But also, volatility is actually down from 15% in 2000. This demonstrates a remarkably robust employment marketplace, in which roughly 2.5 million people will change jobs in any given month. Granted, it is harder to find a job now than a year ago, but it helps to keep in mind that a lot of people are finding new jobs every month, even in a slowing economy. The economy is simply slowing down. It will not come to a halt.

As an aside, the unemployment rate dropped by 0.1%. How can it drop if we lost jobs? Basically, because the unemployment rate is estimated from a survey called the household survey. They literally call hundreds of thousands of homes and ask if anyone is working or looking for work. If you are not looking for work, then you are not counted as unemployed. This month the household survey showed a drop of 255,000 jobs (quite the difference from the headline survey); but an even larger number of people, 450,000, are not looking for a job, presumably because they do not expect to find one. So, even though fewer people are working, the data shows the unemployment rate falling. Go figure.

Taking a Long-Term Perspective

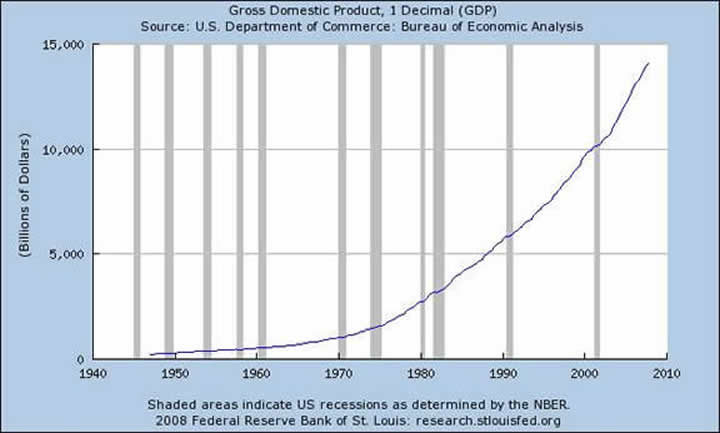

Now, let's get some perspective. Let's say GDP drops by 2%, which is quite possible (Gary Shilling thinks it will be 3%). In a $14 trillion economy, that is a drop of $280 billion. This is admittedly a large number, but the economy will recover. Look at the next chart from the Federal Reserve of St. Louis. It shows GDP growth since 1947. The grey areas are recessions. There have been 11 of them. We are in a 12th . Notice that some were deep and long. But also notice that the curve goes from the lower left to the upper right.

My back of the napkin estimate is that in 2022 the US GDP will be $30 trillion (through a combination of real growth and inflation.) So, Matt, breathe easy. Free markets are the real force. We will only really alter that curve if we do something stupid, like start a trade war. And to listen to some politicians, that could happen.

The Democratic presidential candidates keep telling us that we need to do away with or renegotiate NAFTA, that it has cost the US jobs. But the reality is that only 2.5% of the jobs that were lost last year were due to foreign competition. The remainder of the jobs lost, as Rod Hunter put it in the Wall Street Journal, "[were] caused by changes in consumer taste, domestic competition and technology." And more jobs were created by foreign companies coming here and investing and buying our goods than we lost. Trade is a net winner for the US.

Both Obama and Clinton talked about lost jobs in Ohio and blamed NAFTA. Notice they did not blame NAFTA in their Texas speeches, where trade has created hundreds of thousands of jobs. The vast majority of the jobs lost by Ohio went to states with far lower taxes and right-to-work laws, and not to foreign countries. There are reasons that General Motors is building a new plant for hybrids in Texas and not in Ohio or Michigan, and it is not NAFTA.

If Ohio wants to see real job growth, they could simply adopt the laws and tax structures of Texas or any of a dozen business-friendly states. The same could be said for California, which is also losing jobs due to high taxes and a burdensome bureaucracy.

Again, you can go to the St. Louis Fed database. Given the woes described by the politicians about the loss of manufacturing jobs, you would think the US has barely any manufacturing left. However, what the data really says is that we manufacture more in real terms (accounting for inflation) now than at any time in history. We are just doing it with fewer people. As a nation, we are far more productive today than at any time in history.

At the turn of the century, it took 40% of the population to produce enough food to feed the country. Today it takes 2.5%. That is an amazing growth in productivity. Does anyone think that the loss of all those farm jobs was bad? Not to say that it was not difficult for people to change their lives. Those people who came off the farm had to learn how to work in a new environment. It is no different today. As Rod Hunter notes:

" ... Mrs. Clinton and Mr. Obama ... are tapping into popular anxiety about the economy. Rather than trying to shut the world out, however, the next administration needs to pursue the domestic reforms necessary to ensure that American workers can thrive in the knowledge economy. These include shoring up our education system, clearing obstacles to worker mobility by making health care and pensions portable, and replacing the hodgepodge of displaced worker assistance programs with a single support, training and relocation system. The American worker, not the job, is the national asset."

I couldn't agree more.

Leverage in Reverse Gear

Leverage is going in reverse, and with a vengeance. And it is happening all up and down the economic food chain, regardless of the underlying credits. Brokers and commercial banks are being forced by regulators to call in loans and reduce exposure in order to raise capital. They are raising margins on all sorts of companies and individuals. They are requiring higher margins even for Fannie Mae debt, even though everyone knows the US government would step in if there was a problem. /p>

This reduction in leverage is forcing funds and companies to sell assets into markets that simply do not want to buy anything. Loan sssets that are otherwise solid credits are going for 80 cents on the dollar. I am talking about municipal bonds and high-rated bank loans with default rates of less than 1%. This is a market in severe crisis.

And it is also starting to hurt ordinary people. I have a friend who does a lot of work on eBay. She has good credit. Rather than a bank line of credit, she simply uses credit cards. Or did. This week she got three letters reducing her limits to levels below what she already had on the cards. There are numerous such anecdotal stories circulating.

Let me tell a personal story to illustrate the problem. In 1976 I was a young entrepreneur, working as a print broker. There was a severe paper shortage at the time. I borrowed $10,000 from my friendly personal banker and used it to buy traincar loads of paper. Things went well. I got a lot of business just because I had access to paper in my warehouse. But my bank ran into trouble and the regulators forced them to reduce their loan book. They cancelled any loan they could. I politely suggested that they stick to the terms of our agreement (otherwise known as telling them to go pound sand). When they realized that I did not intend to destroy my business to help their balance sheet, they called my mother (I swear this is true - I was 26 at the time) and told her they would ruin my credit if she did not pay the loan for me. They so worried her that she actually did so, and then told me afterwards. Maddening.

The point is that a bank or broker in a capital crisis will do what it feels it has to do to get back into balance. Relationships that you thought you had are gone with the wind. And with accountants and regulators requiring a much more vigorous mark-to-market on asset prices, banks are forced to reduce lending of all types. This is going to slow down the US economy.

Case in point: a small hedge fund called Tequesta had a portfolio of prime jumbo mortgages made to high-net-worth individuals. These were really solid loans with very low default rates and good collateral. The fund actually made small but steady returns and was only leveraged by two times.

Shouldn't be a problem, right? But Tequesta got its loans from Citibank. As we all know, the selling started in subprime markets but soon migrated to all credit markets. This, in turn, "... created problems for smaller, less-liquid markets. Jumbo mortgage bonds like Tequesta used, for instance, saw valuations drop as dealers and rival mortgage hedge funds refused to indicate at what price they would be willing to buy this paper. Lacking bidders, Tequesta's bonds fell in value. So began a vicious cycle.

"Tequesta's portfolio managers watched on the sidelines as banks dumped billions of dollars worth of mortgage bonds to free up capital. Even bonds backed by loans to the wealthiest Americans traded lower.

"This raised alarms among Tequesta's lenders. Executives at investment-bank prime brokerage operations saw the sharp drop in the value of Tequesta's holdings and demanded additional collateral. In turn, they forced the fund to make additional sales to meet the margin calls."

Eventually the fund simply had to shut down, as Citi simply sold the bonds at whatever price they could get, forcing large losses to investors who thought they had invested in a conservative strategy.

Remember, these loans were good loans. This was not junk. There were simply no buyers of any type of mortgage debt that is not guaranteed by the US government, so "mark-to-no-market" created a serious distortion.

What we have to realize is that about 60% of what Paul McCulley calls the "shadow banking system" has vaporized into thin air and is never coming back. The SIVS, CLO, CDOs, and the rest of their alphabet friends which bought the debt are now in the process of selling anything they can as they close up their funds. Pension funds and insurance companies which bought the debt are understandably on strike. The world economy is going to have to find new structures and buyers for all sorts of debt. This is not going to happen overnight. It will take at least a year, maybe more.

What's That Hissing Sound?

And this brings us to the debate about the Fed and the money supply. Today the Fed announced they had an emergency meeting and decided to raise the limits for the next term auction facility to $100 billion. Banks are not lending to each other, so the Fed is properly stepping in and creating liquidity. If they did not, the world markets would simply seize up.

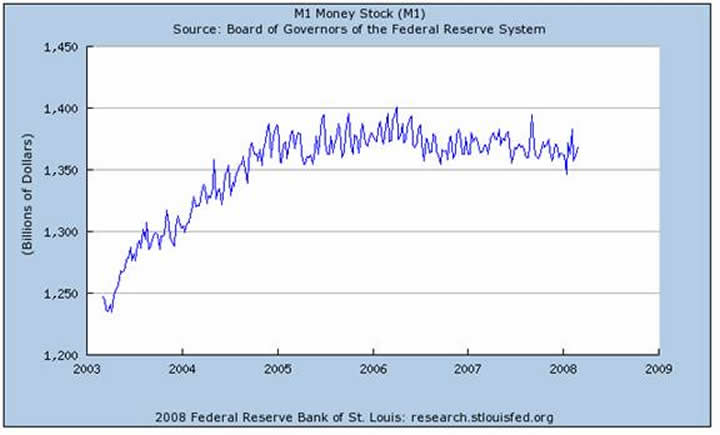

But that is not increasing the money supply. They "sterilize" that money by selling government bonds into the market. There is no net increase in the money supply. Let's look at a few charts. First, let's look at M-1 money supply. M-1 is the measure of the US money stock that consists of currency held by the public, travelers checks, demand deposits, and other checkable deposits including NOW (negotiable order of withdrawal) and ATS (automatic transfer service) account balances and share draft account balances at credit unions. It is what we think of as cash.

I would submit to you that M-1 has not grown for almost three years. But we could take a chart of M-2 and see that it is rising from a 5% annual growth to around 7% from a year ago.

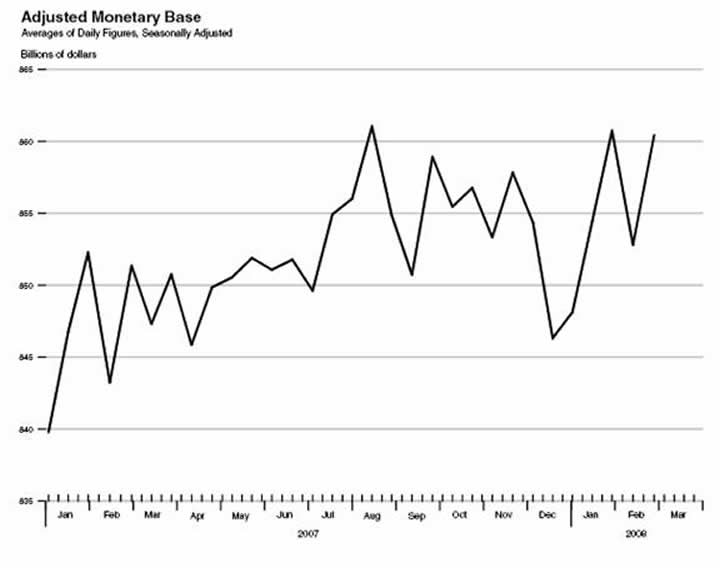

However, M-3, which is no longer produced by the Fed, is growing at 16%, according to Shadow Stats. But what does that mean? Not as much as you might think. The Fed has little control over M-2 and even less over M-3, which includes euro-dollars and other forms of bank-injected leverage. But what they do control is the adjusted monetary base. And it has risen by a negative 0.3% since August, as you can see in the chart below.

Inflation is anywhere and everywhere a monetary phenomenon. And the Fed is not inflating. It is just that simple. My good friend and mentor in the early '80s, Dr. Gary North, who pointed out these charts to me, speculates that the Fed may partially be doing this to help the dollar. Maybe.

But whatever the reason, we are watching two monster bubbles deflate. Housing stands to lose at least $2 trillion and probably $4 trillion in the US, and while the numbers will be smaller in England and other markets in Europe, they will be sizeable. The credit crisis is going to deflate financial assets of all sorts, as the leverage which drove prices up is going to take prices down as risk is repriced. These two phenomena are deflationary.

I know that is not what much of the media and analysts tell you, and I get some very heated (but mostly polite) mail telling me that I simply don't get it. And I understand that price inflation is an issue today. I know oil is rising ($106 a barrel), gold is signaling inflation, and food prices, especially the grains, are off the charts. I know my education costs for seven kids are rising each year, as well as my health insurance. Believe me, I feel your pain.

But I think by the end of the year we will be talking about disinflation, if not deflation. It would be a strange recession indeed to produce inflation in an environment of two major bubbles deflating along with a bear market in stocks. Consumer spending is going to slow. Today we saw a disappointing personal income report, which shows wages rising less than current inflation. These things ebb and flow.

A few quick items. It takes five members of the Fed board of governors to call an emergency meeting. There are now only five members. Senator (I wanted to be president) Chris Dodd (Democrat of Connecticut) is holding up the appointment of two governors for strictly political partisanship. He wants to subject the Fed to partisan concerns.

If something (God forbid) were to happen to one of the current governors, they would not be able to hold an emergency meeting. Dodd is simply putting the nation at risk for his own ego and partisan purposes. You can say what you like about the Fed, and I have been as critical as anyone, but I do NOT want politicians running the Fed. The next time you talk to your Senator, ask him to lean on Dodd and free up the nomination process. And for the Senate Democrats to allow him to do this is wrong. Shame on all of them! The Bible tells us to pray for those in leadership. We should pray for the health of those five governors.

And one quick chart from Prieur du Plessis. This shows us what European investors in the US stock market have done. Ugly. This cannot be helping capital flows. And a different chart using bonds tells a similar story.

So now, let's go back to the original question. Matt, the answer is, we are going to Muddle Through for the next few years. The Fed is going to continue to ease. The futures market is pricing in a 32% chance that the Fed will cut 1% at the next meeting in two weeks! I think 50 basis points is a foregone conclusion. With more bad data, it could easily be more.

Free markets work and will figure out how to respond to this crisis. Count on it. It is not 1929 or 1973. It will be worse than 2001-2, but things will eventually sort themselves out. Just look at the growth in GDP and have faith. But don't start buying the financial stocks or homebuilders just yet.

Next week I am going to write about the housing market. You can see the beginning of a clamor for a federal government bailout of sorts. In an election year, it could easily happen. Watch your pocket, as it is about to get picked.

A Response from Tiffani

I am off to Orlando late next week to speak at the Newport Advisor Conference, and I get to watch some golf at the Arnold Palmer Invitational as their guest. I could use a few days of R&R.

As some of you know, I wrote a few weeks ago at the end of the letter about the cancer scare that my daughter and business partner Tiffani had. The response was quite frankly overwhelming. Tiffani asked me to let her respond, so here are her words.

"I was overwhelmed at the response from readers to Dad's writing about his emotional anticipation of my biopsy results.

"The funny thing is, I was telling Dad that Friday night that Ryan (my fiancée) had told two people and that I would like to keep it private. He sheepishly smiled and tried to casually play off that he had 'mentioned' it to his readers. I looked at Ryan and said, 'You are definitely off the hook!'

"What I didn't realize is how many thousands of emails we would receive. I still have not gotten through them all, and each one deserves a response. Each email filled me with hope, impressed me with the encouragement and heart behind the words from each of you. I did not expect to be so moved; at times I had to stop reading and just cry. Thank you so much for being vulnerable and sharing your personal stories, from a loved one that died the week I read your email, to your own open and honest fears with your bouts with cancer and loved ones' struggles. Grown men told me they had broken down and cried with the knowledge of what Dad must have felt.

"Please be encouraged by how much we were touched getting support from people we have never met, please continue to reach out to each other and share that vulnerability that brings connections between hearts, and thank you so much for boosting my love of the human spirit and teaching me so much from this experience."

That just about says it all. Who cares about a lousy recession, anyway?

Your must have done something right analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.